Country Overview

Saudi Arabia has positioned itself as a major economic powerhouse over the years. Officially known as the Kingdom of Saudi Arabia, this Middle Eastern nation is bordered by Jordan in the Northwest, Iraq in the North and Northeast, Kuwait, Qatar, Bahrain, and United Arab Emirates in the east, Oman in the Southeast and Yemen in the South. Saudi Arabia have a mixed economy with a strong emphasis on oil production, being one of the world’s largest oil exporters. However, the country is actively diversifying its economy through its Vision 2030, a blueprint to transform the socioeconomic landscape of the country. This vision aims to reduce its dependency on oil and develop different sectors such as tourism and renewable energy in order to create a vibrant environment for both local and international investors.

Investing in Saudi Arabia offers access to a rapidly growing market and location connecting three continents: Asia, Africa, and Europe. Saudi Arabia also has signed a Trade and Investment Framework Agreement (TIFA) with United States that promotes the establishment of legal protections for investors facilitating smoother trade and investment flows.

The country is already prepared with their Vision 2060, that aims to achieve net-zero emissions and stable capacity of renewable energy. With its policies to protect investors and forward-thinking approaches, Saudi Arabia has become one of the significant forces in the global market.

Market Glimpse

Initiated in 2016, Vision 2030 has set Saudi Arabia’s economy on a path of significant transformation. Driven by Vision 2030, the country aims to diversify the economy beyond oil and develop new sectors and industries.

According to the General Authority for Statistics (GASTAT) the real GDP during third quarter of 2024 achieved a growth rate of 2.8% compared to the same period of the previous year. It showcases the nation’s resilience in the face of global economic challenges. The countries, Foreign Direct Investment (FDI) rate also has witnessed a boost. The net flow of FDI in the country has amounted to 9.5 billion SAR during the first quarter of 2024, reaching a growth of 5.6% compared to the first quarter of 2023, which was 9 billion SAR.

The digital sector of the country also has experienced an extraordinary transformation, rivalling the progress made over the past three centuries. This rapid advancement has also kept the nation persistent on its investment in communications and information technology (CIT). Apart from several ambitious vision projects and strategic investments, Saudi Arabia also offers several incentives to attract foreign businesses:

- 30-year tax incentive package for multinational companies to establish their regional headquarters in Saudi Arabia that includes 0% corporate income tax

- Real estate brokerage system

- Preferential financing

- Business facilitation offices service etc.

These incentives reduce financial strain of the investor and speed up the process for foreign investors to enter the market.

Along with all these advantages, there are a few pointers that need to be taken care of before setting up a new business:

| Potential Problems | Measures to Protect Business |

| Skilled labour market constraints | Offering competitive salaries, attractive benefits to attract and retain top talent. |

| Infrastructure gaps in some places | Strategic planning for effective supply chain for logistics and operational efficiency. |

| Complex bureaucracy | Gain insights into local regulations, labour laws, and tax codes by consulting with experts. |

Transitioning from the wider economic context, we now turn our attention to the intricacies of payroll management, a critical component for any successful enterprise. This guide will explain the essential aspects of payroll, ensuring compliance and better operational efficiency.

Payroll Compliance Essentials

Saudi Arabia’s commercial registration service enables Saudi investors to start their business immediately by accessing the platform of the Saudi Business Centre. As the commercial registration progresses, the company requires to open an entity file with the Ministry of Human Resources and Social Development. Every organisation should register with the Ministry of Labour (MOL) and General Organization for Social Insurance (GOSI).

The Ministry of Human Resources and Social Development (MHRSD) is a key statutory body responsible for regulating and overseeing labour relations, social development initiatives, and workforce policies.

As the company begins its functions, it should adhere to the relevant employment and social security regulations to ensure that the employees receive accurate compensation, and all statutory dues are deducted and remitted to relevant authorities to avoid non-compliance.

In this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth. To start with the links to relevant official sites are embedded below:

| Category | Regulation Number | Regulation Name |

| Social Security | Royal Decree No. M/33 | Social Insurance Law |

| Labour Law | Royal Decree No. M/51 | Labour Law, Royal Decree No. M/51 |

| Saudi Arabia Ministry of Human Resources and Social Development: Resolution No. 18632 | Ministerial Decision Related to Night Workers |

Onboarding Simplified

The onboarding process for employees in Saudi Arabia is governed by relevant labour laws to ensure compliance with established standards. This process necessitates the creation of a well-defined employment contract mentioning all necessary working conditions and payroll components for smooth future operations. The requirements for Saudi Arabia’s payroll are outlined below:

