Country Overview

Bahrain, located in the Persian Gulf, to the east of Saudi Arabia and to the north of Qatar, has a rich history and a dynamic economy that has traditionally relied on oil. Although now the country is on the mission of diversifying its economic base to ensure sustainable growth and improved living standards for all citizens. Their Economic Vision 2030 is a road map for better economic situation in the country and it is built on 3 guiding principles:

- Sustainability

- Competitiveness

- Fairness

Bahrain is well-positioned to achieve its ambitious goals and continue its legacy as a leading economic force in the region.

Market Glimpse

Bahrain provides access to regional and global markets, making it an attractive destination for growth and investment. Global growth rate of the nation has reached 3.1% in 2023, and it is expected to reach 3.2% in 2024 and 2025. In the 2nd quarter of 2024, the non-oil activities have played a pivotal role in supporting economic growth of Bahrain. As per the Bahrain’s Economic Report of Q2 2024, the real GDP non-oil activities in Q2 2024 are 85.2% accumulating the total value of BHD 3,170.0 million.

Some of the key growing economy of Bahrain include information and communication, accommodation and food services, financial and insurance etc. Due to the blooming opportunities, the country has made progress in attracting Foreign Direct Investment (FDI). The same economic report states that the FDI rate in the country has grown by 9% to reach the stock of BHD16.6 billion.

The country has arisen as a favourable investment zone with its focus on sustainable development and economic diversification. As a result, it has become an appealing destination for investors and a leading hub for business. To make the country further inviting for the investors, the nation has introduced its new Commercial Registration Portal (Sijilat). This portal offers transparency in the licensing and registration processes with Government agencies, investors, and other stakeholders and simplifies the whole process of starting a business.

To attract foreign investors, Bahrain offers several incentives:

- Low establishment and operational costs

- 100% foreign ownership of business assets

- Diverse enterprise and employment support programs

While Bahrain presents numerous advantages, businesses should be mindful of potential challenges:

| Potential Problems | Measures to Protect Business |

| Lack of enforcement of intellectual property rights | Register intellectual property and impose penalties on violations |

| Have different technical standards than western companies | Adopt flexible strategies and engage with local regulators |

| Government payment delays disrupt cash flow | Have emergency investment funds and a centralised payment tracking system |

To ensure the success of any business, it is essential to explore the intricacies of payroll management. This critical aspect not only drives operational efficiency but also guarantees compliance. In this guide, we will examine the key components of payroll, providing a thorough understanding of how to manage it effectively within your organisation.

Payroll Compliance Essentials

Starting a business in Bahrain includes several steps and Sijilat explains everything in detail. The process starts with choosing the relevant business structure and deciding on a name of the company and choosing a location of the business. Next comes the registration of the business along with registration of an eKey to access supportive eServices offered by the Bahraini Government. Lastly, to start the business operations the investor needs Commercial Registration (CR) without license which again can be done through the website of Sijilat.

The Ministry of Labour and Social Development (LMRA) is the Government body responsible for regulating and managing labour relations in Bahrain, overseeing employment laws, and implementing policies to support the national workforce.

In this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth. To start with, the links to relevant official sites are embedded below:

| Category | Regulation Number | Regulation Name |

| Social Security | Law No.24 of 1976 | Social Insurance Law |

| Law No.14 of 2022 | Amending Provisions of Social Insurance Law | |

| Labour Law | Law No. 36 of 2012 | The Labour Law |

| Decree No. (109) of 2023 | End-of-service Gratuity System for Non-Bahrainis in the Private Sector |

Onboarding Simplified

In Bahrain, streamlining the onboarding process is essential for a smooth transition for both employers and employees. Discover below the best practices and legal requirements to make the onboarding experience compliant:

1. Employee Classification

In Bahrain, employees can be classified as following:

| Types of Employees | Definition |

| Full-time employees | Employees working for standard hours and receive statutory benefits. |

| Part-time employees | Employees required to work for fewer hours than full-time and have limited benefits. |

| Apprenticeship | Employee entering with an employer for the purpose of learning an occupation, trade or handicraft for a fixed period during which the apprentice shall work under the supervision of the employer concerned for wage or reward. |

| Temporary employee | Workers hired for specific period or project, based on contract terms. |

