Country Overview

With tropical beaches, imposing volcanoes and palm-tree edged long coastlines, Indonesia stays on top of most holiday lists. But is Indonesia’s potential restricted to being a picturesque vacation destination? Absolutely not! Growing consumer market, abundant resources, upgraded infrastructure, and most importantly, government support has revamped Indonesia as an attractive investment destination.

Indonesia, the largest country in Southeast Asia, is located between the continents of Asia and Australia, sharing borders with Malaysia. It stands as the world’s 4th most populous nation and ranked 10th globally in purchasing power parity. Currently, the nation is pursuing a 20-year development plan, that started in 2005. Previously it has taken effective measures to tackle unemployment, increased capability to master technology and science. Currently, it is running the last phase focusing on improved human capital of the country and strengthened economy in the global market. The country has shown great success in reducing poverty by bringing the poverty rate down to below 10% in 2019.

The country is already preparing with the new 20-year development plan effective from 2025, focusing on becoming a high-income economy by 2045. With its impressive achievements in poverty reduction and ongoing commitment to growth, Indonesia is well on its way to secure a prosperous future for its citizens and becoming a key player in the international arena.

Market Glimpse

Indonesia has a mixed economy and one of the world’s principal trade routes boasted with significant natural resource wealth. The nation’s industrial focus spans manufacturing, mining, and agriculture, with significant contributions from sectors like electric vehicle battery production and infrastructure development.

It is an emerging market economy with the help of its 20-year development plan. The GDP reached IDR20,892.4 trillion and the economy grew on an average by 5% in 2023. Despite challenges such as the 1997 Asian financial crisis and the recent COVID-19 pandemic, Indonesia has shown resilience, attracting substantial foreign investment, which reached IDR 328.9 trillion in the first quarter of 2023. As a member of the G20, Indonesia hosted the 2022 summit in Bali, emphasising global economic cooperation. The ambitious $32-billion megaproject Nusantara, the new capital, symbolises Indonesia’s forward-looking vision and commitment to sustainable growth. The World Bank’s Indonesia Economic Prospects report mentioned a steady growth of the economy of average 5.1% per year from 2024 to 2026.

In addition to robust economic growth and strategic industrial focus, the Ministry of Finance of Republic of Indonesia (‘Government’) has introduced amended regulation Nomor 2 of 2022 (Perpu No 2 Year 2022) on Job Creation (‘the Law’) replacing Nomor 11 Tahun on Job Creation, 2020 to simplify the business process and to overcome the challenges of complicated voluminous laws. The Law consolidates over 80 laws and 1,200 related articles into just 174 articles. The Government also introduced the Online Single Submission system, a streamlined licensing procedures for various sectors in order to offer a much simpler business licensing acquisition process.

