Country Overview

Kuwait has established itself as a significant economic force in the Middle East. This sovereign state is bounded by Persian Gulf in the east, Iraq in the north and west, and Saudi Arabia in the south. Kuwait’s economy relies heavily on its vast hydrocarbon resources. However, with the changing world, the nation is actively working to diversify its economy and reduce its dependence on oil and gas.

To foster a knowledge-based economy and attract more investors, the country is pursuing its Vision 2035 – New Kuwait. This vision seeks to position the private sector as the driving force of the country’s economy. It operates under a supportive institutional framework that promotes social development and business-friendly environment.

The main elements that are being used to achieve this vision, are:

- Strategic geographical location

- Encouraging legislative body

- Comprehensive judicial system

- Balanced international foreign policy

Being the strongest currency of the world, the nation is efficiently striving to maintain its relevance by diversifying its economic options.

Market Glimpse

Kuwait presents a compelling opportunity for investors and workers equally. The country opens the door of opportunities for anyone seeking growth and access to both regional and global markets.

According to World Bank, in 2023 the GDP of Kuwait has reached 163.7 billion USD and proving the strategies of Vision 2035 effective, the 2024-25 Kuwait budget projects non-oil revenue to rise 5.7%.

Foreign Direct Investment (FDI) in Kuwait also has been on an upward trajectory. Kuwait Direct Investment Promotion Authority (KDIPA), a governmental organisation responsible for promoting Kuwait’s investment environment, states in its 9th annual report that it has successfully attracted FDI worth 206.9 million KWD during the 2023/2024 fiscal year, from 95 leading global companies. These investments spanned in diverse sectors, including information systems, the growing insurance industry, and for the first time, the agricultural sector, addressing the country’s priorities in food and health security.

KDIPA is actively promoting new economic sectors under Vision 2035, the key sectors identified by this organisation includes, infrastructure and construction, healthcare, renewable energy, banking, financial services and insurance etc.

To attract foreign investors and businesses, Kuwait offers several incentives, such as:

- Allowable tax credit for a certain number of years

- 100% foreign ownership for businesses set up in the Kuwait Free Trade Zone

- Total or partial exemption from customs duties on imports etc.

Despite these advantages, businesses should be aware of certain challenges:

| Potential Problems | Measures to Protect Business |

| Inconsistent & contradictory policies | Plan carefully and consult with experts to ensure adherence |

| Time-consuming bureaucratic procedures | Have a Kuwaiti agent to have constant coordination |

| Competitive market | Adopt a strategic approach and differentiating offerings is crucial to stand out |

Transitioning from the broader economic context, it is essential to delve into the specifics of payroll management, a critical component for any successful enterprise. This guide will cover the essential aspects of payroll, ensuring compliance and operational efficiency.

Payroll Compliance Essentials

Starting a business in Kuwait involves several key steps and adhering to specific regulations. First, comes the selection of the relevant business structure. The company must register with necessary documents such as civil IDs, a capital certificate, and a lease contract. Submitting the application to the Ministry of Commerce and Industry is the next step to obtain the compulsory licenses and approvals. For detailed information and official procedures, visit the Kuwait Government Online website.

Once all the licenses are on place, the employer can start the business operations and being the process of hiring.

Ministry of Social Affairs and Labour (MOSAL) in Kuwait is a Government body responsible for regulating and overseeing labour relations, social welfare and employment policies and plays a major role in maintaining fair labour practices, protecting worker’s rights and promoting social development in Kuwait.

