EPF is mandatory for companies that have more than 20 employees. In our country, millions of people contribute a share of their salary to the Employee Provident Fund account for later benefits like retirement funds, emergency savings, etc. An employee’s Universal Account Number (UAN) is provided to all EPF members to make transactions. One can utilize the UAN Member portal to carry out all EPF related operations.

The Universal Account Number is a 12-digit number issued by the Ministry of Labour and Employment to any member of the Employees’ Provident Fund Organisation (EPFO), allowing them to manage PF accounts from a single place.

Before 2014, every new company used to assign a new PF account number. This made it difficult to estimate the PF balance accurately. Moreover, it wasn’t easy to keep track of past transactions. As a solution to this issue, it was introduced.

It is a single, unique identification number for all the employees of an organization. It allows employees to consolidate all their Provident Fund accounts associated with different employee IDs from various organizations in one place. This makes it easier for them to withdraw or transfer funds. Any employee in an organization that offers the Employees’ Provident Fund and Family Pension Scheme must fill out Form-11.

When you contribute to the Employee Provident Fund (EPF), a unique number is allotted to your account. But before, all Employee Provident Fund (EPF) accounts were given new numbers each time a person changed jobs. The Universal Account Number introduction on 1 October 2014 has made it easier for employees to access their Employees Provident Fund accounts. It allows for seamless management of all your PF accounts throughout your working life, regardless of how often you change jobs. Your PF account can be transferred with the Universal Account Number even if employed before 2014. As a result, you can easily access your PF accounts and don’t have to remember multiple passwords or details for each account.

Universal Account Number offers the following benefits:

Each employee has a Universal Account Number, which can be checked through one’s employer or by logging on to the UAN Portal. This is usually printed on salary slips, so you can prevent these documents from obtaining your UAN.

