Country Overview

Beyond the impressive skyline and bustling ports, Singapore has established itself as a prime location for business and investment. Officially known as the Republic of Singapore, this island nation in Southeast Asia is bordered by Malaysia to the north and Indonesia to the south. Singapore has a free-market economy. Investing in Singapore grants exclusive entry into major markets such as China, India, and the ASEAN countries due to its numerous Free Trade Agreements (FTAs) and Investment Guarantee Agreements (IGAs). The city-state boasts a highly developed infrastructure, a business-friendly regulatory environment, a skilled workforce and a high standard of living.

The forward-looking policies of Singapore Government has maintained its competitive edge and continued to attract substantial foreign investment. This city-state is committed to sustainable development and taking important measures to achieve such as the “Singapore Green Plan 2030” which aims to accomplish net-zero emissions by 2050.

Market Glimpse

Singapore’s economy is diversified, with key sectors including manufacturing, financial services, and information technology. The Ministry of Trade and Industry (MTI) has revealed that in the 2nd quarter of 2024, the Singapore economy expanded by 2.9%, on a year on year basis reflecting the nation’s resilience amidst global economic challenges. Additionally, in the same quarter of 2024, the Foreign Direct Investment in Singapore has increased by 55,315.10 SGD Million. It also plays a vital role in Asia, as it serves as a major hub for oil trading and refining.

The Singapore Economic Development Board (EDB) mentions the nation has become a destination of choice for enterprise tech due to government initiatives and support. Additionally, the Government Technology Agency (GovTech) outlines that Singapore Government will spend up to an estimated $3.3 billion on info-communications technology (ICT) in 2024 to modernise IST infrastructure and develop digital services.

Due to all these government programs and policies, supporting tech startups and political stability, the nation has been a beneficiary of massive investments from investors all around the world and serves as the headquarters for many companies. The list of Singapore being a favourable investment climate does not cease there. The nation also offers several incentives to the foreign investors –

- Tax holidays, concessions, & exemptions

- Various grants & fundings to support innovation, research & development

- Allows businesses to write off capital expenditures more quickly

- Access to loans with favourable terms

- Access to well-developed industrial zones

- Agreements with over 70 countries to avoid double taxation and reduce tax liabilities.

Along with all the upsides, there are a few pointers that need to be taken care of before setting up a new business.

| Potential Problems | Measures to Protect Business |

| Slow population growth affecting the country’s labour market | Include foreign worker to access a wider talent pool. |

| High operational costs for businesses | Having virtual offices can lead to substantial savings on rental and utility costs. |

| Small domestic market | Have comprehensive marketing and export strategy to hold the local market and diversify revenue streams. |

Transitioning from the wider economic context, exploring the complexities of payroll management is a vital element for any successful company. This guide will navigate through the key aspects of payroll to ensure adherence to regulations and enhancing operational efficiency.

Payroll Compliance Essentials

To commence operations in Singapore, several registrations are required for a company. The process begins with the finalization of the company name, which must be submitted to the Accounting and Corporate Regulatory Authority (ACRA) for approval. The incorporation can be done in 1-2 days. Verification through ACRA’s database ensures that the name is unique and not already in use. Upon completion of the necessary documentation, the company is eligible to receive its Unique Entity Number (UEN) through the BizFile+ portal. ACRA will notify the confirmation of the company’s incorporation and issue company business profile.

As the company starts its operations, adherence to relevant employment, social security, and tax regulations is crucial. Compliance with the Central Provident Fund (CPF) contributions, as mandated by the CPF Board, ensures that employees receive their due benefits. Additionally, adherence to the Employment Act, which governs minimum wage, working hours, and leave entitlements, is essential. Accurate calculation and timely remittance of taxes to the Inland Revenue Authority of Singapore (IRAS) are required to avoid penalties and ensure compliance.

