The Government of India has specified income tax slabs or income ranges. The slabs are divided based on the income range, and different tax rates are specified for each income range. The applicability of a specific income tax slab to an assessee depends on their income, age, and residential status.

Under the current income tax rules, all individuals and corporate entities with an annual income above the exemption limits must pay income tax under Income Tax Act 1961.

The new tax regime was introduced during the budget of 2020. The updated new regime is applicable for income earned during the Financial Year (FY) 2020-21, i.e., Assessment Year (AY) 2021-22. The new tax regime reduces the number of tax brackets, allowing taxpayers to pay at lower rates.

Under the new regime, taxpayers have the choice of paying taxes –

|

Income Tax Slab |

New Regime Income Tax Slabs FY 2022-23(Applicable for All Individuals & HUF) |

|

Upto Rs. 3 lakh |

Nil |

|

Rs.3 lakh to Rs.6 lakh |

5% |

|

Rs.6 lakh to Rs.9 lakh |

10% |

|

Rs.9 lakh to Rs.12 lakh |

15% |

|

Rs.12 lakh to Rs.15 lakh |

20% |

| Above Rs. 15 lakh |

30% |

|

Income Tax Slab |

Tax rates |

| Upto Rs. 2.5 lakh |

Nil |

|

Rs.2.5 lakh to Rs.5 lakh |

5% |

| Rs.5 lakh – Rs.10 lakh |

20% |

|

Above Rs.10 lakh |

30% |

|

Income Tax Slab |

Tax rates |

| Upto Rs.3 lakh |

Nil |

|

Rs.3 lakh to Rs.5 lakh |

5% |

| Rs.5 lakh – Rs.10 lakh |

20% |

|

Above Rs.10 lakh |

30% |

|

Income Tax Slab |

Tax rates |

|

Upto Rs.5 lakh |

Nil |

| Rs.5 lakh – Rs.10 lakh |

20% |

| Above Rs.10 lakh |

30% |

a. Additional Health and Education cess is levied at 4% on the income tax payable.

b. The following surcharges apply to all categories mentioned below:

The following table compares tax rates for the various income slabs under the new and old tax regimes:

|

Old tax regime |

Tax slabs |

New tax regime |

|

Nil |

Upto Rs. 2.5 lakhs | Nil |

| 5% | Rs. 2.5 lakhs to Rs.3 lakhs |

Nil |

|

5% |

Rs. 3 lakhs to Rs.5 lakhs | 5% |

| 10% | Rs.5 lakhs to Rs.6 lakhs |

5% |

|

10% |

Rs.6 lakhs to Rs.7.5 lakhs | 10% |

| 15% | Rs. 7.5 lakhs to Rs.9 lakhs |

10% |

|

15% |

Rs.9 lakhs to Rs.10 lakhs | 15% |

| 20% | Rs.10 lakhs to Rs.12 lakhs |

15% |

|

20% |

Rs.12 lakhs to Rs. 12.5 lakhs | 20% |

| 25% | Rs. 12.5 lakhs to Rs. 15 lakhs |

20% |

|

30% |

Above Rs. 15 lakhs |

30% |

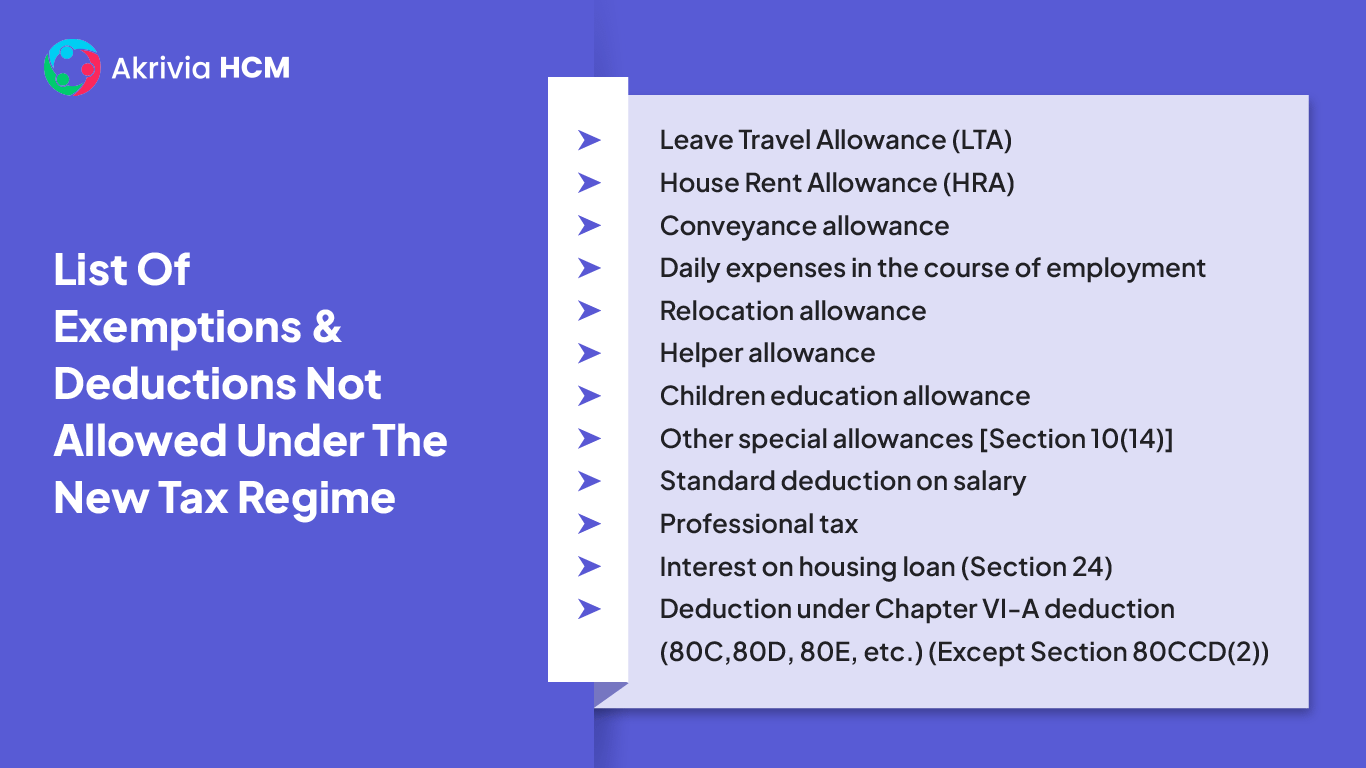

Taxpayers who opt for tax breaks under the new tax regime will have to give up some of the exemptions and deductions they were entitled to under the old regime. In new tax regimes does not allow 70 deductions and exemptions available under the old tax regime.

Here are a few of the exemptions and deductions no longer allowed under the new tax regime:

List of deductions allowed under the new tax regime:

In terms of understand the difference, it will be instructive to calculate tax liabilities under the old and new tax regimes.

Consider a hypothetical income tax

|

Heads |

Old Tax Regime (Rs) | New Tax Regime (Rs) |

|

Gross Income |

10,00,000 |

10,00,000 |

|

Deductions: |

||

|

u/Sec: 80C |

1,50,000 |

– |

|

u/Sec: 80D |

25,000 |

– |

|

u/Sec: 24(b) |

75,000 |

– |

|

Taxable Income |

7,50,000 |

10,00,000 |

|

Tax Slab (OLD) |

||

|

0 to 2.5 Lakh |

– |

– |

|

2.5 to 5 Lakh @ 5% |

12,500 |

– |

|

5 Lakh to 10 Lakh @ 20% |

50,000 |

– |

|

> 10 Lakh @ 30% |

– |

– |

|

Tax Slab (NEW) |

||

|

0 to 3 Lakh |

– |

– |

|

3 to 6 Lakh @ 5% |

– |

15,000 |

|

6 to 9 Lakh @ 10% |

– |

30,000 |

|

9 Lakh to 12 Lakh @ 15% |

– |

45,000 |

|

12 Lakh to 15 Lakh @ 20% |

– |

– |

|

> 15 Lakh @ 30% |

– |

– |

|

Income Tax |

62,500 |

90,000 |

|

Cess @ 4% |

2,500 |

3,600 |

| Total Tax Payable | 65,000 |

93600 |

Based on the above illustrative tax calculation, as a broad generalization, it can be said that:

| Source of Income | Time of Selection of the Option of Old vs New Regime |

| Salary or any other income on which TDS is applicable |

|

| Business Income | For business income, the choice between the old or new tax regime can be exercised only once for a particular business. |

The pros and cons of the old and new tax regimes are tabulated below:

| Advantages | Disadvantages |

| Old Tax Regime | |

| Around 70 exemptions and deductions available under the Income Tax Act | Only investments in specified options are eligible for claiming tax benefits |

| Incentivizes submission of false disclosures as proof of investment | |

| New Tax Regime | |

| Reduced rates of taxation. | Limited/no benefits for individuals who were already investing with obligatory premium payment requirements. |

| Limited tax saving options and hence – enhanced cash flow to the taxpayers | |

Deciding on which tax regime would benefit you can be confusing. The best strategy for determining what is best for you would be to first calculate the tax liability under the old and the new regimes, with and without the applicable deductions and exemptions.

The tax regime with the lower tax liability should then be chosen. However, the prospect of calculating tax liabilities can still be intimidating for most people. Wrong calculation of tax liabilities can lead to wrong decisions and potentially large losses.

Therefore, you need enterprise payroll software to undertake the accurate and correct calculation of tax liabilities to arrive at the right decision on the tax regime appropriate to you and your organization’s needs.

Akrivia HCM provides the best payroll management software that can help you calculate various taxes, create paycheck reports, and track employee payments. You can request a demo of Akrivia HCM’s payroll management software here.

Let’s Recruit, Reward, and Retain

Your Workforce Together!