In this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth. To start with, the links to relevant official sites are embedded below:

| Category | Regulation Number | Regulation Name |

| Social Security Law | Decree of Law No. (61) of 1976 | Social Security Law |

| Labour Law | Law No. (6) of 2010 | Labour Law |

Onboarding Simplified

It is crucial to streamline the onboarding process to ensure a smooth transition for both employers and employees. Find below the best practices and legal requirements to make the onboarding experience compliant and efficient:

1. Employee Classification

In Kuwait, employees can be classified as following:

| Types of Employees | Definition |

| Full-time employees | Employees who are permanent without a specific end date. mentioned. They work for standard hours and receive statutory benefits. |

| Fixed-term employees | Employees who are hired for a specific duration but can be renewed as per the need. |

| Part-time employees | Employees who work for fewer hours than full-time and have limited benefits. |

| Apprenticeship | Employee entering with an employer for the purpose of learning an occupation, trade or handicraft for a fixed period during which the apprentice shall work under the supervision of the employer concerned for wage or reward. |

| Labourer trainee | Employees who get the chance to develop their knowledge and skills or attend the job training within the Company to enhance their abilities, to improve their productivity, prepare them for certain professions or transfer them to others. |

Kuwait’s Labour Law prohibits the employment of individuals under 15 years. To employ minors between the ages of 15 and 18, approval of MOSAL is required.