1. Employee Classification

In Saudi Arabia, employees can be classified based on two specifications, one is their citizenship and second based on their work contract:

| Types of Employment | Definition |

| Full-time workers | Permanent employees without a predetermined end date to their employment. |

| Part time-worker | Employees working for fewer hours than full-time employees and may not get all the benefits available to full-time workers. |

| Temporary worker | Workers hired for specific period or project and ends with its completion. |

| Seasonal worker | Employees hired for a short duration or specific seasonal tasks |

| Incidental Worker | Worker involved in a work not considered by its nature to be part of the usual activities of an employer, and its execution does not require more than 90 days. |

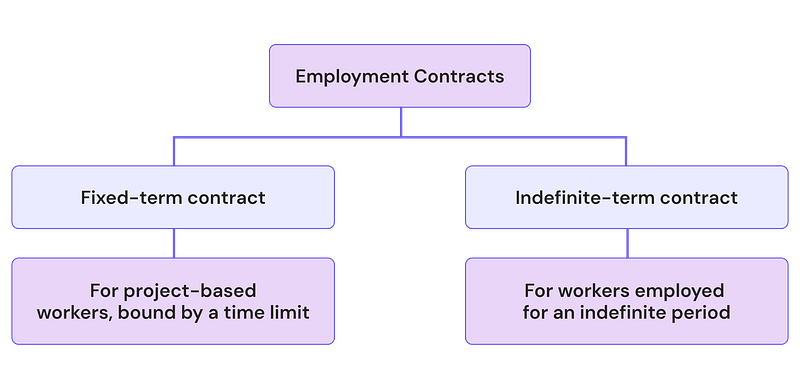

2. Employment Contract

The following are the types of contracts available in Saudi Arabia:

As per Article 52 of Labor law, a work contract shall include details such as:

- Name of the employee & employer

- Nationality & identification details

- Type and location of work

- Type of employment

- Duration of employment (if employee is on fixed-term contract)

- Probation details

- Start date of employment

- Salary details & other benefits

3. Minimum Wages

As per the Ministerial Decision, MHRSD is responsible for enforcing the minimum wage in Saudi Arabia. As per the ministerial decision, the national minimum wage is 4,000 SAR per month.

4. Probation Period

In Saudi Arabia, probation periods may vary according to the terms of the employment contract. However, they must not exceed 90 days, excluding Eid al-Fitr, Eid al-Adha holidays, and sick leave. During this period, either party may terminate the contract, unless a clause specifies that only one party holds this right. The probation period may be extended by written agreement between the worker and the employer, provided it shall not exceed 180 days.

Workplace Protocols

After hiring employees, it is crucial to comply with legal working conditions. The Labour Law, Royal Decree No. M/51 (“Labour Law”) defines working hours, break times, rest days, overtime pay, and other legal entitlements to support and benefit employees.

1. Working Hours

Article 98 of the Labour Law stipulates the standard working hours in Saudi Arabia:

| Maximum Working Hours |

| 9 hours/day |

| 45 hours/week |

Note: The working hours may vary sector wise.

During the month of Ramadan, the working hours reduces to:

| Maximum Working Hours |

| 7 hours/day |

| 35 hours/week |

2. Breaks

Note: These breaks are unpaid, however, nursing mothers are entitled to 1 hour of paid break.

3. Rest Day

A worker is entitled to 2 rest days a week with full pay, one of which shall be Friday.

After informing the relevant labour office, an employer can replace Friday with another day of the week for some of their employees.

The employer must ensure that workers are able to observe their religious practices.

4. Overtime

If the employees working hours exceed the above-mentioned standard hours, then they are entitled to overtime pay. The total working hours shall not exceed 12 hours a day.

According to the Labour Law, the employer shall pay an additional amount equal to the hourly wage plus 50% of the employee’s basic wage. Additionally, all working hours performed during holidays and Eid shall be deemed as overtime hours.

All working hours during holidays and Eid are deemed as overtime hours, and employees must get compensated according to standard overtime pay rates.

3. Night Work Pay

In Saudi Arabia, employees working night shifts do not receive additional compensation. However, if their regular working hours exceed the standard limit, they are entitled to overtime pay.

As per the Ministerial Decision. Saudi Arabia recognizes work performed during the hours from 11 PM to 6 AM as night work, and workers who perform at least three hours of work during the night-work period as night workers.