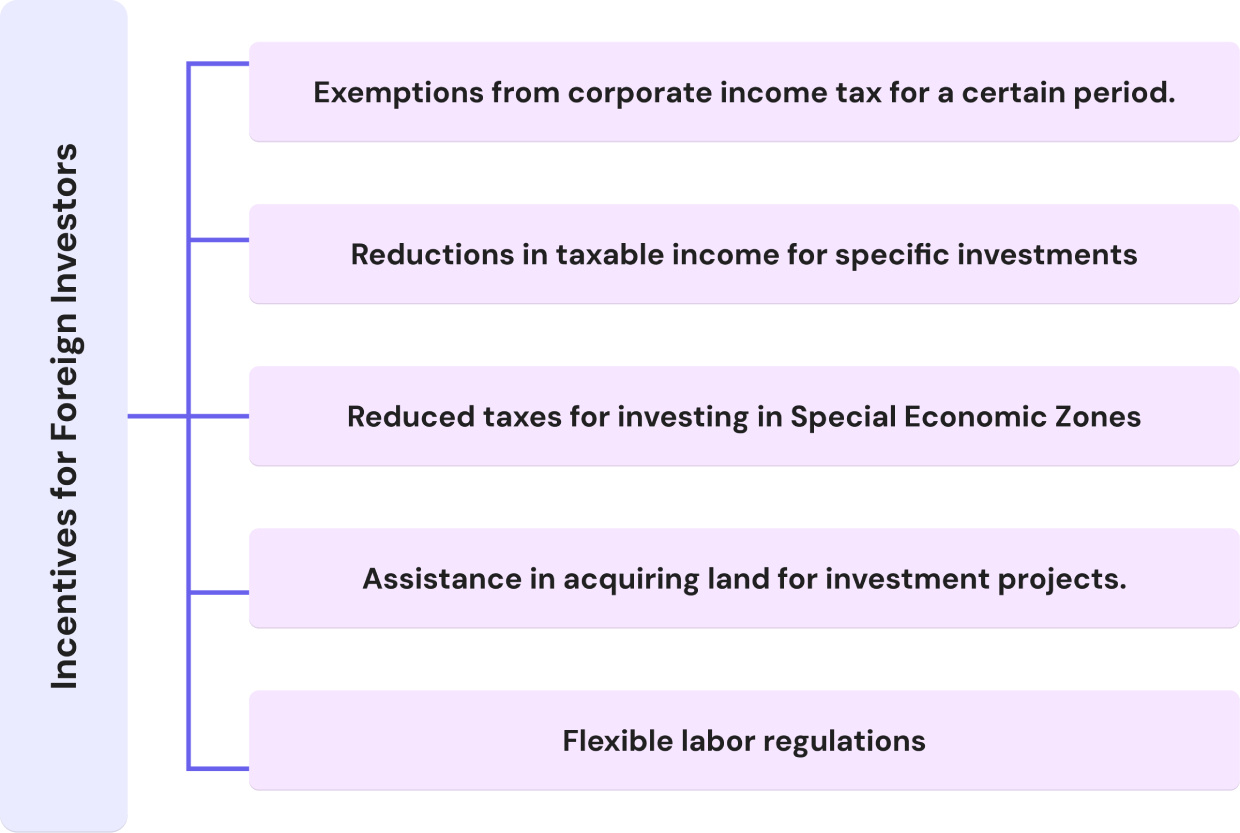

The strategies to make business operations easy in Indonesia does not cease with Government’s effective macroeconomic policies and simplified business process. In addition to all these, the Government also offers a range of incentives to encourage foreign investors.

Along with all the upsides, there are a few pointers that need to be taken care of before setting up a new business.

| Potential Problems | Measures to Protect Business |

| Fluctuating currency exchange rates | Hedging strategies and effective financial planning can reduce the risk. |

| Logistical challenges to remote areas | Effective supply chain and transportation solutions will help to solve the problem. |

| Strict environmental regulations | Performing environmental-friendly business functions is a must. |

| Counterfeiting and piracy | Need to register trademarks, patents, and copyrights for business innovations. |

| Complex tax system and frequent changes | Professional tax advice and full-proof tax planning is required. |

Shifting from the broader economic landscape, let us delve into the intricacies of payroll management, a critical component for any thriving business. This e-book will guide through the essential aspects of payroll, ensuring compliance and efficiency in business operations.

Payroll Compliance Essentials

Several registrations are required for a Company to start their operations in Indonesia. The process will commence with finalisation of the company name, and it is mandatory to submit the application to the Directorate General of Legal Administration Affairs. Additionally, verification through the Legal Entity Information System is required to confirm that the name is not already in use. After completion of all the paperwork, the company is eligible to receive the Business Registration number through Online Single Submission (OSS) portal.

As the company begins its functions, it should adhere to the relevant employment, social security, and withholding tax regulations to ensure that the employees receive accurate compensation, and all statutory dues are deducted and remitted to relevant authorities in order to avoid non-compliance.

In the course of this e-book, the statutory details right from onboarding to offboarding of an employee will be discussed in depth and the links to relevant official sites are embedded below:

Onboarding Simplified

The onboarding process of the employees are regulated by the relevant labour laws to ensure that the employees are hired and placed on work as per the norms stipulated. It insists to have defined employment contract in place with information on all the necessary working conditions and other payroll factors in place for seamless payroll operations. The requirements with regard to Indonesian payroll have been provided for below

1. Employee Classification

Similar to defining an employment contract and getting a legally valid contract in place, it is also crucial to classify the employee type based on the Implementing Guideline on The Withholding of Tax on Income in Connection with Individual Work, Services, or Activities of Government Regulation Number 168 of 2023 (“Withholding Tax guidelines”) as the withholding tax handling will differ based on the following employee classification

| Permanent employees |

|

| Non-Permanent employees |

|

| Non-employees |

|

2. Employment Contract

In Indonesia, Government Regulation (PP) 35 of 2021 on Fixed Term Employment Agreement, Outsourcing Working and Rest Hours and Employment Relationship Termination (“Labour law”) outline 2 types of employment contract

| Type of Contract | Features |

| Indefinite Term Employment Contracts (PKWTT) | For workers employed for an indefinite period |

| Fixed-Term Employment Contracts (PKWT) |

|

The employment contract should be in writing mentioning all the legal information. The mandatory information that should form part of a valid employment contract is stipulated by Labour law as provided under:

- Name & address of the company

- Name of the business’s industry

- Name, gender, age & address of the employee

- Designation of employee

- Venue of work

- Salary details & other entitlements

- Tenure of work (start and end date for PKWT)

- Place & date of expiry of the contract

- Signature of both parties

- Rights & obligation of employee & employer

3. Minimum Wages

Next significant criterion is to comply with the minimum wage norms stipulated under Law of the Republic of Indonesia Number 2 of 2022 (Perpu No 2 Year 2022) on Job Creation (“Job Creation Law”). This is basically to ensure that the employees are prevented from receiving wages less than the government standards.

The minimum wages in Indonesia ranges between IDR 2 million to IDR 4 million and is determined based on the province where the organisation operates.

| Name of the Provinces | Monthly Minimum Wage (in IDR) |

| Aceh | 3.460.672,00 |

| Sumatera Utara | 2.809.915,00 |

| Sumatera Barat | 2.811.449,27 |

| Riau | 3.294.625,56 |

| Jambi | 3.037.121,85 |

| Sumatera Selatan | 3.456.874,00 |

| Bengkulu | 2.507.079,24 |

| Lampung | 2.716.497,00 |

| Bangka Belitung | 3.640.000,00 |

| Kepulauan Riau | 3.402.492,00 |

| DKI Jakarta | 5.067.381,00 |

| Jawa Barat | 2.057.495,00 |

| Jawa Tengah | 2.036.947,00 |

| DL Yogyakarta | 2.125.897,61 |

| Jawa Timur | 2.165.244,30 |

| Banten | 2.727.812,11 |

| Bali | 2.813.672,00 |

| Nusa Tenggara Barat | 2.444.067,00 |

| Nusa Tenggara Timur | 2.186.826,00 |

| Kalimantan Barat | 2.702.616,00 |

| Kalimantan Tengah | 3.261.616,00 |

| Kalimantan Selatan | 3.282.812,21 |

| Kalimantan Timur | 3.360.858,00 |

| Kalimantan Utara | 3.361.653,00 |

| Sulawesi Utara | 3.545.000,00 |

| Sulawesi Tengah | 2.736.698,00 |

| Sulawesi Selatan | 3.434.298,00 |

| Sulawesi Tenggara | 2.885.964,04 |

| Gorontalo | 3.025.100,00 |

| Sulawesi Barat | 2.914.958,08 |

| Maluku | 2.949.953,00 |

| Maluku Utara | 3.200.000,00 |

| Papua Barat | 3.393.500,00 |

| Papua | 4.024.270,00 |

| Papua Tengah | 4.024.270,00 |

| Papua Pegunungan | 4.024.270,00 |

| Papua Selatan | 4.024 270,00 |

| Papua Barat Daya | 3.393.500,00 |

4. Probation Period

For scrutinising the efficiency and capabilities of the employee, probation period serves as a tool. In Indonesia, Job Creation Law regulates the probation period. It is enforceable only on the Indefinite Term Employment Contracts and it must be explicitly agreed upon and stated in the contract for a period not exceeding 3 months.

In case of Fixed-Term Employment Contracts probation period is not applicable. Even if the employer mentions it on the contract, it has no legal validity.

Workplace Protocols

Compliance with employee’s working conditions as per law is again a pertinent factor after onboarding an employee. Job Creation Law outlines the working hours, overtime, break times, overtime wages and leaves eligibility criteria of an employee.

1. Working Hours

| Maximum Working Hours | ||

| 6-day working week | 5-day working week | |

| 7 hours/day | 8 hours/day | |

2. Breaks

The period of rest and break is also important for the employees and the country has specific rules for this matter.

Note that the break time shall not be part of normal working hours.

3. Rest Day

In Indonesia, the weekly period of rest should not be shorter than 1 day after 6 workdays in a week or no shorter than 2 days after 5 workdays in a week.

4. Overtime

Overtime wages are compulsory, and it is counted based on basic wage and fixed allowance.

| Maximum Overtime Hours | |

| Daily Overtime Limit | Weekly Overtime Limit |

| 4 hours | 18 hours |

For overtime work employees are entitled to extra pay.

| Overtime Wages in a Normal Work Week | |

| For 1st hour | From the 2nd hour |

| 1.5 x hourly wage | 2 x hourly wage |

5. Night Shift Pay

In Indonesia, employees working night shifts do not receive additional compensation. However, if their regular working hours exceed the standard limit, they are entitled to overtime pay.