In the course of this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth and the links to relevant official sites are embedded below:

| Category | Regulation No./Name |

| Income Tax Laws | Income Tax Act 1947 |

| Central Provident Fund And Self Help Fund | Central Provident Fund Act 1953 |

| Employment Laws | Employment Act 1968 |

Onboarding Simplified

The onboarding process for employees in Singapore is governed by relevant labour laws to ensure compliance with stipulated norms. This process mandates the establishment of a defined employment contract, enclosing all necessary working conditions and payroll factors for seamless operations. The requirements for Singaporean payroll are outlined below:

1. Employee Classification

Employment Act (‘the Act’) is the main labour law of Singapore, and as per the Act, an employee can be employed in the following terms:

2. Employment Contract

The employment contract or offer letter should be in writing, mentioning all the legal information. The mandatory information that should form part of a valid employment contract is stipulated by Employment Law as provided under–

- Full name of employee & employer

- Job title & responsibilities

- Start date of employment

- Duration of employment (if employee is on fixed-term contract)

- Working hours

- Number of working days per week

- Rest day

- Salary period

- Basic salary

- basic rate of pay (for hourly, daily or piece-rated workers)

- Fixed allowances & deductions

- Other salary-related components (Bonuses & Incentives)

- Overtime payment rate & period

- Leave entitlement

- Medical benefits

- Probation period

- Notice period

- Place of work

3. Probation Period

Employment Act in Singapore does not have specific clauses defining the probation period, the duration mostly ranges between 3-6 months. The exact duration is determined by the employer, which must be mentioned in the agreement or employee contract.

4. Minimum Wages

As a national policy, the Ministry of Manpower (MOM) has not prescribed any minimum wages for all workers in Singapore, regardless of whether they are local or foreign. The employers are encouraged to remunerate their employees based on their skills and competencies and determine the increment or decrement based on market demand and supply for labour.

Workplace Protocols

Ensuring compliance with an employee’s working conditions, as mandated by the Act is a crucial aspect following their onboarding if an employee is covered under Part IV of the Employment Act, which outlines hours of work, breaks, overtime pay, and rest days. For other employees, the employment contract sets the scope of these conditions.

Note: Part IV of the Employment Act applies to:

- A workman (doing manual labour) earning a monthly basic salary of $4,500 or less.

- An employee who is not a workman, but who is covered by the Employment Act and earns a monthly basic salary of $2,600 or less.

1. Working Hours

| Maximum Working Hours | ||

| 5 days or less a week | OR | More than 5 days a week |

| 9 hours/day | 8 hours/day | |

| 44 hours/week | 44 hours/week | |

2. Breaks

The period of break is also important for the employees and the Employment Law has specific rules for this matter.

| Maximum Continuous Working Hours | 8 hours |

| Minimum Break Duration | 45 minutes |

3. Rest Day

As per the Employment Act, employees are not required to work more than 6 consecutive hours without a break.

Employers are obliged to provide 1 rest day per week. For shift workers, the rest day can be a continuous period of 30 hours.

4. Overtime

Overtime is the work done in excess of the normal hours of work (excluding breaks).

| Maximum Overtime hours in a month | 72 hours |

| Overtime Pay Formula | Hourly basic rate of pay X 1.5 X Overtime hours worked |

The overtime rate payable for non-workmen is capped at a salary level of $2,600, or an hourly rate of $13.60. For others, there is no cap, the actual hourly basic rate of pay will be applied.

Overtime payment must be made within 14 days after the last day of the salary period.

5. Nightshift Pay

In Singapore, employees working night shifts do not receive additional compensation. However, if their regular working hours exceed the standard limit, they are entitled to overtime pay.

