Introduction

If you’re a business owner, this thought must have certainly crossed your mind at some point or the other – ‘am I spending too much on payroll?’ Well, you’re not alone on that one, for sure.

Being one of the most important components of operational costs, payroll costs should ideally make up 15-30% of a company’s gross revenue.

However, in the case of labor-intensive industries like hospitality, healthcare, manufacturing, and construction, payroll costs can go as high as 60% of total revenue.

But regardless of how big a chunk of your revenue you’re putting towards payroll, a clear understanding of your payroll expenses is necessary to ensure not just profitability, but also compliance and long-term sustainability.

Primary Components of Payroll Costs

A company’s payroll costs would primarily consist of all the expenses it is obligated to pay its employees as an employer. These can include direct as well as indirect costs. The most common ones include:

- Salaries: The biggest part of payroll costs goes towards salaries. Salary expenditure is incurred routinely by businesses, and mostly at a fixed cost, making it a predictable expense.

- Overtime, Commission and Bonus: Overtime pay, commissions and bonuses are off-cycle payments, and it can be difficult to forecast these costs. That’s why, employers must invest in proper attendance and performance tracking software to make it easier to predict these costs.

- Employee Benefits: Employee benefits like health insurance, mental health benefits and PTOs also need to be considered when it comes to payroll costs. These expenses can be difficult to track as unlike employee salaries these aren’t given out as a monetary incentive. Rather, these involve paying out a third party, like an insurance agency, or a revenue loss from halted productivity.

- Reimbursements: Another form of of-cycle expenditure, reimbursements are offered to employees for business expenses that were paid by them as out of pocket expenses. This can include expenses like plane tickets, accommodation, meals and transport.

- EAPs: Employee Assistance Programs which are focused on an employee’s personal and professional wellbeing are another commonly offered non-monetary incentive in compensations packages. Companies often need to pay for these programs out of pocket, as well.

- Payroll Taxes: Depending on the location of the company, employer also need to pay payroll taxes in various forms. In India, employers must withhold income tax as TDS and make timely deposits to the government. In the UAE, payroll taxes go a step further where employers must not only withhold social security contributions, but also match a designated percentage of it. These taxations also come under direct payroll costs.

- Payroll Processing: Ironically enough payroll processing costs also come under direct payroll costs. In cases where companies outsource their payroll, they need to pay a third-party service provider according to plans based on pay frequency or number of employees. For in-house payroll, companies can opt for a payroll processing software which factors is subscription, implementation and maintenance costs.

Keeping track of various on and off-cycle payments can be difficult for payroll teams. Investing in a set payroll framework can go a long way in simplifying this process.

Basics of Creating a Payroll Framework

Deciding on a payroll framework focuses on prioritizing profitability while keeping payroll costs under a set percentage. A comprehensive payroll framework should ideally consist of the factors that make it easier to understand payroll costs and manage these expenses better.

Here are five factors a payroll framework should be based on:

1. Payroll Accounting

Payroll accounting refers to the company practice of keeping track of payroll costs like employee salaries, benefits, incentives, deductions and other components that constitute payroll expenditure. These expenses are noted in financial journal entries and documenting them properly is essential for budgeting, legal compliance and workforce planning.

A payroll accounting process generally includes timekeeping, maintaining employee information, calculating accrued wages, managing withholdings, compiling reports for audits, and processing salaries.

Payroll accounting can be done in three ways:

- Manual: This involves in-house payroll processing where all processes involved in payroll are carried out manually. That includes everything from timekeeping to processing salaries.

- Payroll Software: A payroll software can be ideal for SMEs who want to process their payroll in-house. Automating the payroll process in this manner can greatly enhance the efficiency of the payroll process.

- Outsourcing: Enterprise-grade companies can choose to completely outsource their payroll accounting.

2. Forecasting Payroll Costs

Considering how payroll costs consist of both direct and indirect costs, predicting payroll expenses can be a long-drawn numbers game that requires consistent effort to manage. A company would require historical data to estimate future values and accordingly plan their cashflow.

Moreover, to keep up with changing business needs, payroll costs need to be forecasted regularly, often at a quarterly, bi-yearly or annual basis. The frequency of reviews can benefit companies by allowing them to adjust internal and external expenses, while budgeting for the oncoming months.