6. Leaves Entitlement

Employees in Indonesia are entitled to leaves on religious and public holidays as mandated by the government.

| Public Holiday | |

| New Year | January 01 |

| Isra Mi’raj | February 08 |

| Chinese New Year | February 10 |

| Holy Day of Silence | March 11 |

| Good Friday | March 29 |

| Easter Day | March 31 |

| Eid-Al-Fitr 1445 Hijri | April 10 to April 11 |

| International Labor Day | May 01 |

| Ascension of Jesus Christ | May 09 |

| Vesak Day 2567 | May 23 |

| Pancasila Day | June 01 |

| Eid-al-Adha 1445 Hijri | June 17 |

| Islamic New Year 1446 Hijri | July 07 |

| Independence Day of Republic of Indonesia | August 17 |

| Birthday of Prophet Muhammad | September 16 |

| Christmas Day | December 25 |

Apart from religious and public holidays employees of Indonesia are also entitled to several other paid statutory leaves as provided below:

| Leave Type | Minimum Entitlement |

| Annual leave* | 12 days |

| Sick leave | No limit*** |

| Maternity leave | 1.5 months each before as well as after childbirth |

| Paternity leave** | 2 days |

| Menstruation leave | 2 days |

| Wedding of the worker | 3 days |

| Children’s wedding | 2 days |

| Son’s circumcision | 2 days |

| Child’s baptism | 2 days |

| Death of a spouse, child, child-in-law, parent, or parent-in-law | 2 days |

| Death of family member living in the same house | 1 day |

*Note – The employee must work 12 months consecutively to be eligible for annual leave. On termination of employment (including voluntarily resignation) employers can encash the unused annual leave.

**Note – This leave is applicable even for miscarriage.

***Note- Employers are required to pay compensation for sick leave as follows

- For first 4 months ,100 percent of the normal wage.

- For second four months, 75 percent.

- For third four months, 50 percent

- Subsequent months, 25 percent until employer terminates the employment.

The payment for the above leaves is based on the normal wage agreed as per the employment contract.

a. Holiday Pay

Employees working on a holiday are compensated according to standard overtime pay rates as mentioned below:

| Overtime Wages during Holidays in 6 Day Working Week | ||

| First 7 hours | 8th hour | 9th to 11th hour |

| 2 x hourly wage | 3 x hourly wage | 4 x hourly wage |

| Overtime Wages during Holidays in 5 Day Working Week | ||

| First 8 hours | 9th hour | 10th to 12th hour |

| 2 x hourly wage | 3 x hourly wage | 4 x hourly wage |

7. Event-based Compensation

Employer is obligated to offer a range of benefits and compensation to ensure security of the employees while they are at work. In Indonesia, Work Accident Insurance (JKK) is a mandatory social security scheme that employers contribute for every month and if employees are injured or down with illness due to the work environment, they can get monetary benefit or health service benefits or both from this fund. It is regulated by Number 82 of 2019 (82/2019) on Work Accident and Casualty Security Program Implementation.

| Compensation for Accident | Compensation for Death |

| Reimbursement for transportation | Death compensation |

| Compensation for temporary inability to work | Funeral expenses |

| Medical rehabilitation costs | Periodic compensation |

| Disability compensation | Educational scholarships to the worker’s heirs |

| Denture replacement | |

| Hearing aid replacement | |

| Eyeglasses reimbursement |

For the details on benefits to be paid out in the above mentioned scenarios refer the regulation link.

8. Other Benefits

Although there are no other statutory benefits available, the employees may receive one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Annual supplementary wage etc.