6. Leaves Entitlement

Employees in Singapore are entitled to religious and public holidays listed below:

| Holiday List 2025 | |

| New Year’s Day | 1 January |

| Chinese New Year | 29 January 30 January |

| Hari Raya Puasa | 31 March* |

| Good Friday | 18 April |

| Labour Day | 1 May |

| Vesak Day | 12 May |

| Hari Raya Haji | 7 June* |

| National Day | 9 August |

| Deepavali | 20 October |

| Christmas Day | 25 December |

* Dates may be modified as official changes are announced

Employees are also entitled to several other paid statutory leaves as provided below:

| Leave Type | Minimum Entitlement |

| Annual leave | Based on years of service (Refer to Table 1 below) |

| Sick leave | 14 days |

| Hospitalisation leave | 46 days |

| Maternity leave | 16 weeks* |

| Paternity leave | 2 weeks |

| Shared parental leave | 4 weeks |

| Adoption leave | 12 weeks |

| Childcare leave | 6 days** |

*12 weeks if the child is not a Singapore citizen.

**For Singapore citizen. Parents of non-citizens can get 2 days.

| Year of service | Days of leave |

| 1st | 7 |

| 2nd | 8 |

| 3rd | 9 |

| 4th | 10 |

| 5th | 11 |

| 6th | 12 |

| 7th | 13 |

| 8th and thereafter | 14 |

a. Holiday Pay

Employees are entitled to an additional gross rate of pay for a day if they work on a public holiday, provided they were not absent on the working day immediately before or after the holiday without consent or a reasonable excuse, or if they were on authorised leave. However, employees are not entitled to holiday pay if the holiday falls on a day during their approved unpaid leave.

7. Event-based Compensation

Employers are required to provide a range of benefits and compensation to ensure the safety and security of their employees while at work. In Singapore, the Work Injury Compensation Act 2019 (WICA) allows employees to claim compensation for work-related injuries or diseases without the need to file a civil suit under common law. This act offers a low-cost and faster alternative to common law for resolving compensation claims. Claims must be filed within 1 year from the date of the accident.

| Compensation for Accident | Compensation for Death |

| Medical leave wages | Medical expenses |

| Medical expenses | Lump-sum compensation |

| Lump-sum compensation for permanent incapacity |

For the details on benefits, the types of compensation and their limits refer this link.

8. Other Benefits

In Singapore an employee is entitled to one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Rest day pay

- Annual supplementary wage

- Public holiday pay

Salary Essentials

1. Salary Components

In Singapore, various salary components are commonly included as part of an employee’s gross salary, reflecting different aspects of compensation and benefits.

The table below provides an overview of the various salary components that constitute the gross salary in Singapore payroll.

| Salary Component | Definition |

| Basic salary | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement. |

| Allowances | Allowances paid for salary period, such as:

|

| CPF | Deduction made for compulsory employee contribution to CPF for Citizen and Singapore Permanent Resident |

| Self-help group fund (SHG) | Deduction made for respective SHG fund contributions from your employees’ wages. |

| Other deductions | All ad-hoc deductions, e.g. deductions for no-pay leave, absence from work etc. |

2. Payslip Components

The Employment Act of Singapore outlines that all employers must issue itemised pay slips to employees covered under this Act. The format of the payslip can be in either soft or hard copy and must be given along with payment or within 3 days working days of payment to employee.

The payslip must contain the following details:

- Full name of employer & employee.

- Date of payment

- Basic salary

- Basic rate of pay & Total number of hours or days worked (only for hourly or daily or workers)

- Start and end date of salary period.

- All fixed allowances

- All ad-hoc allowances

- Bonuses, rest day pay & public holiday pay (if any)

- All fixed deductions

- All ad-hoc deductions

- Overtime hours worked & pay

- Start and end date of overtime payment period (if different from start and end date of salary period)

- Net salary paid in total

Decoding Deductions

Employers are obliged to make several mandatory deductions in the below form:

1. Withholding Taxes

In Singapore tax year runs from 1st January to 31st December. In contrast to numerous other nations, Singapore employers are not responsible to deduct taxes at the source for their employees. Instead, individuals are required to file their annual tax returns and settle the due amount at the conclusion of each fiscal year. It is paid directly to the local tax authority, the Inland Revenue Authority of Singapore (IRAS). The applicable income tax rate may differ for individuals based on their resident status and income slabs. For detailed information, visit this link.