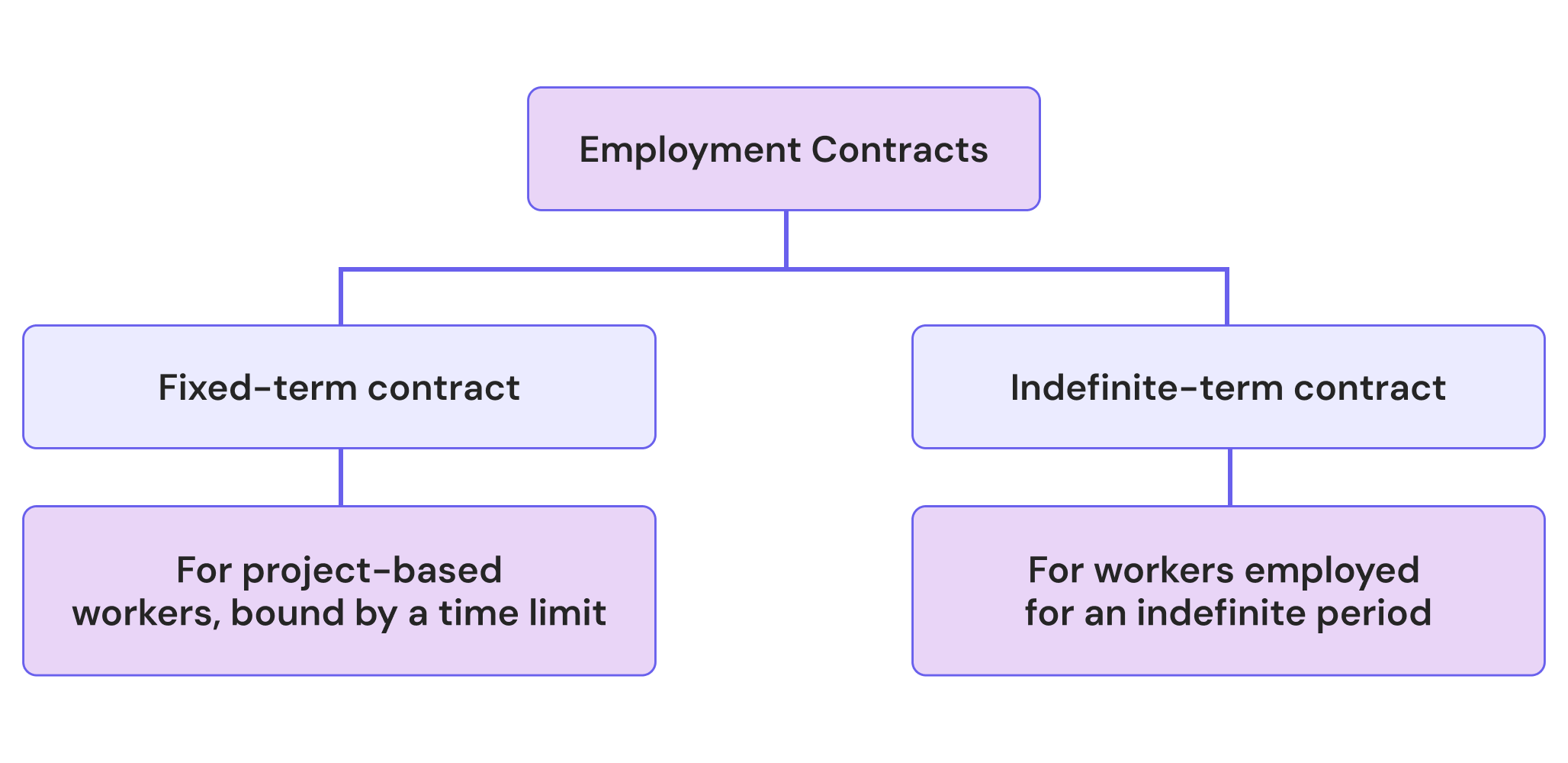

2. Employment Contract

An employment contract is an agreement where a worker agrees to work under the employer’s supervision for a wage.

Every person who attains 15 years of age shall be entitled to sign a work contract for an unlimited period. In the case of limited period contract, this period shall not exceed one year until he attains the age of 18 years old.

Based on the employment type, there are 2 types of contracts:

The contract must be in accordance with the standards defined in Article 28 of the Labour Law, the mandatory information that must be included in a valid employment contract are the following:

- Name of employee & employer

- Date of signing the contract

- The effective date

- Salary details

- Type of employment

- Contract period

- Nature of work

The contract shall be drawn up into three copies; one for each party whereas the third copy shall be sent to the Competent Authority at the Ministry.

As per Article 29 of the Labour Law, all contracts shall be written in Arabic and further translated to foreign language. In legal matters, only the Arabic version of the employment contract is considered valid in court.

For limited-term employment contracts, the duration must be between 1 to 5 years. Upon expiration, the contract can be extended if both parties agree.

Employers involved in government projects or employing workers in remote areas must provide accommodation and transportation for their workers. If accommodation is not provided, a suitable housing allowance must be given. The specifics of remote areas, suitable accommodation, and housing allowance will be decided by the Minister.

3. Minimum Wages

As per Article 63 of the Labour Law, the Minimum wages shall be revised within 5 years according to the nature of profession and trade, considering the inflation rates in the country by the Minister along with the Consultant Committee for Labour & Organization Affairs. The minimum wage is 75 KWD per month for private sector employees.

4. Probation Period

Article 32 of the Labour Law allows employers to offer a probationary contract for up to 100 working days. During this period, either party can terminate the contract without notice. If the employer terminates the contract, they must pay the worker a terminal service indemnity according to the provisions of this law. An employee cannot be placed on probation with the same employer more than once.

Workplace Protocols

1. Working Hours

Article 64 of the Labour Law provides the normal workings hours limit as follows:

| Maximum Working Hours |

| 8 hours/day |

| 48 hours/week |

During the month of Ramadan, the working hours need to be reduced to 36 hours a week. The working hours of hard labour, health harmful labour and hazard labour or for hard conditions may be reduced by virtue of a decision to be issued by the MOSAL.

2. Breaks

Article 65 of the Labour Law stipulates the break time for all workers and the break hours must not be calculated within the working hours.

Note: For banking, financial and investment sector are exempt from above provision and may extent the working hours up to eight continuous hours.

According to Article 25, a female worker is entitled to 2 hours during work hours to breastfeed her child. Employers must provide a daycare centre for children under 4 years old if there are more than 50 women or over 200 employees in the company.

3. Rest day

The worker has the right to one fully paid weekly off day which shall be fixed by 24 continuous hours after every six worked days

4. Overtime

If the employees working hours exceed the above-mentioned standard hours, then they are entitled to overtime pay.

According to Article 66 of Labour Law, the additional working hours must not be more than 2 hours per day and in a maximum number of 180 hours per year.

Also, the additional work periods should not exceed 3 days a week and 90 days per year.

For the overtime wages payable refer to below table:

| Overtime Wages | |

| Normal working days | Basic wage + 25% |

| Weekends or rest days | Basic wage + 50% |

In case the employees are required to work on weekend, the employer must provide them with an additional pay to 50% of their basic wage for that day and another day off.