6. Leaves Entitlement

As per the Labour Law, the employees are entitled to get paid public holidays mentioned below:

| Holidays | Date | Number of days |

| Saudi Arabia National Day | September 23 | 1 day |

| Eid-al-Fitr | Starting from the day following 29 of Ramadan | 4 days |

| Eid-al-Adha and Arafat Day | Starting from the Arafat day. | 4 days |

Note: Excluding New Year’s Day and National Day, the dates are subject to variation each year.

Apart from the statutory holidays mentioned above, the employees of Saudi Arabia are entitled to several other paid statutory leaves as provided below, the specific sections of the Labour Law have been mentioned as well:

| Leave Type | Maximum Entitlement |

| Annual leave (Article 109) | 21 days* |

| Paternity leave (Article 113) | 3 days |

| Marriage Leave (Article 113) | 5 days |

| Death of a spouse, child, parent, or parent-in-law (Article 113) | 5 days |

| Hajj leave** (Article 114) | 10-15 days |

| Examination leave (Article 115) | Based on the actual number of examination days (considered as part of annual leave) |

| Sick leave (Article 117) | 120 days |

| Maternity leave (Article 151) | 10 weeks |

* It increases to 30 days if the employee spends 5 consecutive years in the service of the employer.

** To be eligible for this leave, the worker must have spent at least two consecutive years of service with the employer. Hajj leave can be availed only once during an employee’s tenure.

a. Holiday Pay

Employees receive their full regular salary during public holidays. If an employee is required to work on a public holiday, then they are entitled to overtime pay at 150% of their hourly wage in addition to their regular salary for that day.

7. Event-based Compensation

Employer is obligated to offer a range of benefits and compensation to ensure security of the employees while they are at work. In Saudi Arabia, Occupational Hazards Contribution is a mandatory social security scheme that employers contribute for every month. In case of work-related accidents, this fund is used for compensation.

In case the employee’s demise, the family is entitled to receive the compensation as follows:

| Compensation for Injury | Compensation for Death |

| Full wage (Basic Salary plus fixed allowances) for 60 days in case of temporary inability to work and then,

75% of wage for the balance entire duration of treatment. |

A grant to the family of the injured person |

| Medical rehabilitation costs | Monthly Compensation |

| Compensation equal to the percentage of the estimated disability | Compensation equal to his wages for three years, with a minimum of 54,000 riyals |

8. Other benefits

Although there are no other statutory benefits available, the employees may receive one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Commissions and other supplemental wages

- Health insurance

- Accommodation and air tickets

Salary Essentials

Employers generally must pay workers at least once a month. Wages must be paid in Saudi riyals. As per Article 90 of the Labour Law, employers should pay wages on time and in accordance with the agreed terms of employment contract.

MHRSD introduced Wage Protection System and the employers, based on the guidelines employer are required to register all wage payments via the Protection of Wages software available online.

To participate in the program, employers generally must open a bank account for each employee and pay all wages and monetary benefits into that bank account, recording transactions with the Protection of Wages software on a monthly basis.

As per Wage protection | Ministry of Human Resources and Social Development guidelines, the establishment, in case not paying the employee’s wages on the determined due date, would be penalized with SR3,000, and the fine is multiplied based on the multiplicity or enumeration of the labourers.

1. Salary Components

The table below provides an overview of the various salary components that constitute the gross salary:

| Salary Component | Definition |

| Basic salary | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement before any additions or deductions. |

| Allowances | It is a regular additional payment given to employees alongside the basic wage. For instance:

|

| Others | The non-fixed portion of the salary, for instance:

|

| Social Security Contribution | Employer contribution to GOSI, Unemployment Insurance and Occupational Hazard are not deducted to calculate net pay of an employee.

Additionally, employee contribution to GOSI, Unemployment Insurance are deducted to calculated net pay of an employee. |

| End-of-Service Benefits | Gratuity, leave encashments and recoveries to be calculated after termination of an employee |

2. Payslip Components

In Saudi Arabia, employers are legally obliged to provide online payslips to their employees. While there are no legal stipulations regarding the format, these payslips typically include the following components:

- Basic salary

- Allowances

- Deductions

- Net salary

Decoding Deductions

Employers of Saudi Arabia are obliged to make a few mandatory deductions as mentioned below:

1. Withholding Taxes

Like other GCC countries, employment income is not subject to Saudi Arabia’s personal income tax.

2. Social Security

The General Organisation of Social Insurance (GOSI) oversees Saudi Arabia’s social insurance system, which comprises of:

- Annuities branch

- Occupational hazards branch.

Participation in the occupational hazards branch is compulsory for all workers, whereas the annuities branch is mandatory only for the following categories:

- Saudi nationals under a work contract

- Saudi nationals working for a Saudi-based employer,

- Government employees.