Salary Essentials

1. Salary Components

In Indonesia, the Withholding Tax guidelines outlines the mandatory salary components. Follow the below table to understand different salary components that forms part of Gross salary in Indonesia payroll.

| Salary Component | Definition |

| Basic Pay | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement. |

| Fixed allowances | A fixed allowance is a regular payment given to employees alongside the basic wage. It is not tied to attendance or performance. For instance,

a) Food allowance b) Transportation allowance c) Telephone allowance |

| Non-fixed allowances | This is an irregular portion of the salary, often tied to attendance or performance of the employee. For instance,

a) Performance linked incentive b) Non-recurring Religious Holiday Allowances (THR) c) Bonus. |

| Social Security | Employer contribution occupational accident protection, healthcare and death compensation is considered as part of Gross pay in Indonesia. |

| Tax allowance | Employer borne tax portion |

| Benefit-in-Kind (BIK) | Any benefit in the form of goods or services are considered as benefit in kind and taxable as prescribed. Some of the examples of BIK are:

a) Provided free food and beverages b) Car facility c) Housing benefit d) Gifts and others as prescribed. |

2. Payslip Components

The regulation does not stipulate any mandatory payslip components; however it is preferable to specify the components of Gross Salary and applicable deductions for transparency.

Decoding Deductions

Employers are obliged to make several mandatory deductions in the below form:

1. Withholding Taxes

Indonesia follows January to December tax year and mandates employers to withhold income tax from employees’ salaries on a monthly payroll frequency as provided in Withholding Tax guidelines (“PPh 21”). The administration of income tax in payroll is governed by the following authorities

Till tax year 2023 individuals were taxed based on Annual projection method considering annual projected salary after mandatory payroll deductions, annual tax slabs were applied as per the previous guideline PER-16/PJ/2016 provided by the relevant authority as stated above. This method considered residential status as key criteria to identify the tax rate and computation procedure.

| Residential Status | Stay Criteria | Citizenship |

| Resident Indonesian | More than 183 days in a calendar year | Indonesian |

| Resident expat | More than 183 days in a calendar year | Non-Indonesian |

| Non-Resident | Less than 183 days in a calendar year | Non-Indonesian |

However, there were numerous complexities encountered by individuals while applying the annual projection method, especially for employees working only for part of the year. Considering the challenges, Indonesian Government has recently implemented significant changes to individual taxation by shifting from an annual to a monthly taxation method to simplify the process.

The applicable monthly tax rates are provided for in NOMOR 58 TAHUN 2023 followed by the implementation guidelines NOMOR 168 TAHUN 2023 by the Ministry of Finance that elucidates the computation procedure and other criteria about the withholding rates for income related to work, services, or activities of individual taxpayers.

The guidelines insists that the taxes are to be computed in the below manner:

a. Monthly taxes: For period other than December / Termination, monthly effective rates are to be applied on gross salary (before any payroll deductions). Gross salary considers all the components provided in the Section “Salary Structure” of this e-book.

The revised rules to determine the monthly tax effective rates are based on employee’s residential status, employee type and PTKP status. The PTKP status of an employee is determined by DJP as at beginning of the tax year only.

| Effective Monthly Tax rates & PTKP Deduction | ||

| Tax category | PTKP Deduction (in IDR) | Marital & Dependent Status |

| TER A | 54 million | Single without dependent |

| TER A | 58.5 million | 1. Single with Maximum 1 dependent

2. Married without dependents |

| TER B | 63 million | 1. Single with Maximum 2 dependents

2. Single with Maximum 3 dependents |

| TER B | 67.5 million | 1. Married with Maximum 1 dependent

2. Married with Maximum 2 dependents |

| TER C | 72 million | Married with three dependents |

b. Yearly taxes: On year-end or termination of an employee annual tax rates are applied on Net Taxable Salary as mentioned in the table below. To compute annual net taxable salary the below mentioned payroll deductions needs to be considered –

- Occupation Expenses/Position allowance of 5% on the total annual gross income up to a maximum of IDR 6.000.000 per annum.

- Penghasilan Tidak Kena Pajak (PTKP) based on marital status and dependent details.

| Annual Tax Table | ||

| Taxable Income above (IDR) | Taxable Income to (IDR) | Tax Rate |

| 0 | 60 million | 5% |

| 60 million | 250 million | 15% |

| 250 million | 500 million | 25% |

| 500 million | 5 billion | 30% |

| 5 billion | – | 35% |

Note: For Non-residents flat tax rate of 20% will apply both monthly and in year-end/on termination.

As mentioned previously in “Onboarding section” of the e-book the above steps pertain to tax withholding for Permanent employee category only, however for other employee categories the Withholding Tax guidelines provides a different procedure for tax handling.

| Employee Type | Taxation Mechanism |

| Non-permanent employees | Monthly effective tax rates are applied on Gross Salary (including Year-end / Termination month) |

| Non-employees | Annual tax slabs are applied on 50% of the Gross salary (including Year-end / Termination month) |

Refer the regulation link for more information.

