TDS Traces is a web portal developed by the Income Tax Department of India to provide taxpayers with a single window to view their TDS statements and track the credit of TDS deducted by their employers or other deductors.

To use TDS Traces, you must create an account on the website and provide your PAN number and other personal details. Once you have created an account, you can login and view your TDS statements for the past few years. You can also track the credit of TDS deducted by your employers or other deductors.

There are several benefits to using Traces, including:

To use TDS Traces, you will need to follow these steps:

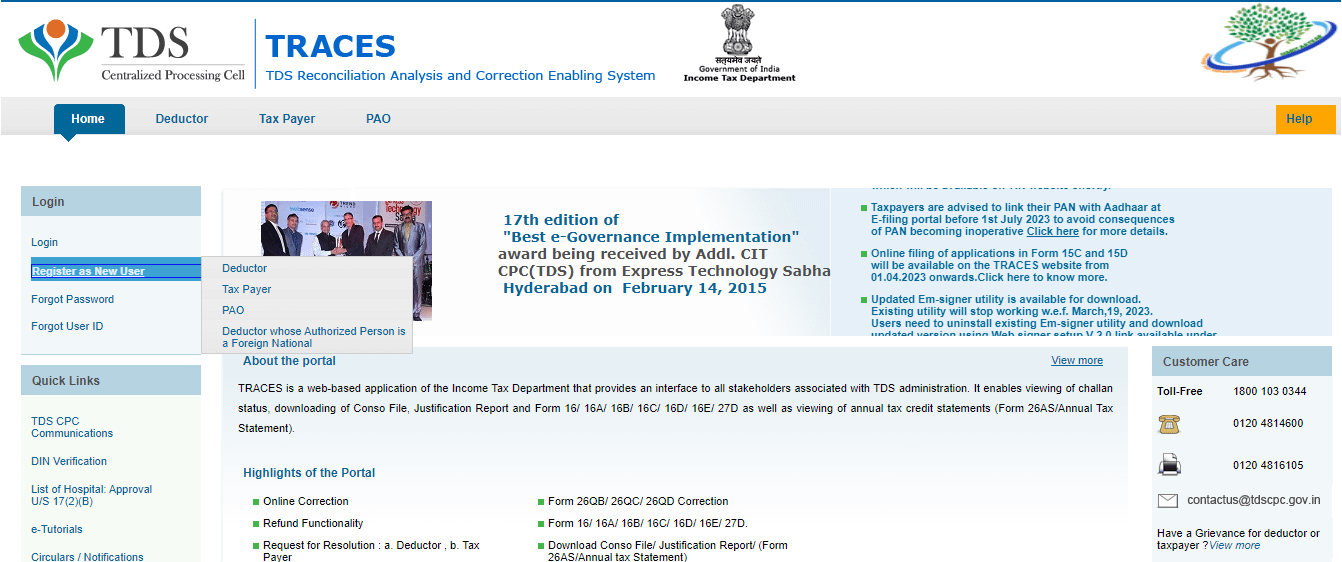

Step 1: Go to the TDS Traces website.

Step 2: Click on the “Create Account” button.

