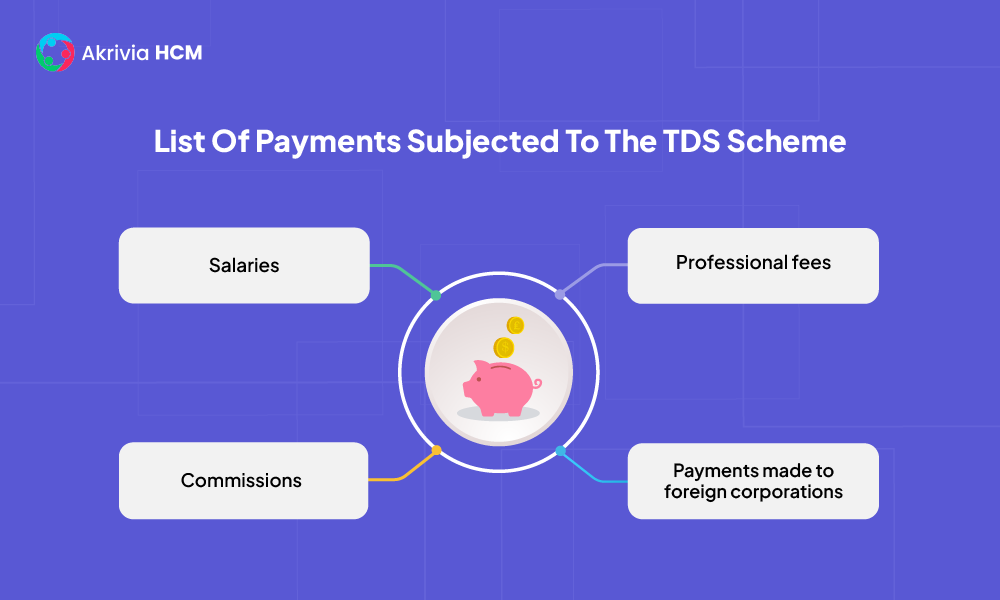

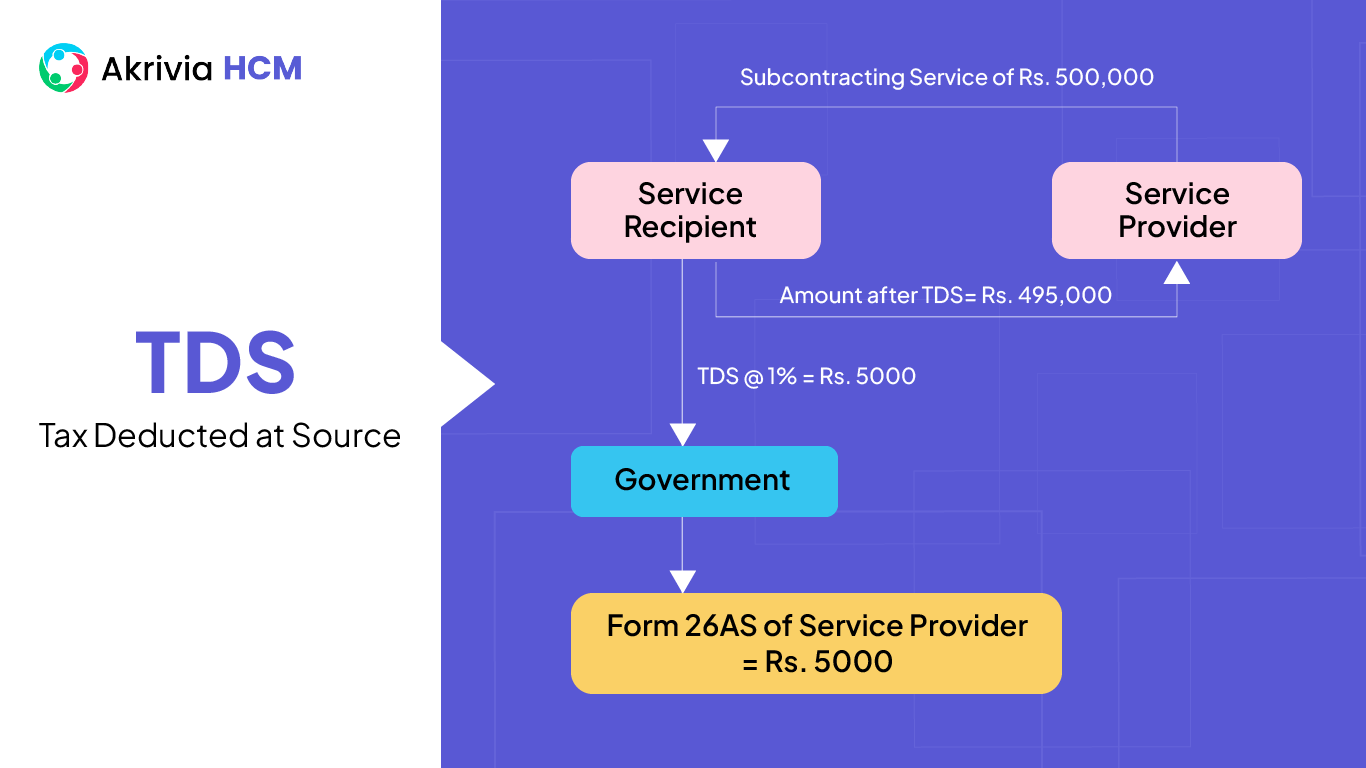

TDS stands for Tax Deduction at Source. It is a type of tax applicable only on specified payments such as rent, salary, professional and technical fees, commission, interest, and more. Generally, the income recipient is liable for paying tax. With the introduction of TDS, the person paying the said amount is liable to deduct a specified percentage and then remit the balance amount to the recipient of the income. TTDS provisions are generally applicable for service sales and not for product sales.

The responsibility of deduction is upon the organization paying the sum. It is applicable for specified payments mentioned under section 194 of the Income Tax Act, 1961. However, the provisions are not applicable when an individual or HUF is exempted from having their books audited. In the case of salaried income, the employer company is responsible for deducting it. It must be deposited to the Government as per the due dates, and a TDS return must be filed.

However, if the recipient of income falls under the following category, The TDS provisions are not applicable

1. Central or State Government

2. Reserve Bank of India

3. Mutual Trust

4. Statutory corporate whose income is not liable to tax

An individual earns salaried income, taxed as per the Income tax slabs. If the total taxable income of an employee is within Rs. 5,00,000, the tax liability is nil. However, if it exceeds Rs. 5,00,000, TDS deduction starts. Thus, its rate on salary may differ from 20% to 30% on a case-by-case basis.