Reporting

Although the employers in Singapore are not mandated to withhold income tax, they are legally obligated, under Section 68(2) of the Income Tax Act, to prepare Form IR8A along with Appendix 8A, Appendix 8B, or Form IR8S (as applicable) for their employees by the 1st of March each year.

| No. of Forms | Purpose |

| Form IR8A | This form is used to report employment income records to the government. |

| Appendix 8A | This form must be completed for employees who were provided with benefits-in-kind. |

| Appendix 8B | This form must be completed for employees who derived profits from Employee Stock Option (ESOP) Plans or other forms of Employee Share Ownership (ESOW) Plans. |

| Form IR8S | This form must be completed if excess CPF contributions have been made on employees’ wages and/or if a refund on excess CPF contributions has been claimed or will be claimed. |

| Form IR21 | This form must be completed for tax clearance of foreign or Singapore Permanent Resident (SPR) employees. |

Under Auto Inclusion Scheme (AIS), which is mandatory for employers with 5 or more employees starting from Year of assessment 2022, employers must submit their employees’ income information to IRAS electronically by 1 Mar every year. To register for AIS, employer must visit the mytaxportal and apply.

The above-mentioned reports can be filed electronically via the following modes:

- Submit with payroll software (API). IRAS partners payroll software vendors integrating the payroll software with the AIS Application Programming to facilitate employers’ preparation and submission of the employment income information

- Submit employment income information directly via IRAS’ online digital service at MyTaxPortal

- Submit via Provident and Tax (PAT) system, which is a web-based system developed and managed by CrimsonLogic Pte Ltd, that supports e-Submission of Employment Income.

Non-Compliance

The returns must be submitted by 1st March of the following year. According to Section 94 of the Income Tax Act, employers who miss this deadline may face a fine of up to $5,000, or imprisonment for up to six months if the fine is not paid.

Employers must accurately and completely report employees’ employment income. Under Section 95 of the Income Tax Act, providing incorrect information affecting another person’s tax liability is an offence. Offenders may face a penalty of up to twice the tax undercharged, a fine of up to $5,000, imprisonment for up to three years, or both.

2. Social Security

Even though the employers are not responsible to deduct the income tax, they are required to withhold the social security contributions which are segregated as follows –

a. The Central Provident Fund

CPF is a compulsory social security savings program, financed by contributions from both employers and employees. Employers are obligated to make CPF contributions for any employee who earns more than $50 per month. These contributions are due at the end of each month.

To determine CPF contributions follow the below-mentioned steps:

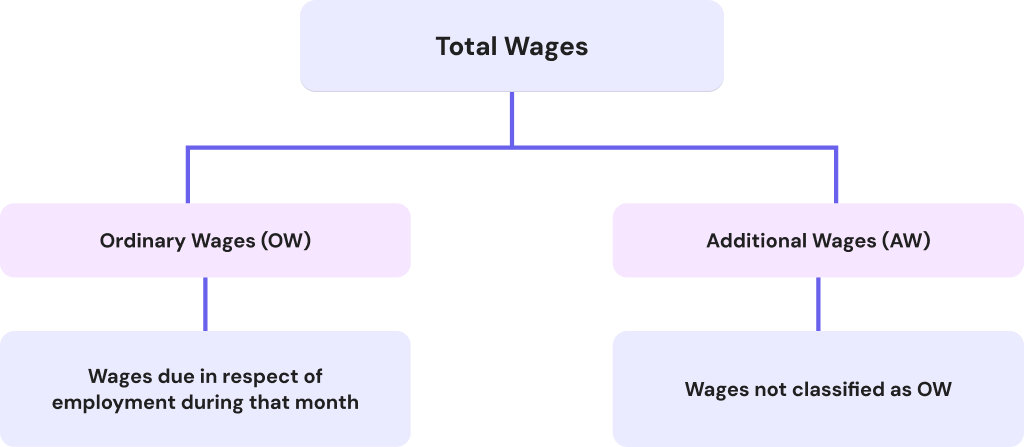

- Step 1 – Determine the total wages of the employee to calculate the CPF contributions. Refer below to understand total wages.