3. Cashflow Management

Cashflow management refers to tracking the flow of money going in and coming out of a business. It involves monitoring the net amount of cash, excluding the expenses, to determine the amount of cash left to cover essentials like employee salaries, loan repayments and vendor payments. Effective cashflow management allows businesses to maintain financial stability, and hence, must be considered an important entity for creating a comprehensive and sustainable payroll framework.

For most businesses, cashflow can primarily be from any of the following three sources:

- Cashflow from operations

- Cashflow from investments

- Cashflow from financing

Tracking the movement of money from these three categories along with careful planning can help businesses ensure sufficient cashflow to meet payables on time and avoid being in deficit.

4. A Scalable Payroll Budget

All companies must have a set payroll budget which includes direct payroll costs. But only ensuring a payroll budget isn’t enough for creating an effective payroll framework. As business needs expand with the growth of the business itself, scalability becomes imperative in all aspects from operations to expenses.

However, alarmingly enough, despite payroll costs being the lion’s share of a company’s operational expenses, most business leaders don’t even take payroll data into account when developing expansion and growth strategies.

By analysing payroll data, workforce planning can be done more effectively, as it would offer an all-inclusive picture of not just payroll costs but also employee compensation, retention and turnover trends. This would ensure a much more flexible approach to workforce planning. That way, a scalable payroll budget can be designed to accommodate the prompt needs of an expanding workforce. It can also ensure better talent acquisition and retention.

5. Legal Compliance

Legal compliance is also essential when it comes to a payroll framework. Compliance not only ensures that employees are being treated fairly, but it also protects the company from potential legal conflicts that can lead to penalties and lawsuits.

Companies need to ensure compliance in the following aspects:

- Labour Laws: Labour laws outlining minimum wage, work hours, overtime limits and overtime pay need to be followed by every employer to ensure that employee rights are not being violated.

- Tax Reporting and Remittance: Employers in several countries are required to calculate, deduct and remit income taxes and social security contributions from their employees’ monthly salaries.

- Compliance with Employee Benefits: Governments in several countries also mandate that employers must provide mandatory employee benefits like paid leaves and insurance coverage.

These five factors are essential for creating a payroll framework that’ll allow companies to manage payroll costs much more effectively. However, besides these elements, a payroll framework must also consider circumstances of expansion, recession and other market trends that can affect payroll costs.

Factors That Can Affect Payroll Costs

Considering a significant portion of a business’ revenue goes towards payroll costs, it is important to note that these costs can easily be impacted by external factors. The most prominent among these factors are:

1. Market Trends

After witnessing the Great Resignation during the pandemic, the role of market trends in determining labour supply and demand becomes very apparent. Payroll costs can fluctuate according to trends like availability of skilled labour, talent pool demographics, and economic conditions like inflation or recession.

2. Expansion

Business growth is also synonymous with increasing payroll costs, as increasing operational requirements comes with the need to hire more personnel. Other factors like cross-country expansion plans also throw in factors like fluctuating currencies and exchange rates, changes in wages rates and even availability of labour.

3. Regulatory Changes

Regulatory laws like minimum wage rates, work hours, overtime limits and tax withholding percentages can be changed by the government or assigned regulatory bodies at any point of time. This can also result in increased payroll costs for employers.

4. Industry Specific Factors

Industry related factors like technological advancements can raise the demand for certain skills, resulting into an increased demand for skilled labour or requiring more investment in professional development programs. Besides this, competition from other companies can also increase payroll costs for talent retention and acquisition efforts.