Apart from above contribution, both employers and employees must also contribute to an unemployment insurance fund (SANED) managed by GOSI.

Employers need to contribute both employer and employee contribution and are mandated to withhold contributions from employees’ wages and remit it to the organisation.

For non-Saudi employees, employers are required to contribute to the occupational hazards branch only and not to the annuities branch. The contribution rates are as follows:

| GOSI Schemes | Employee Contribution | Employer Contribution | Minimum Capping (in SAR) | Maximum Capping (in SAR) |

| Annuities (Applies only to Saudi nationals) | 9% | 9% | 1,500 | 45,000 |

| SANED (All employees) | 0.75% | 0.75% | ||

| Occupational hazards (for Saudi & other GCC nationals) | – | 2% | ||

| Occupational hazards (for non-GCC workers) | – | 2% | 400 | 4,500 |

As per the new Social Insurance Law, the annuities branch contribution rates for both employer and employee will gradually increase by 0.5% annually from the second year of employment, culminating in a total increase of 2% by the fifth year to new entrants to the labour market.

The new entrants are those who do not have subscription periods in the civil retirement or social insurance systems prior to July 3, 2024.

The amendment will result in a final rate of 11%, up from the current 9%.

Unified Law for Extension of Insurance Coverage

The employers in Saudi Arabia are required under the Unified Law for Extension of Coverage to register employees from other GCC countries who are working in the Saudi Arabia. The other GCC countries are Bahrain, Kuwait, Oman, Qatar, and UAE.

An employee and an employer shall bear their share of the contributions from the contribution salary in accordance with the rates applicable under the law of the employee’s home state, provided that the share of the employer does not exceed the percentage in force in the state of employment.

In cases where the contribution of an employer is less than the required percentage, the employee shall cover the difference in contribution to ensure full payment thereof to the civil pension/social insurance institution whose law applies to the employee. In such case, the employer shall deduct the difference from the employee salary.

An employer shall deduct an employee’s share from his monthly salary or wages, including the contribution differences and shall deposit the same together with his due share in the bank account specified by the civil pension/social insurance institution whose law applies to the employee.

In case of an employer’s failure to pay the contributions within the legally prescribed dates, non-registration of all or some of his employees/workers to whom the provisions of this Law apply, his failure to report the termination of service of any of his workers, or his payment of contributions based on false wages, such employer shall be subject to the penalties applicable in the civil pension/social insurance law in the state of employment.

Reporting

Employers must submit the monthly social insurance contribution and payroll documents to GOSI by the 15th of each month.

Non-compliance

| Type of Non-Compliance | Implications |

| Delay in payment of contributions | 2% of the outstanding contributions |

| Non-registration of contributions salary | Penalty of 500 to 3000 SAR depending on the size of the establishment. |

| Failing to comply with social insurance law | Penalty between 5,000 to 50,000 SAR will be levied. |

For detailed information, visit this link.

3. Minimum Take Home Pay

Employer can deduct the following amount from Employee wages:

A. With worker consent (Article 91):

Amount necessary for repair or restoration to the original condition, provided that such deductions do not exceed an amount equivalent to five-day wage per month.

In case there are any other deductions to be made by the employer, they may file a grievance demanding for the same. The worker may also file a grievance with the labour court regarding the allegations levelled at him or the employer’s estimation of the damages.

If the labour court rules that the employer is not entitled to claim such deductions or if it awards the employer a lower amount, the employer shall return to the worker the amounts unjustifiably deducted, within seven days from the date of the award.

B. Without worker consent:

- Deductions of repayment of loans that does not exceed 10% of the employee’s wage.

- Social insurance or any other contributions due on workers as provided for by law.

- Worker’s contributions to thrift funds or loans due to such funds.

- Instalments of any scheme undertaken by the employer involving home ownership programs or any other privilege.

- Fines imposed on the worker on account of committed violations or damages.

- Any debt collected in implementation of a judicial judgment, provided that the monthly deduction shall not exceed one quarter of the worker wage, unless the judgment provides otherwise. The sequence of the deductions should be as follows: alimony, food, clothing, accommodation debts and at last, other debts.

The minimum take home pay for employees should not be less than half the worker’s due wage, unless the labour court determines that further deductions can be made or that the worker needs more than half his wage. In the latter case, the worker may not be given more than three quarters of his wage

Seamless Offboarding

Ensuring compliance during the offboarding process is essential and must not be neglected by employers. Employment termination generally occurs due to retirement, resignation, or dismissal for serious reasons.