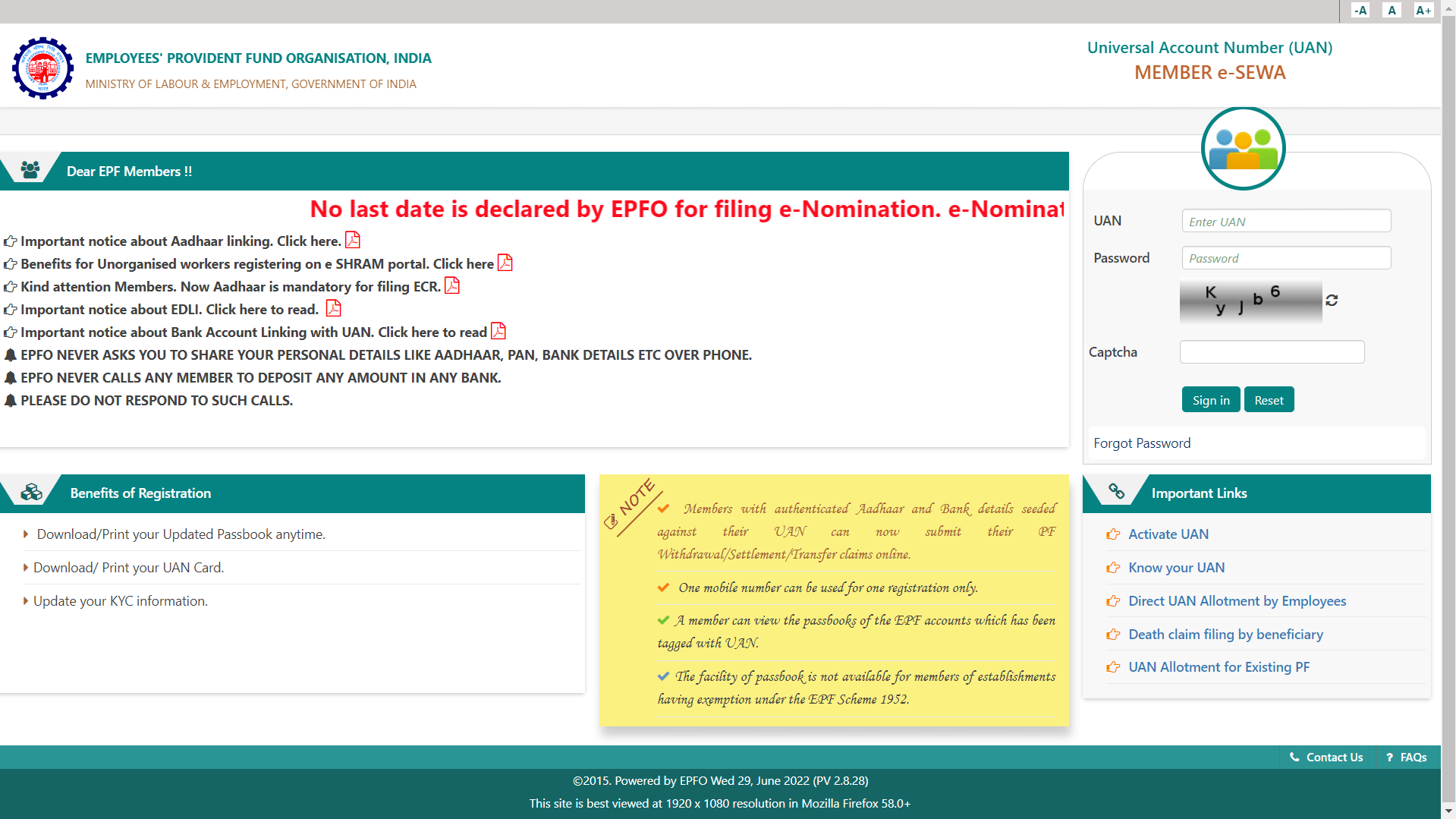

Step 1: Go to UAN Portal and log in to your account.

Step 2: You can check the status of your UAN by entering your PAN and Aadhaar number, along with other required details.

Step 3: To get the EPFO office and state, enter your PF number or member ID, and select the appropriate option from the dropdown menu.

Step 4: You can use your PAN or Aadhaar number to search for a person’s UAN.

Step 5: To complete this form, you must enter your name and date of birth. You will also need to enter a mobile phone number and type the code below into the field provided.

Step 6: Tap ‘Get PIN‘ to authorize your account. The system will send your PIN to your mobile number when you enter it.

Step 7: To view your details, click See the UAN number. You will receive a message on your registered phone number.

You can contact your employer or the human resources department of your company to know your UAN. This number will appear on your monthly salary slip, as PF deductions from your pay will generally be reflected in the total amount you earn.

To generate it, you can apply these two ways:

Way 1: When you take up employment, the company will generate a permanent UAN number that remains valid for life or until you change employers. The company will ask for a few documents to set up the account.

Way 2: If your employer does not take the necessary steps to generate the Universal Account Number, you can do so by generating it yourself. To do this, follow the steps given above.

To activate UAN, the following documents are required:

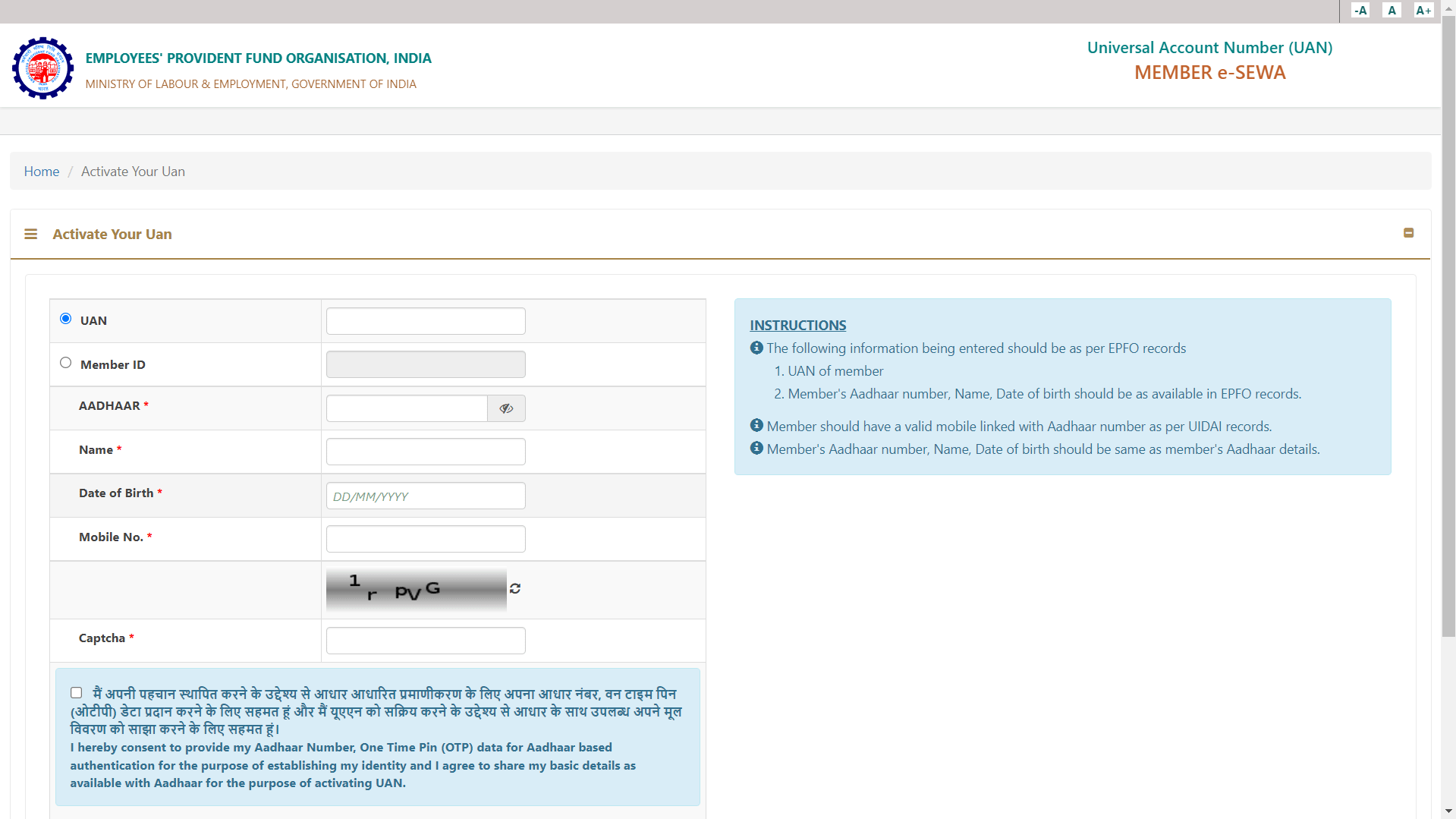

You can activate its number by following these steps:

1. Visit the ‘Activate UAN’ page on the UAN portal.

2. To activate the Universal Account Number, you must enter three pieces of information: your PAN number, Aadhaar number, and UAN.

3. Please provide your personal details as requested on the page.

4. Your mobile number will receive a verification pin to complete the registration process.

5. Click Authorize and Activate when you have entered the pin.

You can download your UAN card online by following these steps:

You can also download your UAN card using the EPFO Umang app. To download your UAN card using the Umang app, follow these steps:

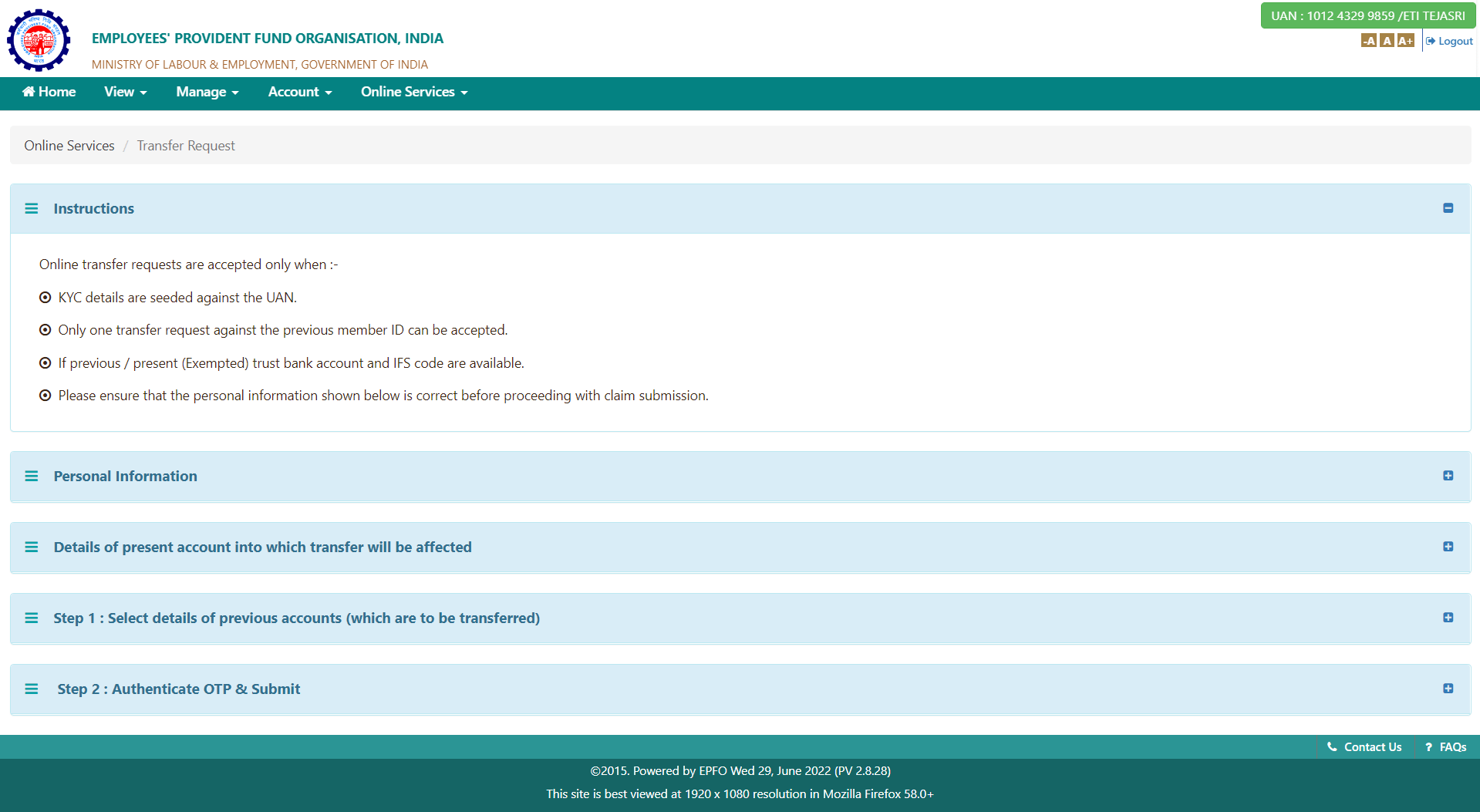

The process of transferring a PF account via UAN is listed below:

1. Check the eligibility for PF (Provident Fund) and ensure that all previous and current employers’ records are uploaded online with EPFO.

2. Submit the digital signature online.

3. To file an online transfer, you must register on the EPFO portal.

4. To initiate a transfer of your account, log into the EPF member portal and select the option to transfer your account.

5. Please complete all three sections of the form.

6. Enter your attesting authority and member ID/UAN. Then click on “Get OTP”.

7. An OTP will be sent to your registered mobile number. Enter this OTP to continue.

8. Once you submit your form, you will receive a tracking ID.

9. Submit the printout of the transfer form to your current employer.

Use these steps to withdraw money using UAN:

The UAN Member portal is a convenient resource for members. They can manage, transact, update, and view their account from the portal. The portal provides direct access to users and keeps track of their accounts in a simplified and transparent manner.

Let’s Recruit, Reward, and Retain

Your Workforce Together!