The employers are required to keep a special record for the overtime work hours indicating the dates of relevant days, number of overtime hours and the respective wages for the additional work which they have assigned to the employees.

5. Night Work Pay

If the employees work overtime during night, between 10:00 p.m. to 7:00 a.m., it is considered as night work. In such situations, the employees are entitled to 50% additional payment of their regular wage rate.

Women shall not be employed at night excluding those who work in hospitals, health centres, private treatment houses and other health institutions.

6. Leaves Entitlement

Employers must ensure that all eligible employees receive the statutory leaves. As per Article 68 of the Labour Law, the employees are entitled to get paid public holidays as mentioned below:

| Public Holidays | Date | Number of Days |

| New Gregorian Year | January 1 | 1 |

| Ascension (Isra & Miraj) Day | Dates may vary each year | 1 |

| National Day | February 25 | 1 |

| Liberation Day | February 26 | 1 |

| Eid al-Fitr (Lesser Bairam) | Dates may vary each year | 3 |

| Waqfat Arafat Day | Dates may vary each year | 1 |

| Eid al-Adha (Greater Bairam) | Dates may vary each year | 3 |

| Hijiri New Year Day | Dates may vary each year | 1 |

| Prophet Birthday | Dates may vary each year | 1 |

Apart from the public holidays, the employees in Kuwait are entitled to several other paid statutory leaves as provided below as mentioned in the relevant sections of the Labour Law:

| Leave Type | Maximum Entitlement |

| Maternity leave (Article 24) | 70 days* |

| Sick leave (Article 69) | 75 days** |

| Annual leave*** (Article 70) | 30 days |

| Study leaves (Article 75) | As per the company policy |

| Hajj leave**** (Article 76) | 21 days |

| Bereavement leaves for first or second grade relative (Article 77) | 3 days |

| Iddah leave (Article 77) | 4 months & 10 days for Muslim female employees |

| 21 days for non-Muslim female employees |

* After paid maternity leave, an employer may grant up to 4 months of unpaid leave upon request for childcare.

** The below table explains the sick leave compensation for an employee:

| Leave Days | Compensation Paid |

| First 15 days | Full wage |

| Next 10 Days | Three quarter wage |

| Next 10 Days | Half wage |

| Next 10 Days | Quarter wage |

| Next 30 days | Unpaid |

*** Employee entitled to Annual leave after completion of at least 9 months in the service of the employer. Official holidays and sick leave days shall not be counted in the annual leave. Also, the salary shall be paid in advance before going on annual leave.

**** Applicable only after completing 2 years in the service, provided that the Hajj leave has not availed previously.

Holiday Pay

If employees need to work during a public holiday, they are entitled to 200% of the regular salary rate of pay, plus an additional day off in lieu/paid.

7. Event-based Compensation

The employer must implement all necessary safety precautions to protect workers, machinery, equipment, and materials within the company, as well as anyone using these materials, from workplace hazards. To ensure standardised precautions, every employer is mandated to keep occupational safety records according to guidance issued by the Minister.

As per Article 90 of the Labour Law, If the worker is injured, the employer shall report the accident immediately to each of the following: –

- The Police Station of the area under whose jurisdiction the place of work is situated.

- The Labour Department under whose jurisdiction the place of work is situated.

- The Public Institution for Social Security or the insurance company in which the workers are insured against the work injuries.

| Compensation for Injury | Compensation for Death |

| The employees are entitled to receive their full wage for the entire treatment period as determined by the medical doctor. | Any financial entitlements at the suggestion of the Minister, upon taking the opinion of the Minister of Health. |

| If the treatment period exceeds 6 months, they are entitled to half the wage until they recover, are proven disabled, or pass away. |

8. Other benefits

Although there are no other statutory benefits available, the employees may receive one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Commissions and other supplemental wages

- Health insurance

- Accommodation and air tickets

Salary Essentials

As per Article 57 of Labour Law, the employer shall deposit the salaries in the relevant accounts opened with local financial institutions through Wage Protection System (WPS). A copy of the statements sent to those institutions in this regard shall be forwarded to MOSAL.