Reporting

Along with the regulations, the reporting of the tax return has also evolved. Now the returns must be submitted electronically through the new simplified application, e-Bupot 21/26 which is part of Directorate General of Tax’s online filing system, DJP Online. It also includes auto generated withholding evidence feature that serves as immediate reference for employees. This feature will not only reduce the employer burden to generate the certificates / forms through the government portal directly but will also help in review it with the data submitted by the taxpayers.

The obligation of an employer for payroll will be fulfilled only if the deductions made are remitted and reported on time without any delay. Below are the key dates to keep in mind to fulfil tax obligations on time –

| Deduction | Remittance | Filing |

| End of the respective month | 10th of the following month | 20th of the following month |

Non-Compliance

The company should be vigilant when it comes to maintaining of compliance with income tax. Otherwise, for withholding tax the consequences will be grave:

| Type of Non-compliance | Implications |

| Late payment / Underpayment | An interest of approximately 1% per month will be charged on the outstanding tax amount for each month of delay. |

| Late filing | An administrative penalty of IDR 1,00,000 will be applied for each tax return period. |

2. Social Security

In Indonesia, the National Social Security System (Sistem Jaminan Sosial Nasional or “SJSN”) requires all employees, including expatriates working for more than 6 months, to participate, providing extensive coverage across different areas of social security. The administration of these programs is handled by two main organisations:

Employers play a crucial role in funding these contributions, guaranteeing extensive coverage for their employees. The structure and contributions of the scheme are outlined as follows:

a. BPJS Ketenagakerjaan (Manpower)

| Coverage under BPJS Manpower** | Employee contributions | Employer contributions | Minimum capping

(in IDR) |

Maximum capping

(in IDR) |

| BPJS Old Age (JHT) | 2% | 3.7% | 1 million | 0 |

| BPJS Death (JKM) | – | 0.3% | 1 million | 0 |

| Occupational Accident Protection (JKK) | – | Ranges between 0.24 to 1.74%* | 1 million | 0 |

| BPJS Pension (JP) | 1% | 2% | 1 million | 10.042.300 |

*Note – The rates are categorised based on industry risk level i.e., very low risk, low risk, moderate risk, high risk and very high risk as provided below:

| Risk Category | JKK contribution rate |

| Very low risk | 0.24% |

| Low risk | 0.54% |

| Moderate risk | 0.89% |

| High risk | 1.27% |

| Very high risk. | 1.74% |

b. BPJS Kesehatan (Health)

| Coverage under Healthcare* | Employee contributions | Employer contributions | Minimum capping (in IDR) | Minimum capping (in IDR) |

| BPJS Healthcare (JPK) | 1% | 4% | Refer Table 2 in Annexure section of the e-book* | 12.000.000 |

*Note – The minimum wage varies based on province in which the organisation is registered with BPJS authorities.

Reporting

Employers must use the Electronic Payment System (EPS) to submit employee contributions and report them to BPJS manpower authorities by the 15th of the next month. Whereas the submission and reporting of BPJS healthcare contributions should be done by the 10th of the next month through E-DABU application.

Non-Compliance

For any late payment in the social security contribution, a 2% penalty is applied for each month of delay.

3. Minimum Take Home Pay

The employers are eligible to make some deductions on employee’s salary based on valid reasons. However, the government has specified the reasons and limitations to prevent employee exploitation. Knowing the legal deduction grounds and maximum caps is important to avoid non-compliance.

Article 63 to 65 of Government Regulation (PP) on Number 36 of 2021 on Wages clarifies the legal deductions of wages can be made for –

- Fine

- Indemnity

- Prepaid Wage

- Loan payment or loan instalment.

- Rent of house/properties owned by the company.

All the deductions should be in accordance with the work agreement and company regulations. The total amount of wage deduction must not exceed 50% of the net salary received by the employee.

Seamless Offboarding

Maintaining compliance in the offboarding process is equally important and the employers should not brush aside this part of the employment. Usually, the termination of employment occurs when an employee retires, resigns or get dismissed from the work for grave reasons.

The provision regarding the eligibility is governed by the Law of the Republic of Indonesia Number 2 of 2022 (Perpu No 2 Year 2022) on Job Creation While its taxability is provided by Government Regulation (PP) Tariff of Article 21 Income tax on Incomes in the Form of Severance Pay, Pension Benefit, Old-Age Allowance and Old Age Security Paid in Lump Sum.

As per the above regulations, upon termination of an employment contract, employees are eligible for termination payments in the form of –

- Severance and Long service Pay; it is determined based on the length of service. The calculation of the pay will be mentioned below.