Depending on the cause of termination, employees are entitled to specific termination payouts as provided below, however the settlement of the amount needs to be paid within a maximum of 1 week from the end of the contractual relationship. But if the worker initiates the termination, the employer must settle all entitlements within 2 weeks.

1. Retirement

The regular retirement age is 65 years. However, for employees under 50 Hijri years (48 years and 6 months Gregorian calendar) and have contributed for period not exceeding 240 months (20 years), then the retirement age will gradually increase, starting with a 4-month increase, based on their age as of July 03, 2024, aligning with the new statutory retirement age range between 58- 65 years. The required contribution period for early retirement ranges from 25 to 30 years.

Employees who are 50 Hijri years or older at the time the system comes into effect, and who have a contribution period exceeding 240 months (20 years), are not eligible for early retirement.

Upon the end of a worker’s service, the employer is required to pay the worker’s wages and settle all entitlements.

Upon retirement, the employee is entitled to receive the following End of Service Benefits:

- A notice period with full pay, or compensation if the employer prefers the employee not to work during this period

- Compensation for any unused holiday entitlement

- Repatriation expenses

- End of Service Gratuity (EOSG)

- The amount of any debts or loans which may be due from the labourer shall be deducted from End of Service Benefits.

Employees are entitled to receive end-of-service award, which should be calculated based on their last wage (excluding some of the commissions, sales percentages, and similar wage components which are subject to increase or decrease). The amount of this award should be corresponding to the time they have spent on the job during the year.

The workers who leave the work due to a force majeure, are also entitled to the full end-of-service award. Likewise, a female worker is also entitled to the full award if she ends her contract within 6 months from the date of her marriage or 3 months from the date of giving birth.

The calculation of EOSG in case of Retirement is outlined below:

| Years of Service | Amount of EOSG |

| Less than 1 year | No gratuity |

| Less than 5 years | Half a month’s wage |

| More than 5 years | One month wage |

The end-of-service award shall be calculated on the basis of the last basic wage and the worker shall be entitled to an end-of-service award for the portions of the year in proportion to the time spent on the job

2. Resignation

Employees intending to resign need to serve a notice period as mentioned in the contract. Usually, indefinite term contract employees are required to serve 60 days’ notice while for other workers, 30 days’ notice is required.

After resignation, the employee is entitled to receive the following End of Service Benefits:

- A notice period with full pay, or compensation if the employer prefers the employee not to work during this period

- Compensation for any unused holiday entitlement

- End of Service Gratuity (EOSG)

- The amount of any debts or loans which may be due from the labourer shall be deducted from End of Service Benefits

| Years of Service | Amount of EOSG |

| Less than 2 years | No gratuity |

| 2 to 5 years | 1/3rd of the end-of-service award |

| 5 to 10 years | 2/3rd of the end-of-service award |

| More than 10 years | Full end-of-service award |

The end-of-service award shall be calculated on the basis of the last baisc wage and the worker shall be entitled to an end-of-service award for the portions of the year in proportion to the time spent on the job

3. Dismissal

An employee may be terminated by the employer or authority due to the following reasons:

- Serious breaches of company policy or ethical standards

- Gross misconduct or any form of violence

- Prolonged unapproved absence

- Probationary employees who fail to meet the required performance standards

If an employee is dismissed as per Article 80 of labour law, then the employee is not eligible for end of service gratuity or notice pay. If an employee is dismissed for reasons other than mentioned in Article 80 of labour law, then employee is eligible for the following:

- A notice period with full pay, or compensation if the employer prefers the employee not to work during this period

- Compensation for any unused holiday entitlement

- Repatriation expenses

- End of Service Gratuity (EOSG)

- The amount of any debts or loans which may be due from the labourer shall be deducted from End of Service Benefits.

The employer often gives the workers a chance to state their reasons for objecting to the termination. If an employee is dismissed without just cause, then they are entitled to full gratuity as per Saudi Arabia’s Labour Law else they lose their right to gratuity.

Conclusion

Saudi Arabia presents a highly favourable business environment, with government initiatives actively encouraging foreign investment through various fiscal incentives. Additionally, the country’s rapid technological advancements and workforce fuelling ceaseless innovation, further position Saudi Arabia as a prime location for international businesses. However, managing payroll in Saudi Arabia involves several complexities. Handling different pay periods, social security obligations, and loan repayments, while ensuring compliance with statutory reporting demands a robust payroll system. Investing in advanced payroll systems and staying updated on regulatory changes are crucial for effective payroll management.