WPS is a government-mandated electronic payment system introduced by MOSAL. It is an electronic salary transfer system that allows institutions to pay workers’ wages via banks, approved and authorized to provide the service. It is important to maintain the following information for processing via WPS:

- Name of an employee

- Employee’s Account number

- Employee’s Civil ID

- Salary Amount

- Bank ID

1. Salary Components

| Salary Component | Definition |

| Basic salary | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement before any additions or deductions. |

| Allowances | These are additional allowances offered by employers including:

These components may vary by industry and job position. |

| Others | The non-fixed portion of the salary, for instance:

|

| Social Security Contribution | Employer contribution to PIFSS forms part of gross pay. Additionally, employee contribution to PIFSS does not forms part of gross pay. |

| End of Service Benefit | Gratuity, leave encashments and recoveries to be calculated after termination of an employee |

2. Payslip Components

In Kuwait, employers are legally obliged to provide online payslips to their employees. While there are no legal stipulations regarding the format, these payslips typically include the following components:

- Basic salary

- Allowances

- Deductions

- Net salary

- Leave encashments

- End-of-service benefits

Decoding Deductions

1. Withholding Taxes

In Kuwait, employees, whether they are Kuwaiti nationals or expatriates, do not have to pay personal income tax.

2. Social Security

Although there is not tax deduction, the employers are required to make deductions for social security contribution. In Kuwait, the social insurance system implements the Social Security Law, and it is administered by the Public Institution for Social Security (PIFSS).

Employees aged between 18 to 65 are eligible to make contributions.

Monthly Salary used for calculation of social insurance contributions includes the total basic salary and any allowances, including the children allowance, and any other remunerations classified as complementary salary.

The table below refers to the contribution rates:

| Type | Minimum Salary Range (in KWD) | Maximum Salary Range (in KWD) | Employee Contribution | Employer Contribution |

| Basic Insurance Fund | 230 | 1,500 | 5% | 10% |

| Supplementary Insurance Fund | – | 1,250 | 5% | 10% |

| Pension Increase Fund

(Basic + Supplementary) |

– | 2,750 | 2.5% | 1% |

| Financial Reward Fund | – | 1,500 | 2.5% | – |

| Unemployment Insurance | – | 2,750 | 0.5% | 0.5% |

Note: Basic fund is to cover the risk of illness, disability, old age or death.

Supplementary Insurance fund covers the same risks as the basic insurance fund. Contributions to the Supplementary Fund are mandatory for employees and employers when the employee’s salary exceeds the maximum salary threshold for the basic social security contributions, that is, more than 1,500 KWD and a maximum of 1,250 KWD.

The financing of Pension Increase fund shall be from the contributions that are deducted from the total basic and supplementary salary up to a maximum of 2,750 KWD.

Financial reward fund shall be from the contributions that are deducted from the salary of the basic insurance subscription up to a maximum of 1,500 KWD and shall be borne by the employee and the contributions shall be suspended if the contribution period reaches 18 years.

Unemployment insurance fund contribution enables the employees to meet their living requirements upon resignation or termination of service.

Contributions are considered payable to PIFSS at the beginning of the month following the month for which they are due.

If the date of payment coincides with a day off or an official holiday, the date shall be extended to the first working day following the holiday.

Insurance Protection Extension System

Private sector and public sector employers in Kuwait are required under the Gulf Cooperation Council (GCC) Insurance Protection Extension Program to register employees from other GCC countries who are working in Kuwait in the applicable pension or retirement insurance system of their home country.

Employers in Kuwait are required, for each of their employees working in Kuwait whose home country is another GCC country, to deduct any applicable contributions from the employee’s wages and make any applicable employer-provided contributions based on requirements of the pension or retirement insurance program of the employee’s home country and must remit those contributions to a bank account designated by the applicable social insurance agency of the employee’s home country. Attachments to submit upon Enrolment and End of service is defined by PIFSS.