The employee must specify other income sources under a declaration to the employer company. The employer is liable to deduct it, considering the other income declared by the employee. The amount liable to be deducted is divided into the number of months remaining for the financial year.

Accordingly, the monthly portion of TDS is deducted from the in-hand net pay per month. Employers can automate the TDS deduction using cloud-based payroll software. Such payroll processing systems are of immense help in calculating the TDS in salary. The employer needs to report the TDS deduction of the employee through Form 24Q, in case of sale of immovable property, Form 26QB is filed.

TDS = Amount * TDS Rate

TDS rates are as follows:

| Section | Sources of Income/Expenses | Threshold Limit | TDS Rate (%) |

| 192 | Payment of Salary Income | As per the Income-tax slab | As per the slab rate |

| 192 A | Premature withdrawal of Employee Provident Fund | ₹ 50,000 | 10%,

20% (In case PAN is not provided) |

| 193 | Interest on Securities and Debentures | ₹ 10000 for Securities and ₹ 5000 for Debentures | 10% |

| 194 A | Besides ‘interest on securities’ like interest on bank deposits, loans, and advances, post office deposits, etc. | If the payer is a bank or any banking institution, banking co-operative society, or the post office, the threshold is ₹ 10,000. In any other case, it is ₹ 5,000 | 10% |