- Step 2- Select the contribution rate table that applies to the employee, based on their citizenship status

- Step 3 – Different rates apply to different age groups so select that and based on the employee’s age.

Below is the illustrative CPF Contribution rate table for Singapore Citizens or Singapore Permanent Residents (3rd year onwards) earning total wage more than $750, for the year 2024.

| Employee’s Age (in years) | Employer Contribution (percentage of wage) | Employee Rate (percentage of wage) |

| 55 & below | 17% | 20% |

| Above 55 To 60 | 15% | 16% |

| Above 60 To 65 | 11.5% | 10.5% |

| Above 65 To 70 | 9% | 7.5% |

| Above 70 | 7.5% | 5% |

Note: In case of age change, new contribution rates are effective from the first day of the month following the employee’s 55th, 60th, or 65th birthday.

To know detailed contribution rate applicable for CPF contribution follow this link

b. Self Help Group (SHG) Funds

SHG Funds in Singapore are established to support and uplift low-income households within the Chinese, Eurasian, Muslim, and Indian subcontinent communities. Employers are responsible for deducting the appropriate contributions from employees’ wages and remitting them to the respective SHG funds. This system ensures that each community receives targeted assistance to address their unique needs and challenges.

To know the detailed contribution for each fund follow this link.

The following table outlines the key details of various Self-Help Group (SHG) funds:

| Name of SHG Funds | Administration Body | Eligibility | Contribution Rates |

| CDAC | Chinese Development Assistance Council | Employees who belong to the Chinese community and are:

|

Refer to Table 1 |

| ECF | Eurasian Association | Employees who belong to the Eurasian (a person of both European and Asian ancestry) community and are:

|

Refer to Table 2 |

| MBMF | Majlis Ugama Islam Singapura | Employees who are Muslims and are:

|

Refer to Table 3 |

| SINDA | Singapore Indian Development Association | Employees of Indian sub-continent, Bangladesh and Sri Lanka descent who are:

|

Refer to Table 4 |

CDAC Contribution Rates (Table 1)

| Monthly Total Wages | Monthly contribution |

| $1,000 or less | $2 |

| > $1,000 to $1,500 | $4 |

| > $1,500 to $2,500 | $6 |

| > $2,500 to $4,000 | $9 |

| > $4,000 to $7,000 | $12 |

| > $7,000 to $10,000 | $16 |

| > $10,000 | $20 |

ECF Contribution Rates (Table 2)

| Monthly Total Wages | Monthly contribution |

| $1,000 or less | $2 |

| > $1,000 to $1,500 | $4 |

| > $1,500 to $2,500 | $6 |

| > $2,500 to $4,000 | $9 |

| > $4,000 to $7,000 | $12 |

| > $7,000 to $10,000 | $16 |

| > $10,000 | $20 |

MBMF Contribution Rates (Table 3)

| Monthly Total Wages | Monthly contribution |

| $1,000 or less | $1 |

| > $1,000 to $1,500 | $3 |

| > $1,500 to $2,500 | $5 |

| > $2,500 to $4,500 | $7 |

| > $4,500 to $7,500 | $9 |

| > $7,500 to $10,000 | $12 |

| > $10,000 to $15,000 | $18 |

| > $15,000 | $30 |

SINDA Contribution Rates (Table 4)

| Monthly Total Wages | Monthly contribution |

| $1,000 or less | $1 |

| > $1,000 to $1,500 | $3 |

| > $1,500 to $2,500 | $5 |

| > $2,500 to $4,500 | $7 |

| > $4,500 to $7,500 | $9 |

| > $7,500 to $10,000 | $12 |

| > $10,000 to $15,000 | $18 |

| > $15,000 | $30 |

c. Levies

Within this framework, various levies and contributions are designed to support workforce development and manage the employment of foreign workers. Two key components of this system are:

I. Skills Development Levy (SDL):

The SDL is a mandatory levy that employers must pay for all employees working in Singapore, including foreign employees. This levy is in addition to the monthly CPF contributions. CPF Board collects SDL on behalf of the Skills Future Singapore Agency (SSG).