Registration of an employee from another GCC country who is working in Kuwait in the pension or retirement insurance system of their home country involves coordination with the Kuwait Public Institution for Social Security, which functions as a liaison to the social insurance agencies of other GCC countries.

The employee and employer shall bear their share of the contributions from the contribution salary in accordance with the rates applicable under the law of the employee’s home state, provided that the share of the employer does not exceed the percentage in force in the state of employment.

If the share of contributions required by the law applied in the country where the employee is based exceeds the employer’s share in the law applied in the country where the work is located, the employer is obligated in this case to deduct the difference from the employee’s wage. Contribution payments under the GCC Insurance Protection Extension Program generally must be made monthly.

Reporting

| Reporting | Due Date |

| Registering with PIFSS | Within 10 days from the date of employment |

| Payment of monthly contribution | By the first of the month following the month for which contributions apply. |

Non-compliance

If the employer fails to maintain compliance with the requirements, the company must bear penalties as mentioned below:

| Type of Non-compliance | Implications |

| Late payment | Penalty of 1% of the outstanding contribution |

| Failure in submitting relevant data/notice/form | Fine of 5 KWD per day |

| Failure in registering any employee within 10 days of the joining | Penalty of 10% of the outstanding contributions plus 1% for the delay in contribution |

3. Minimum Take Home Pay

As per Article 37 of the Labour Law, the employees must be notified in writing of the penalties imposed. Furthermore, the below limits need to be adhered to:

- Employers must not deduct more than 10% of a worker’s Wage to settle any debts or loans owed to the employer, without charging interest.

- According to Article 38 of the Labour Law, no deduction in case of penalty may be executed from the worker’s Wage for a period of more than 5 days monthly. If the penalty exceeded this limit, the extra amount should carry forward.

- Additionally, wage deductions for debts, including alimony, food, clothing, and other obligations, are capped at 25% of the worker’s wage, with alimony debts taking priority over other debts.

Seamless Offboarding

Ensuring a fair separation is as important as maintaining the standard workplace protocols. Employers must be aware of the labour laws regulations related to termination.

Offboarding of an employee may occur due to several reasons:

- Completion of a fixed-term contract

- Employee resignation

- Employer termination with valid reason and proper notice

- Dismissal due to misconduct

Conditions for termination of different Contract Types

- If the contract is made for an unlimited period, the notice shall be made in the following manner to be fair:

- Monthly salaried employees require a 3-month notice for contract termination. If terminated without at least 1-month notice, the terminating party must pay the other party an amount equal to the employee’s salary for that period.

- The employer can terminate the employee during the notice period, but the employee’s service term continues until the end of the notice period, including their right to receive wages for that time.

- If either party terminates a limited period contract without having the right to do so, then the party ending it must compensate the other party. The compensation cannot exceed the employee’s salary for the remaining contract period. Any debts which may be due for the other party shall be deducted from the compensation amount.

While calculating the employee dues, the last salary paid shall be considered. If employees receive a salary based on piecework, the relevant estimate shall be made on the average wage duly paid to them for the actual working hours during the last 3 months.

Note: Irrespective of the type of separation, for any debts or loans, due from the employees will be deducted from their entitlements.

1. Retirement

Upon Retirement, the employees are entitled to receive the following End of Service Benefits (EOSBs):

- Remuneration due

- Compensation for any unused holiday entitlement

- Terminal Service Indemnity

The calculation of Terminal Service Indemnity at the time of retirement and is outlined below:

| Years of Service | Amount of the Terminal Service Indemnity |

| 0 to 5 years | 15 days wages for each year of service |

| More than 5 years | 1 month’s salary for each year |

Note: Total amount of Terminal Service Indemnity shall not exceed one-and-a-half-year wage.

2. Resignation

Upon resignation, the employees are entitled to receive the following EOSB:

- Remuneration due

- Compensation for any unused holiday entitlement

- Terminal Service Indemnity

Serving a notice period is standard practice, however, as per Article 48 of Labour Law, employees can resign without notice, is some specific situations and still be entitlement to the end of service benefits.