- Compensation Pay, it comprises of the following

- Unexpired and unused paid annual leave of the employee

- Cost or expense incurred for travel by employee and his family members to the place of work that has not been reimbursed

- Any other compensation agreed as per individual or organisation work agreements and collective work agreements.

To calculate the Severance Pay, refer to the table below:

| Service period | Severance Pay |

| Less than 1 year | 1 month’s wage |

| 1 to 2 years | 2 month’s wage |

| 2 to 3 years | 3 month’s wage |

| 3 to 4 years | 4 month’s wage |

| 4 to 5 years | 5 month’s wage |

| 5 to 6 years | 6 month’s wage |

| 6 to 7 years | 7 month’s wage |

| 7 to 8 years | 8 month’s wage |

| More than 8 years | 9 month’s wage |

The calculation of Long Service Pay is as follows:

| Service period | Long Service Pay |

| 3 to 6 years | 2 month’s wage |

| 6 to 9 years | 3 month’s wage |

| 9 to 12 years | 4 month’s wage |

| 12 to 15 years | 5 month’s wage |

| 15 to 18 years | 6 month’s wage |

| 18 to 21 years | 7 month’s wage |

Depending on the termination reason, the type and amount of termination pay out will vary as explained below:

1. Retirement

The employer may terminate the employment of the workers when they enter pensionable age of 58 years. The retiring employee is eligible for the following benefits –

- 75 times of applicable severance pay

- 1-time of applicable long service pay

- Compensation pay

2. Resignation

Employees intending to resign need to serve a notice period. It is usually 30 days in Indonesia; however, for employees in probation period it is 7 days only.

Resignation of employees on their own will get the following benefits –

- Compensation pay

- Separation payment, if provided by employment agreement or company regulation.

3. Dismissal

Employer or authority can terminate an employee due to intentional or negligent actions that cause damage, loss, or destruction to the employer’s property. In such cases the following benefits will be applicable –

| Termination Reason | Applicable Benefits |

| Termination of employees by authorities in case of crime causing loss to company |

|

| Termination of employees by authorities in case of crime not causing loss to company |

|

| Termination of employees absent for 5 (five) business days or more without written information that is equipped with valid evidence and have been summoned by businesses for 2 (two) times in an appropriate manner and in writing; |

|

| Termination of employees due to violation of the provisions on employment agreement, company regulation, or collective employment agreement and previously have been given the first, second, and third warning, each valid for maximum of 6 (six) months |

|

Also note, severance pay is taxable for the employees at different slabs.

| Severance Tax Slab | ||

| Taxable Income above (IDR) | Taxable Income to (IDR) | Tax Rate |

| 0 | 50 million | 0% |

| 50 million | 100 million | 5% |

| 100 million | 500 million | 15% |

| 500 million | – | 25% |

Conclusion

Indonesia offers a promising environment for businesses, with its supportive regulatory framework and ease of managing payroll being key highlights and the various incentives for businesses further enhance its appeal.

The ease of managing payroll can be ensured by investing in robust payroll systems, leveraging advanced technology, and maintaining a keen understanding of regulatory changes. The key of managing payroll in Indonesia lies in staying informed and implementing best practices. Along with the compliance, the overall efficiency and satisfaction of the workforce will enhance the effective management of Company.

FAQs

Yes, paying Tunjangan Hari Raya (THR) is mandatory in Indonesia including part-time workers as well. Employers are required to provide this religious holiday allowance to all employees who have worked for at least one month. The THR amount is typically equivalent to one month's salary.

No, an employee is allowed to encash the unutilised annual leaves that has not lapsed only on termination of employment (including voluntary resignation).

As per Government regulation No.35 of 2021 in the first instance, for the period of prolonged illness, the employee is eligible for 2 times the severance pay and 1 time of long service pay while on retirement after rehire the employee is provided with 1.75 times of severance pay and 1 time of long service pay based on years of service.

Yes, employees working between 1 to 7 hours on a week off/holiday is eligible for two times the normal pay as overtime pay. For employees working for hours exceeding 7 and between 8 hours, are eligible for three times the normal pay however if it exceeds 8 hours four times the normal pay will be paid out.

Yes, the maximum probation period is 3 months for an employee hired on work agreement of unspecified period however for employees hired on specified period of work agreement no probation period can be included.

No, employees are not entitled to annual leave during their probation period. Annual leave is only granted after completing 1 year of service.