SDL is levied based on the monthly wages as provided below:

| SDL contribution rates | |

| Monthly Total Wages | Monthly contribution |

| <=$800 | $2 |

| >$800 but less than and equal to $4500 | 0.25% *Total Wage |

| >$4500 | $11.25 |

Non-Compliance

For late payment of SDL contribution, employers may have to pay a penalty of 10% on the outstanding amount each year.

II. Foreign Worker Levy (FWL):

FWL is a pricing mechanism to regulate the number of foreigners in Singapore. The levy is paid depends on two factors:

- The worker’s qualifications

- The number of Work Permit or S Pass holders hired

Employers will receive the bill for this levy, sent by Ministry of Manpower (MOM) and it must be paid for each month by the 17th of the following month. The amount of levy varies by different sectors, for detailed information regarding the contribution follow this link.

Reporting for CPF, Self Help Funds and SDL

Employers are permitted to deduct the employee’s share of CPF and SHG contributions from their monthly wages and remit to the CPF Board. To submit CPF contributions in Singapore, all employers must use CPF EZPay, a digital service designed to streamline the process. Employers can submit CPF contributions through CPF EZPay in three ways:

| CPF EZPay | Electronic Standing Instruction (ESI) | File Transfer Protocol (FTP) |

| With CPF EZPay, employees’ details can be saved and loaded, and amendments can be easily made for monthly CPF submissions. The auto-computation feature is utilised for hassle-free submission. | If Direct Debit payment mode is already being used and employees’ wages generally do not change every month, ESI can also be set up within CPF EZPay. Once ESI is set up, monthly submissions and deductions will be automatically made. | A file can be uploaded via CPF EZPay to submit CPF contributions. The file must adhere to the FTP Specifications. |

Non-Compliance

If all outstanding CPF contributions are not settled, including any late payment interest and composition amounts by the stipulated deadline which is 14th of the following month, the CPF Board will initiate prosecution proceedings against them. Upon conviction for offences under Section 58(1)(b) of the CPF Act, employers will face the following legal liabilities:

- For late payment, an interest of 18% per annum (1.5% per month) will be charged starting from the first day of the following month after the contributions are due. The minimum interest payable is $5 per month.

- A court fine of between $1,000 and $5,000 per offence and/or up to 6 months’ imprisonment for the first conviction.

- A court fine of between $2,000 and $10,000 per offence and/or up to 12 months’ imprisonment for subsequent convictions.

3. Minimum Take Home Pay

In Singapore, there is no legally mandated minimum take-home pay requirement for employees. However, there are law mandated capping on the deductions. The deduction for damage or loss of money or goods must not exceed 25% of the employee’s one month salary. Similarly, the deductions for recovering advances, loans should not exceed 25% of the one-month salary. Employers cannot deduct more than 50% of the total salary payable in any one salary period.

Seamless Offboarding

Ensuring compliance during the offboarding process is crucial and should not be overlooked by employers. Typically, employment termination occurs due to retirement, resignation, or dismissal for serious reasons. Depending on the reason for termination, the employee is entitled to specific termination payouts, as outlined below:

1. Retirement

According to the Retirement and Re-employment Act (RRA), the minimum retirement age is 63 years, and employer cannot ask employees to retire before that age.

The Employment Act does not specify any law mandated benefits for retiring employees. However, they are entitled to the benefits as per the employment contract or as negotiated usually two weeks to one month salary per year of service.

The retiring employee is eligible for the following benefits, if provided in their employment contract:

- Ex gratia payment

- Gratuity

2. Resignation

Employees intending to resign need to serve a notice period as mentioned in the contract. If the notice period was not specified in employment contract, it will be determined based on the length of your service, as outlined below:

| Length of service | Notice period |

| Less than 26 weeks | 1 day |

| 26 weeks to less than 2 years | 1 week |

| 2 years to less than 5 years | 2 weeks |

| 5 years or more | 4 weeks |

Upon resigning, the employee will get benefits as per their employment contract or as negotiated usually two weeks to one month salary per year of service.