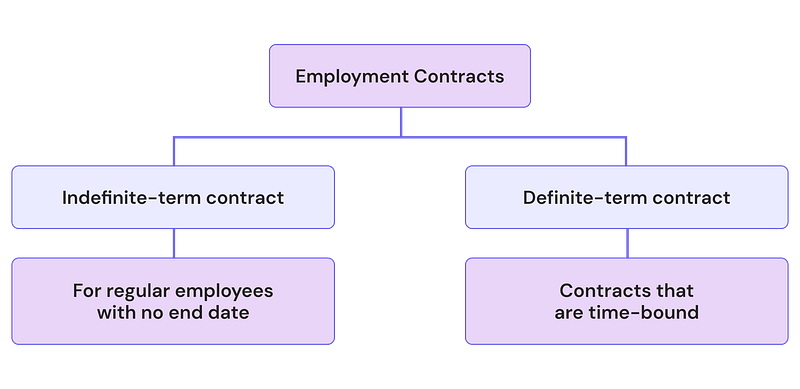

2. Employment Contract

In Bharain, the employment contracts must be written in Arabic and recorded in duplicate, with each party retaining a copy. If the contract is in another language, an Arabic version must accompany it. Usually, the contracts are of 2 types and the contract shall be deemed for an indefinite period if it meets the conditions as per Article 98 of Law No. 36 of 2012, The Labour Law (“Labour Law”).

As per Article 20 of the Labour Law, a work contract concluded between an employer and an employee must have the following information:

- Employer’s name, the address of the business premises & commercial registration number

- Worker’s name, date of birth, qualifications, position or occupation, residential address, nationality & personal identification details.

- The nature, type of employment & term of the contract in case of a definite term

- Salary details, method and time of payment

- Details of all the benefits in-kind

- Other particulars to be determined by a resolution of the Minister in charge of labour affairs.

As per Article 68 of the Labour Law, an employer shall retain worker’s file for at least 2 years from the date of termination containing the below details:

- Name, age, CPR number, social status, residence address and nationality.

- Job title, occupation, qualification and experience.

- Date of employment, wage and the developments.

- Holidays and leave taken and any penalties imposed upon him.

- Date and reasons of termination of their service.

3. Minimum Wages

In Bahrain, there is no legally mandated minimum wage for employees or expatriate workers in private sector.

4. Probation Period

Under Article 21 of the Labour Law, employers in Bahrain can put employees on probation for up to 3 months. In some occupations, the probation can be extended to 6 months through a resolution of the Minister in charge of labour affairs. During probation, either party can terminate the contract with at least one day’s notice. An employee cannot be placed on probation more than once by the same employer.

Workplace Protocols

After hiring employees, it is crucial to comply with legal working conditions. The country’s Labour Law defines working hours, break times, rest days, overtime pay, and other legal entitlements to support and benefit employees.

1. Working Hours

| Maximum Working Hours |

| 8 hours/day |

| 48 hours/week |

Note: The working hours may vary sector wise.

During the month of Ramadan, the working hours reduces to:

| Maximum Working Hours |

| 6 hours/day |

| 36 hours/week |

2. Breaks

Note: The intervals of rest shall not be calculated as part of the working hours.

According to Article 35 of the Labour Law, after maternity leave, a female worker is entitled to 2 daily breastfeeding breaks, each lasting at least 1 hour, until her child is 6 months old.

3. Rest day

The standard workweek in Bahrain is 48 hours, typically distributed over 6 days (Saturday to Thursday). Friday is considered the weekly rest day.

According to Article 57 of the Labour Law, employers can change the rest day for some workers. Employers can also provide a paid weekly rest day for more than 24 consecutive hours, if the total work hours do not exceed 48 hours per week.

If an employee works during rest day, they are entitled to their regular wage plus an overtime wage of 150% of their regular wage, or they can choose to take another day off instead.

4. Overtime

If an employee works for more than the standard working hours, then the extra working hours are considered as the overtime, and the employee is entitled to receive extra payment for each extra hour worked.

As per Article 53 of Labour Law, the employee’s actual hours of work shall not be more than 10 hours a day. Actual working hours including rest period shall not be more than 11 hours a day.

For workers who carry out intermittent jobs by their nature as designated by a resolution of the Minister in charge of labour affairs, the period of attendance shall not be more than 12 hours in each day.

| Overtime Wages | |

| Normal working days | Basic wage + 25% |

| Weekends or rest days | Basic wage + 50% |

5. Night Work Pay

Employees working overtime between 7:00 P.M. to 7:00 A.M. are entitled to an additional payment of minimum 50% of the hourly wage for each hour of work.