| 194 B | Prize money from lottery, crossword puzzle etc. | ₹ 10,000 | 30% |

| 194C | Payments to contractors and sub-contractors | ₹ 30,000 for Single Payment and ₹ 1,00,000 for Annual Payment | 1%* |

| 194 DA | Maturity of life insurance policy | ₹ 1,00,000 | 5% |

| 194 G | Commission on the sale of lottery tickets | ₹ 15,000 | 5% |

| 194 H | Commission or Brokerage | ₹ 15,000 | 5% |

| 194 I | Rent for use of Land and building/ furniture/ fitting | ₹ 2,40,000 | 10% |

| 194 I | Rent for use of Plant and machinery | ₹ 2,40,000 | 2% |

| 194 IA | Funds recieved from immovable property other than agricultural land | ₹ 50,00,000 | 1% |

| 194 J | Royalty, professional or technical services | ₹ 30,000 | 10% |

| 194 K | Dividend income from shares and mutual fund units | ₹ 5,000 | 10% |

| 194 LA | Compensation paid on acquisition of certain immovable property | ₹ 2,50,000 | 10% |

| 194 N | Annual cash withdrawal from one or more accounts with a bank/ co-operative society/post office | ₹ 1,00,00,000 | 2% |

| 194-O | Payment made by an e-commerce operator to a seller on the sale of goods and services via its e-commerce portal | ₹ 5,00,000 | 1% |

1) Say Mr. Vaibhav has won a lottery of Rs. 3,00,000 from ABC Lottery house. The lottery house is responsible for deducting TDS @ 30% as per section 194B. The TDS amount would be Rs. 3,00,000 * 30% = Rs. 90,000. The amount will be paid to the Government and Rs. 2,10,000 will be paid to Mr. Vaibhav. The amount will be reflected in the Form 26AS of Mr. Vaibhav.

2) A private limited company has paid Rs. 2,00,000 as professional fees to Mr. Surendra. The Company must deduct Rs. 20,000 (Rs. 2,00,000 * 10%) as TDS and remit only the balance amount of Rs. 1,80,000 to Mr. Surendra. The amount will get reflected in the Form 26AS of Mr. Surendra.

The Company will be responsible for deducting it on every payment, provided it has crossed the threshold. The due date of the amount is the 7th of every month. However, for deductions made in March, the extended due date of the 30th of April is applicable. Taxpayers may be busy at the end of the year, and hence, extended time is allowed for TDS deposition.

The person paying the sum of TDS is required to file a TDS return. By filing it, they report the amount of TDS against their PAN. After the return is filed, the amount gets reflected in the recipient’s Form 26AS. If the tax payable in their income is nil, the TDS reflected in form 26AS must be reported in their Income Tax return. The IT Department will credit the refund to the bank account declared by them.

a) Download the required file format from Tax Information Network of Income Tax Department.

b) The return is prepared in ASCII format using the extension .txt. Taxpayers can prepare their TDS returns using the NSDL website’s return preparation utility.

c) The FVU (File Validation Utility) provided by NSDL must be used to verify the file. If any error will be identified, rectify the same and re-verify again.

d) The generated file of the extension “fvu” should be either submitted to TIN Facilitation Centre or can be uploaded on the Income Tax portal using your TAN-based login – Income Tax Department.

A penalty of Rs. 200 is payable, under section 234E, if you failed to file the return within the due date. However, the penalty amount cannot exceed the amount limit mentioned in the report. Akrivia HCM can help the Company streamline TDS compliance and reduce TDS penalties.

There are two ways to know the status of a TDS refund. You can check it through the E-Filing website or the TIN NSDL website.

Here you need to follow these steps while checking the status through the E-Filing website:

Any amount deducted from the person/employee as TDS collection would come under an excess TDS deduction.

In these cases, the person who deducts the amount is liable for a refund claiming the extra money. After calculating, the additional amount paid is refundable at a specific time.

Let’s Recruit, Reward, and Retain

Your Workforce Together!