3. Dismissal

An employee may be terminated by the employer or authority due to intentional or negligent actions, causing damage, loss, or destruction of the company’s property. In such instances, the employee is not subjected to any benefits.

Conclusion

Investors prioritise stability, and Singapore meets this demand through its steady economic growth, stable politically scenario and low inflation. Undoubtedly, this nation presents an attractive landscape for businesses, characterised by its streamlined regulatory environment and uniformed fiscal policies for managing compliance easily while the efficient legal system safeguards investments and intellectual property rights.

Having an advanced payroll systems and a proactive approach to staying on top of the regulatory updates will ensures seamless payroll management. In addition to that, utilising the cutting-edge technology and expert advice will help the company to achieve compliance while enhancing workforce satisfaction and operational efficiency. Singapore’s commitment to fostering a business-friendly atmosphere further solidifies its position as a prime destination for enterprises seeking growth and stability.

FAQs

If an employee’s overseas posting is incidental to Singapore employment, IR8A must be filed.

If the overseas posting is not incidental to Singapore employment, IR8A is still required, but employment income should not be filled in items a) to d) of Form IR8A.

"Full Year" or "Part of the Year" should be selected in item e) 2, depending on the case.

Yes, contributions made by an employer to a pension/provident fund outside Singapore, in respect of employment exercised in Singapore, are taxable.

Yes, CPF contributions made by the employer on the employee's behalf must be reported in IR8A under item d) 1. Allowances.

If the child is not a Singapore citizen, then 12 weeks of maternity leave is applicable.

In case of twins or triplets, it will be treated as a single delivery, and single maternity period benefits will be provided.

There is no statutory entitlement for marriage or compassionate leave.

Such leave entitlements depend on the terms of the employment contract or mutual agreement between the employer and employee.

The classification depends on when the OT pay is due, and the date of payment determines whether it qualifies as OW or AW.

If OT is payable by the 14th of the following month, then it is OW, otherwise it will be classified as AW.

Misclassification can lead to legal penalties and back payments owed to employees if they are incorrectly categorised as non-eligible for benefits such as CPF contributions.

No, since 1 January 2003, foreign employees are exempt from CPF contributions as they are not expected to retire in Singapore.

CPF contributions are required only for Singapore citizens and Permanent Residents (PR).

Employers must contribute to CPF when an employee earns more than 50 SGD per month.

In Singapore, contributions to the CPF are mandatory for employees who are Singapore citizens or PR.

These contributions cannot be waived, except under specific circumstances, such as when an employee reaches the retirement age.

No, withholding tax is not applicable in Singapore.

However, employers are required to file Employment Income Record annually by 1st March of the following year.

CPF contributions are based on total wages earned in a month, excluding any no-pay leave.

No contribution applies for the no-pay leave days.

Wages must be apportioned to align with the relevant calendar month for CPF contributions.

The revised CPF contribution rate applies from the next month when the employee’s age changes.

If the bonus is paid in a month following the employee’s departure, CPF contributions should be made in the month it was paid.

CPF contribution rates for PR apply starting from the day the PR status is granted.

CPF contributions are required only for the period during which the employee was still a PR.

Yes, SHG contributions are based on total wages, including the 13th-month wage.

Employees under multiple employment can opt to contribute through a single employer.

SHG contributions are required whenever the employee receives wages for the month.

The first component of the employee's race, as indicated on their NRIC, determines the SHG fund.

If the employee is working overseas, SDL is not required.

Yes, SDL must be paid for all employees, including part-time, temporary, and casual employees.

Yes, a single Additional Wage (AW) ceiling can be applied if:

- Both employers are related.

- The employee is informed about the application.

- The employment contract terms remain unchanged.