Table of Contents

India has a network of laws and statutes that every organisation must comply with. Statutory Compliance means that all actions that an organisation takes must adhere to the provisions set by the law. Therefore, processing employees’ payroll and social security benefits must also comply with the relevant laws. The employer’s treatment of the organisation’s employees should also obey the relevant state and central labour laws. Non-compliance would invite penalties, fines, and legal action against the organisation. Following the tenets of the labour laws is beneficial to the employer, employee, and the organisation.

Statutory compliance is important from both the employer’s and the employee’s perspectives. Many labour are laws created for the employee’s benefit, such as the Industrial Relations Act, Women and Child Safety, social security, minimum benefits, Health and Occupational Safety, etc. Non-compliance with any of the above-mentioned laws means that the Government of India will take action that may threaten the company’s legal existence.

The HR departments and employers have the legal responsibility to ensure legal compliance with these laws. The Government of India conducts statutory audits periodically to ensure and verify such compliance. To maintain their corporate existence and avoid all legal hassles, companies should ensure complete compliance.

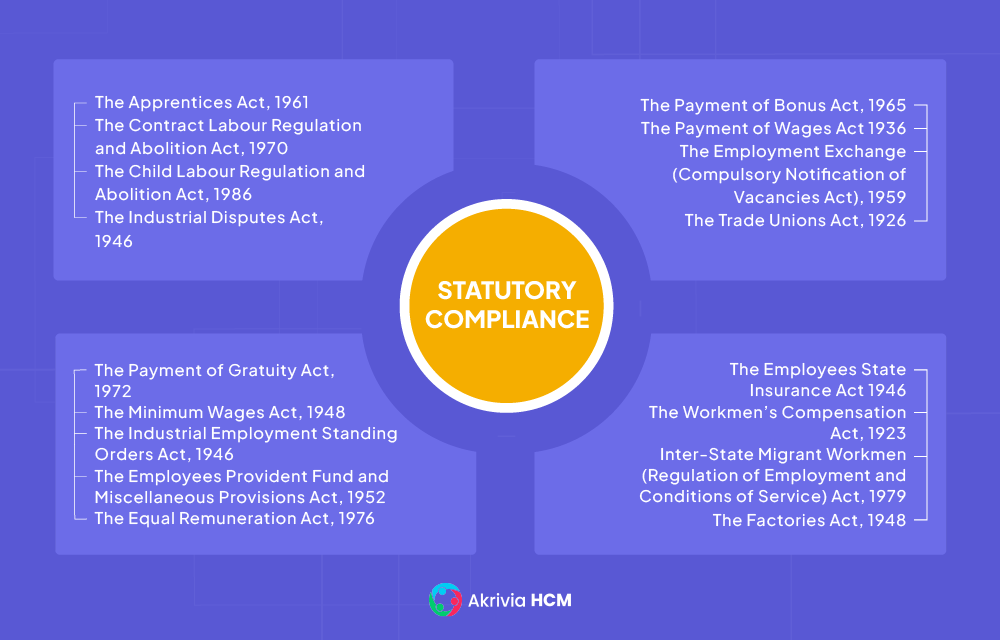

The list of important Acts which affect an organization and its HR function is enclosed below:

This act ensures that apprentices are provided with proper skills and training in their chosen trade. The 2014 amendment of Apprentice Act ensures that the minimum age for being engaged as an apprentice is 14 years. However, the Bill adds that the minimum age for apprenticeship in designated trades related to hazardous industries shall be 18 years.

This act ensures that contract labor is not exploited, and their working condition is improved. A worker will be deemed on contract when he is hired in connection with the work of an establishment by or through a contractor.

This act prohibits the employment of children in certain environments. A child is a person below 14 years of age. So, any child under 14 years of age should not be exploited under the guise of employment.

This Act was created for businesses and various industries to make provision for the investigation and settlement of industrial disputes, and for certain other purposes.

This Indian law makes it necessary for companies to pay a one-time gratuity to retired employees. Gratuity is also applicable to an employee who has worked with a company for a minimum of 5 years and is finally resigning. Payment of Gratuity is applicable to companies with over 20 employees.

This Indian labor law sets the minimum wage that must be paid to skilled and unskilled labors. The constitution has defined “minimum wage” or ” living wage” as the level of income that the worker needs to have to live a decent life having basic facilities like health, comfort, and education.

These are rules, regulations and obligations set by the Government of India to regulate the working conditions in the industrial environment.

This act makes it compulsory for institutions, factories, and other establishments to provide a Provident Fund, [Pension] Fund, and Deposit-Linked Insurance Fund for the benefit of the employees.

This act asks institutions to provide for the payment of equal remuneration to men and women workers. It also stands for the prevention of discrimination, on the ground of sex, against women in the matter of employment.

This act makes it necessary for institutions/employers to provide certain benefits to employees in case of sickness, maternity, and employment injury and to make provision for certain other matters in relation to them.

This act is applicable to factories or other institutions with more than 20 workers, to provide for a minimum bonus of 8.33 percent of wages. The minimum salary eligible for a bonus is Rs. 3,500 per month.

This act is primarily intended to help industrial workers who earn less. The limit of the salary is 24000. Anyone earning less than 24000 a month is eligible to raise an issue under the said act. This act prohibits improper wage deductions and eliminates unnecessary wage delays.

This act was set in place by the Government of India to improve working conditions of workers. It sets the safety standards for workers employed in factories. All the factories in manufacturing goods, including weaving cloth, knitting of hosiery and other knitwear, clothing, and footwear production, dyeing and finishing textiles, manufacturing footwear come under this law. According to this act, the working week of factory workers should not exceed 60 hours.

According to this act, an office needs to notify about available vacancies to job seekers. Office refers to an office of the central or state government, which collects and furnishes information on prospective employers, available vacancies, and job seekers.