6. Leaves Entitlement

As per Official Bank Holidays | CBB the employees are entitled to get paid religious and public holidays for 2025 listed below:

| Public Holidays | Date | Number of Days |

| New Year’s Day | January 1 | 1 day |

| Eid Al Fitr | March 30 to April 1 | 3 days |

| Labour Day | May 1 | 1 day |

| Eid Al Adha | June 6- June 8 | 3 days |

| Al Hijra New Year | June 26 | 1 day |

| Ashoora | July 4 and July 5 | 2 days |

| Prophets Birthday | September 4 | 1 days |

| National Day | December 16 and December 17 | 2 days |

Note: Excluding New Year’s Day and National Day, the dates are subject to variation each year.

Apart from these statutory holidays, the employees of Bahrain are entitled to several other paid statutory leaves as provided in the Labour Law:

| Leave Type | Maximum Entitlement |

| Maternity leave (Article 32) | 60 days |

| Annual leave* (Article 58) | Not less than 30 days (2.5 days per month) |

| Bereavement leaves (Article 63) | 3 days |

| Childbirth leave (Article 63) | 1 day |

| Iddah leave**(Article 63) | 1 month |

| Wedding leave (Article 63) | 3 days |

| Sick leave (Article 65) | 55 days*** |

| Hajj leave****(Article 67) | 14 days |

* Applicable after completing at least 1 year of service. If the period of service is less than one year, then entitlement shall be for the proportionate period of service.

** Applicable for female workers only and can be combined with annual leaves and can be extended to 3 months and 10 days. If she does not have annual leave balance, the leave will be unpaid.

*** The below table explains the sick leave compensation for an employee:

| Leave Days | Compensation Paid |

| First 15 days | Full pay |

| Next 20 Days | Half pay |

| Next 20 Days | Unpaid |

The entitlement of a worker to sick leave on full or half pay may be accumulated for a period not exceeding two hundred and forty days.

**** Applicable only after completing 5 years of service and it is granted only once to the worker during his whole service period.

Holiday Pay

If employees work on public holidays, the employer must compensate them. This can be either a day off for each holiday worked or payment at 150% of their regular wage. If these holidays fall on a Friday or another public holiday, employees will receive an additional day off.

7. Event-based Compensation

Employers are obligated to provide a safe and healthy workplace for their employees. They must adhere to the Occupational Health and Safety (OHS) standards established by the LMRA to ensure employee safety. In Bahrain, Occupational Hazards Contribution is a mandatory social security scheme that employers contribute for every month.

In case the employers violate the laws and regulations related to occupational health and safety violations, they will be subjected to penalties ranging from BHD 200 to BHD 500.

In case the employee’s Injury or demise, the employee or their family will be entitled to receive the compensation as follows:

| Compensation for Injury | Compensation for Death |

| Medical rehabilitation costs | Compensation based on the extent of the injury |

| Payment of wage during the period of his treatment. If the period of treatment exceeds six months, the employer shall pay one half of the wage until he recovers. |

A grant to the family of the injured person |

8. Other benefits

Although there are no other statutory benefits available, the employees may receive one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Commissions and other supplemental wages

- Health insurance

- Accommodation and air tickets

Salary Essentials

Employers are required to pay their employees’ salary according to the schedule specified in their contract. In Bahrain, as per Resolution No. (68) of 2019 on the Wages Protection System, wages must be paid through Wage Protection System (WPS). It is important to maintain the following information for processing via WPS:

- The Full name of the employee

- The amount paid as wage

- Date of payment of wage

- Employee’s personal number

- Employee’s account number

- Employer account number

- Employer personal number or commercial registration number

1. Salary Components

Various salary components are commonly included as part of an employee’s gross salary, the table below provides an overview of the various salary components that constitute the salary structure in Bahrain payroll:

| Salary Component | Definition |

| Basic salary | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement before any additions or deductions. |

| Allowances | These are additional allowances offered by employers including:

These components may vary by industry and job position. |

| Others | The non-fixed portion of the salary, for instance:

|

| Social Security Contribution | Employer contribution to SIO, Unemployment Insurance and Occupational Hazard are not deducted to calculate net pay of an employee.