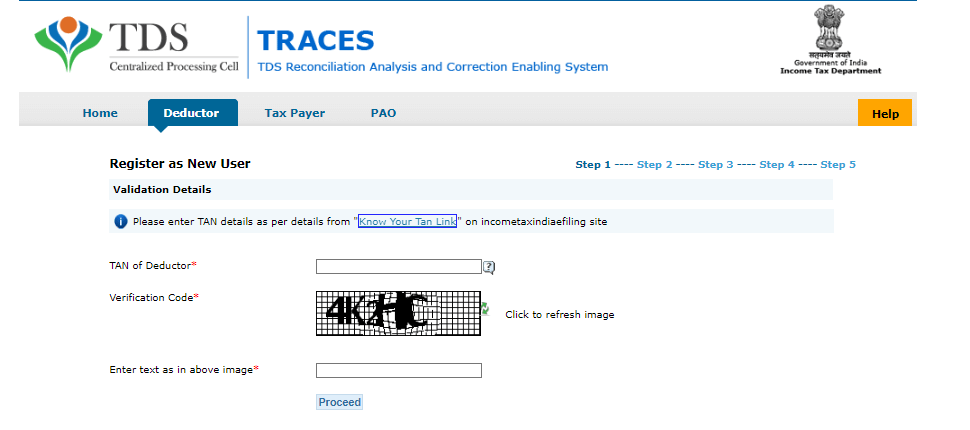

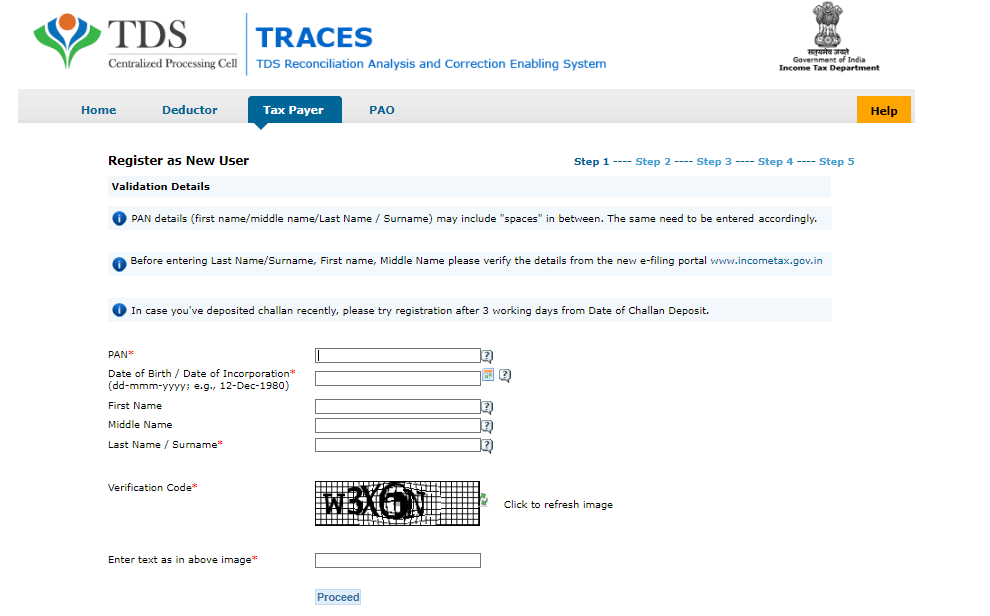

Step 3: Select the type of user and proceed

Step 5: Click on the “Submit” button.

Step 6: You will receive an email with a link to activate your account.

Step 7: Click on the link in the email to activate your account.

Step 8: Login to your account.

Step 9: You can now view your TDS statements and track the credit of TDS deducted by your employers or other deductors.

Step 1: You can login to your TRACES account using your PAN number and password. If you do not have an account, you can create one by clicking the “Create Account” button.

Step 2: The “Aggregated TDS Compliance” tab is where you can generate reports on your TDS compliance.

Step 3: You can choose to generate a report based on default or fiscal year. A default is a situation where a deductor fails to deduct TDS or fails to deposit it with the government. A fiscal year is a period of 12 months, starting from April 1st and ending on March 31st.

Step 4: You will need to enter the required details, such as the financial year or the default type.

Step 5: Once you have entered the required details, click on the “Submit Request” button. The report will be generated and you will be able to download it.

The Request for Resolution (RfR) facility in TDS Traces allows taxpayers to raise queries or seek resolutions for any discrepancies or issues related to their TDS credits and deductions. Here are the steps on how to use the “Request for Resolution” facility in TDS Traces:

Step 1: Visit the TDS Traces Portal: Go to the official TDS Traces website. Ensure you have the necessary login credentials (User ID, Password, TAN, and CAPTCHA code).

Step 2: Log In: Enter your User ID, Password and TAN to log in to the portal.

Step 3: Navigate to Request for Resolution: Once logged in, look for the option related to “Request for Resolution”.

Step 4: Select the Appropriate Category: Choose the category of request you want to raise. This could include issues related to TDS credits, mismatch in TDS details, or other relevant matters.

Step 5: Fill in the Required Details: Complete the request form with accurate and detailed information. This may include providing specific transaction details, the nature of the issue, and any supporting documents that may be required.

Step 6: Submit the Request: After completing the necessary information, submit the request through the portal.

Step 7: Track the Status: You may be provided with a reference number or a way to track the status of your request. Keep this information for future reference.

Step 8: Wait for Resolution: The tax authorities will review your request and take appropriate action. This may involve verification of the provided details and reconciliation with their records.

Let’s Recruit, Reward, and Retain

Your Workforce Together!