This act provides for registration of trade unions (including association of employers) with a view to render lawful organization of labor to enable collective bargaining.

The Workmen Compensation Act 1923 aims to provide financial compensation to employees in case they meet with an unfortunate accident while performing their duties. All workers in railways, airlines, driving industry, construction site workers are eligible for this compensation.

This act was set in place to regulate the employment of inter-State migrant workmen and to prevent them from being exploited.

The Key Provisions of Statutory Compliance in India are explained in detail below:

This Act administers the payment of proper wages to both direct and indirect employees. This essentially monitors that all wage payments are timely without any unauthorized deductions. There are some important conditions under the Act:

State and central government have the authority to set the minimum wages for workers under the ambit of this law.

This is the payment of an annual bonus to employees earning less than Rs 21,000 in an establishment and who have completed 30 working days in the financial year. This applies to all organizations with more than 20 employees on their salary payroll and the profits earned by the establishment. The bonus rates may range from 8.33% to 20%. It should be paid within eight months of closing the accounting year.

All employees’ salaries are subject to TDS unless they submit a Form 15G/Form 15H that they have made tax-saving investments. The TDS income tax slabs are as follows:

| Income Tax Slabs | Old Tax Regime | New Regime | ||

| Citizens below 60 years | Senior citizens above 60 years | Super senior citizens above 80 years | All categories | |

| Rs 0–2.5 lakhs | No Tax | No Tax | No Tax | No Tax |

| Rs 2.5–3 lakhs | 5% rebate under Section 87 a | No Tax | No Tax | 5% rebate under Section 87 a |

| Rs 3–5 lakhs | 5% rebate under Section 87 a | No Tax | ||

| Rs 5–7.5 lakhs | 20% | 20% | 20% | 10% |

| Rs 7.5–10 lakhs | 20% | 20% | 20% | 15% |

| Rs 10–12.5 lakhs | 30% | 30% | 30% | 20% |

| Rs 12.5–15 lakhs | 30% | 30% | 30% | 25% |

| Rs 15 lakhs and above | 30% | 30% | 30% | 30% |

It is the responsibility of HR departments in organizations to make the deductions and make payments to the Income Tax department.

Two acts – the Maternity Benefits Act of 1961 and the Employees State Insurance Corporation (ESIC) Act of 1931 – govern the payment of maternity benefits to pregnant women. This Act applies to women employed by the government in any sector, shops, and commercial establishments where more than ten people are employed.

ESIC Act applies to companies that have more than 20 employees and draw a salary exceeding Rs 21,000. The employer and employee pay 4.75% and 1.75%, respectively. Such employees are covered under the ESIC Act. This covers pre-natal and post-natal absence (maternity leave) from work, considered paid medical leave. Wages paid include 26 weeks of payment during such leave. The woman employee should have worked for 80 days during the preceding calendar month to be eligible. Medical records should be provided regarding the birth of their child. If free medical care is not provided to the employee, the employer has to pay Rs. 3,500 as a medical bonus to the employee as stated in the amendment to the Act as of 19.12.2011.

This Act applies in 16 Indian states to provide social security to employees. It is determined by the wages, designation, and the total employees working. The application for the Act also differs from the specific Act in each state.

The Equal Remuneration Act, 1976 mandates paying equal salaries for the people who work in the same position and share the same responsibilities without discriminating based on gender. This Act was constructed to secure women from bias because they used to get less remuneration, and men used to get more salary than them. Every type of organization must follow this Act.

The Shop and Establishment Act controls the employment conditions of workers in shops and other commercial establishments. It covers such issues as weekly and daily working hours, rest periods, overtime rates, holidays and leaves entitlements, compensation for unfair dismissal, etc. An entity must register within 30 days of beginning business, and the company must register under this Act even if it has no employees. The companies must apply for it and submit a fee and required documents. The application process takes 15 days to complete.

The Employees’ Provident Fund Act was issued to ensure social security for employees. The Act applies to any establishment employing more than 20 people, requiring each employee to contribute some portion of their salary to the fund. Additionally, the employer must also contribute. Companies can manage their employees’ funds with the EPF solution. This fund ensures social security after an employee’s termination or retirement by depositing contributions into an account.

Gratuity is the sum of money provided by the employer to the employees for their productive work when they retire or leave after 15 years of continuous job. If companies have more than ten employees, they must follow the Payments of Gratuity Act, 1972. The amount of gratuity depends on basic salary, years of work and the days in a month.

The formula of gratuity for 2 conditions are:

1. Companies covered under the Act

Gratuity amount= (15 x last drawn salary x tenure of working)/26

2. Companies not covered under the Act.

Gratuity amount= (15 x last drawn salary x tenure of working)/30

Akrivia HCM provides the best digital HR solutions to enterprises, with one of Top Payroll Software in India to help you transition smoothly from paper- and file-based working to a digital, mobile solution. Akrivia HCM’s solution provides a smooth, seamless changeover to an AI-based HR management system that encapsulates all personnel management functions under one roof.

HR in a company helps regulate the work environment and ensures no non-compliance with labor laws in the country. All labor laws and tax regulations come under statutory compliance.

All industries and other establishments are bound by the labor laws and tax laws set by the government. Compliance in payroll may include the Minimum Wages Act 1948, Employees Provident Fund and Miscellaneous Provisions Act, 1952 and anything related to salary or compensation.

Statutory compliance is often held by the HR department who ensure that the company is sticking to the labor and tax laws.

The best benefit of statutory compliance is avoiding any risk of being penalized by the government. It minimizes any risks of non-compliance. Thereby increasing the productivity and efficiency of the organization.

Let’s Recruit, Reward, and Retain

Your Workforce Together!