The calculation of EOSG at the time of Resignation and is outlined below:

| Years of Service | Amount of the Terminal Service Indemnity |

| 0 to 3 years | No Terminal Service Indemnity |

| 3 to 5 years | 15 days wages for each year of service |

| 5 to 10 years | 20 days wages for the remaining |

| More than 10 years | 1 month’s salary for each year |

3. Dismissal

As per Article 41 of Labour Law, the employer may terminate the employee’s service without notice and indemnity or remuneration in specific situations as specified in the article.

If the dismissal does not fall under the above-mentioned reasons, then the employees are entitled to the following EOSB:

- Remuneration due if employee serves notice period

- Compensation for any unused holiday entitlement

- Terminal Service Indemnity

Conclusion

With its highest-valued currency and current vast economic opportunities, Kuwait is a prime location for business in the Middle East. The country’s commitment to achieve the focal points of Vision 2035 maintains the country’s significance in the global stage. However, managing payroll in Kuwait presents its own set of challenges. Although the complication of personal income tax is absent here, the local labour laws, social security contributions, and statutory reporting requires a comprehensive and efficient payroll system. Investing in advanced payroll solutions and staying updated with regulatory changes will ensure compliance and effective payroll management in Kuwait.

FAQs

Basic Insurance Fund, Supplementary Insurance Fund, Pension Increase Fund, Financial Reward Fund and Unemployment Insurance Fund are the different types of funds in the social insurance system.

Basic salary, social allowances, children’s allowance and other fixed allowances are subject to social insurance contributions.

Contributions to the financial reward fund will be suspended once the contribution period reaches 18 years.

Social insurance contributions are calculated based only on the salary paid during the month. If an employee is on unpaid leave, no contributions will be made for that period, as no salary is being paid.

No, employees cannot voluntarily increase their social insurance contribution rate.

Contributions are calculated on the actual gross salary for that month. Employers must report the change to Public Institution for Social Security (PIFSS) promptly to ensure compliance.

If the payment date coincides with a holiday or public holiday, the date is extended to the first working day following the holiday.

Employees with multiple jobs in Kuwait must contribute to social insurance for all employers, but the combined contributions are subject to the salary cap of 2,750 KWD per month.

Social insurance contributions for other GCC nationals working in Kuwait are governed by the GCC Unified Pension System, which ensures that GCC citizens employed outside their home country contribute to their respective national pension systems.

Yes, employees on probation are entitled to overtime pay if they work beyond the normal working hours.

No, break hours are not calculated within working hours.

The employee should not be made to work for more than 5 continuous hours per day as a mandatory break of 1 hour needs to be provided. However, the banking, financial and investment sector shall be exempted from this provision and the working hours shall be eight continuous hours.

Yes, the employer must compensate the employees with another day off if they work on public holidays that fall on the rest days.

Actual working days must be calculated without calculating weekly off days.

Yes, probation period is counted in the calculation of total service period and considered when calculating end-of-service benefits.

No, the official holidays and sick leaves are not counted in the annual leave.

Yes, employees are entitled to accumulate their annual leaves, provided the total accumulated leave does not exceed the equivalent of 2 years' worth of leave.

No. Hajj leave is only granted for first-time pilgrims. If the employee has performed Hajj before, even with another employer, they are not eligible for Hajj leave again.

No. Salary for the month must be paid in full and not in instalments.

If the employee resigns, before completing their contract the employer is not obligated to pay repatriation costs unless explicitly stated in the employment contract. However, the employer must comply with the terms of the agreement regarding relocation.

Yes, employees are entitled to payment for unused annual leave upon termination.

Yes, a female employee is entitled to receive the full terminal service indemnity if she terminates the employment contract within 1 year from the date of marriage.

Yes, an employer can deduct debts or loans from an employee’s terminal service indemnity payout.

Commissions are included in the wage for terminal service indemnity calculations only if they are fixed, recurring, and a guaranteed part of the salary.

Terminal service indemnity is applicable to both foreigners and Kuwaiti nationals in Kuwait upon dismissal and resignation.