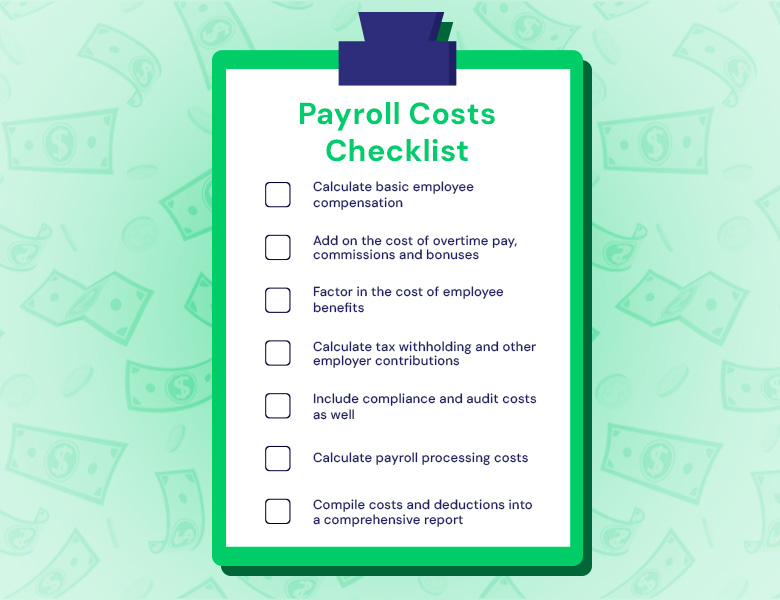

How to Calculate Payroll Costs: A Checklist

With so many essential aspects of running a business being dependent on payroll, it becomes essential to accurately forecast, calculate and process payroll. However, the number of regulatory laws, tax deductions and other indirect costs, don’t make the process any easier. That’s why we’ve put together a simplified checklist on how to calculate payroll costs, without getting overwhelmed by the intricacies of the process.

Payroll Costs Checklist:

Strategies to Optimize Payroll Costs

Given how much payroll costs can amount to, optimizing these costs must come across as a priority for most business leaders. Besides, simplifying these costs can also help in raising profit margins.

1. Automating Payroll

Payroll automation can reduce processing time and greatly streamline things for payroll teams. As most calculations will be done automatically, resource allocation in terms of time and labour can be minimized. There’s also chances of less errors which can improve compliance and reporting. Automation can also help companies issue payslips, process tax forms and TDS certificates with ease. These advantages can add up to significant savings in terms of payroll costs.

2. Avoid Over-hiring and Overstaffing

Over-hiring is a tactic that is often used by companies to ensure their talent needs are always met. During recruitment, managers can hire extra candidates to avoid situations where shortlisted candidates can renege and decline their offer, leaving a position open for longer. In several cases, over-hiring is a standard practice to hoard employees from potential competitors. But with over-hiring, payroll costs also rise significantly. Not only do employers have to pay more people, the loss of productivity also affects business operations.

3. Monitoring Overtime Pay

In most countries, overtime costs are twice the usual wage rate, which can result in an unprecedented increase in payroll costs. That’s why monitoring workers’ overtime is essential for optimizing payroll costs. Properly tracking work hours through attendance management software can help employers pay employees accurate wages.

Moreover, tracking work hours and productivity can help in identifying workload patterns that indicate understaffing. This can also contribute towards sustainable hiring decisions in the long term.

4. Retain High Performers

By putting in active retention efforts, companies can save on resources required to hire and train new employees. The combined cost of having an open position and recruiting and training a new employee to fill that position far exceeds the cost of retaining a current high performing employee. Incentives targeted at improving employee retention, like performance bonuses and promotions, can help companies save time as well as money.

5. Evaluate Employee Benefits

Employee benefits pose as one of the most significant hidden payroll costs for businesses. But most of the time it does happen that the employee benefits the company is paying for isn’t as useful to employees and hence go unavailed for the most part. Nobody’s winning in this scenario, except the third-party the company is paying.

That’s why companies need to keep track of how their offered benefits are being utilised and evaluate their necessity accordingly. In some case, employers may even need to restructure employee benefit components to include more relevant ones. This exercise will not only ensure that employers are receiving significant ROI from these efforts, but also boost employee engagement rates.

Summing Up

Payroll costs are a significant monetary investment that businesses need to make on a consistent basis. As it consumes a large part of the revenue, payroll costs can easily snowball out of control if they’re not understood and processed properly. Moreover, discrepancies in employee salaries or taxes can also a land a business into trouble, risking penalties, fines and reputational damage.

That’s why it is essential for businesses to understand their payroll costs and frequently revise their payroll processing framework. This will not only ensure a streamlined payroll process but also guarantee that businesses stay compliant despite the ever-changing compliance laws.