No, a female employee giving birth to twins is entitled to the same maternity leave benefits as for a single birth.

As per Article 21 of regulation PER 168 Year 2023 (“Article 21 Tax”), in the month of termination, for Resident Indonesian the Net taxable income based on actual months worked will be subject to Article 21 Tax however in case of Resident expat the Net taxable income will be projected for 12 months for tax consideration.

As per Article 21 of regulation PER 168 Year 2023, in case of death of an employee, both Resident Indonesian and Resident Expat will be subject to Article 21 Tax on projected Net taxable income.

The marital and dependent status are critical factor for determining the applicable Monthly tax table and Penghasilan Tidak Kena Pajak (PTKP )deduction. Even if there are changes in this status during the year the status only at the beginning of the year will be considered.

Any settlement amount received after termination month will be considered as gross income and will not be subject to any deductions such as Occupational cost, BPJS employee contribution and PTKP. Annual tax rate as per Article 17 of Law of the Republic of Indonesia Number 7 of 2021on Harmonization of Tax Regulations (HPP) will be directly applied on the settlement amount.

Yes, any remuneration received by experts undertaking independent work such as tax consultants, lawyers, accountants etc., is considered as part of gross income and 50% of such amount is subject to annual tax rate as per Article 17 of HPP.

If an employee receives income in foreign currency, the calculation of Article 21 or Article 26 of Income Tax in Relation to Work, Services, or Activities shall be based on the exchange tariff determined by the Minister at the time of payment of income or when the income is payable, according to the event that occurs first.

No, starting January 2024, Indonesia has eliminated the distinction between irregular and regular income, treating all income equally for tax purposes.

As per PMK Number 66 of 2023 the maximum exemption limit of IDR 1.5 million pertaining to sports facilities does not apply to golf, horse racing, power boating, paragliding, and motorsports.

There are two options, either employer can deactivate the employee from the records for the month of full loss of pay so that no contribution needs to be remitted, or employer contributes on behalf of employee to BPJS Manpower at minimum capping of 1million and later recover it from employee in next payroll.

The contributions for BPJS Kesehatan and BPJS Ketenagakerjaan are generally computed on the contribution base consisting of Basic salary and fixed allowance. If an employee receives an increment mid-month, the contribution rate will be calculated on the revised contribution base.

No, it is sufficient for the employees to furnish details on the BPJS Ketenagakerjaan Membership Card to the new employer, based on this the BPJS Ketenagakerjaan authorities are notified so that the employee can continue to contribute till the time they are employed in this organisation.

The pension age stipulated in Government regulation (PP) 45 year 2015 (45/2015) is 57 years effective January 01, 2019 and it will subsequently increase by 1 year for every 3 next years until reaching the Pension Age of 65 years. If the contributor has reached the pension age but continues the employment, then either he/she can choose to receive pension benefits when reaching the pension age or when they stop working (provided it is not more than 3 years after the pension age) i.e., in this case till the year 2027.

Employees do not contribute separately to JKP program, out of total contribution of 0.46% around 0.24% is allocated out of the contribution already made to Workplace Accident Insurance (JKK) and Death Insurance (JKM) program and remaining 0.22% is paid by the Central Government.

Yes, Employers are obliged to generate the withholding tax evidence from the DJP tax portal to provide the same to employees i.e., Form 1721 VIII every month and Form 1721 A1 every year end/on exit based on the monthly and annual reporting.

In case of retrospective salary revision employees receive arrears amount that is subject to BPJS Kesehatan and BPJS Ketenagakerjaan contribution. This contribution pertaining to arrear amount (backpay salary) is reported in column “RAPEL” of “BPJS TK UPAH”.

The severance pay income of an employee will be reported in the E-Bupot 21/26 Bulanan with the tax object code 21-401-01. On submission the Form 1721 VII will be generated to be shared as withholding evidence to that employee.

The 2 statutory payroll reports are:

- E-Bupot 21/26 Bulanan: Employers must remit the withheld income tax by the 10th of the following month. The corresponding tax return must be filed by the 20th day of the following month.

- E-Bupot 21/26 Tahunan: Employers are required to submit this comprehensive report by January 20th of the following year.

It is obligation of the organisation A to report income, and the corresponding tax of the employee resigning based on actual months worked in E-Bupot 21/26 Tahunan and provide the Form 1721 A1 as withholding evidence within 30 days of resignation. Employee is obliged to submit this previous employment details with new employer.