Additionally, employee contribution to SIO is deducted to calculate net pay of an employee. |

| End of Service Benefit | Gratuity to be calculated upon termination of an employee. |

2. Payslip Components

A detailed payslip must be provided with each payment of the wage to the employee. These payslips typically include the following components:

- Basic salary

- Allowances

- Deductions

- Net salary

- Leave encashments

- End-of-service benefits

Decoding Deductions

1. Withholding Taxes

Bahrain does not impose personal income tax on either expatriates or Bahraini nationals. Additionally, non-residents’ income are exempt from tax and social insurance in the country.

2. Social Security

Although there are no mandatory deductions for income tax, employers are eligible to deduct social security contributions. In Bahrain, Social Security Law is administered by the Social Insurance Organisation (SIO). When any employee is hired, the employer must register its employees with the SIO.

All the contributions must be paid monthly for compulsory insurances against old age, disability, and death for Bahraini employees only, and against work-related injuries including death for all employees.

The employee and employer monthly contributions are based on contribution on Basic salary and fixed allowances (‘salary’) received in the month of January in each year.

In respect of workers who enter employment after the month of January, the contribution shall be computed based on full wages in the month of such entering to employment and until the end of the month of December and thereafter they will be treated based on January’s salary.

Insurance contributions are paid for the month of entering employment of the worker on the basis of a full month if the total number of days worked during that month is at least fifteen days, and, similarly, contributions are paid in respect of the month of termination of service on the basis of the full month also, provided that the total number of days worked during that month is at least fifteen days; but no contributions are payable if the number of days is lesser.

As per the Article 33 Clauses (1) and (2) of Law No. 14 Social Insurance law:

- Employer is obligated to pay monthly subscription at 11% of the wages towards insurance branch against old age, disability and death. This is upon theenforcement of this Law, and it increases annually by a rate of 1% until it reaches 17%.

- Employee is obliged to pay 7%

Table below refers to the contribution rates effective 01 January 2025 for Bahrain’s working in Bahrain:

| Type | Salary Range (in BHD) |

Employer Contribution | Employee Contribution |

| SIO contribution (Bahraini nationals) | 150-4,000 | 14% | 7% |

| Occupational Hazards (All employees) | 150-4,000 | 3% | – |

| Unemployment insurance (All employees) | 150-4,000 | 1% | 1% |

As per Social Insurance law, for Bahraini nationals working in other GCC countries, the employer’s contribution rate will be increased by 1% at the beginning of each year as of January 2023 until January 2028, so that the total percentage of the employer’s share becomes 17%. The share of employees will remain constant to 7% from January 2023.

The below table specifies the change in subscription rates for Bahraini nationals from 2022 onwards working in other GCC regions:

| Employer’s Share | Employee’s Share | Total subscription | Year |

| 9% | 6% | 15% | April 2022 |

| 11% | 6% | 17% | May 2022 |

| 12% | 7% | 19% | January 2023 |

| 13% | 7% | 20% | January 2024 |

| 14% | 7% | 21% | January 2025 |

| 15% | 7% | 22% | January 2026 |

| 16% | 7% | 23% | January 2027 |

| 17% | 7% | 24% | January 2028 |

Gulf Cooperation Council (GCC) Insurance Protection Extension Program

Registration of an employee from another GCC country who is working in Bahrain in the pension or retirement insurance system of their home country involves coordination with the SIO.

Employers having employees whose home country is another GCC country, are obliged to deduct any applicable contributions from the employee’s wages and make any applicable employer-provided contributions based on requirements of the pension or retirement insurance program of the employee’s home country and must remit those contributions to a bank account designated by the applicable social insurance agency of the employee’s home country.

The employee and employer shall bear their share of the contributions in accordance with the rates applicable under the law of the employee’s home state, provided that the share of the employer does not exceed the percentage in force in the state of employment.

If the actual employer’s share exceeds the percentage in force in the state of employment, then the difference in rates to be deducted from employee’s wage.

Reporting

The contribution should be paid to SIO before 15th of the following month.

Non-compliance

| Type of Non-compliance | Implications |

| Late payment | 5% of the contributions due for each month or fraction of a month of delay |

| Non-participation in insurance contribution | 20% of the unpaid contribution |

| Violating the law | Fine ranging from 100 dinars to 500 dinars |

3. Minimum Take Home Pay

- As per Article 82 of the Labour Law, the employer may deduct the compensation for loss or damage from the worker’s wage, provided it does not exceed five days Basic salary, fixed allowances and other benefits (Wage)in a month and overall deduction should not exceed two months’ wages.

- As per Article 44 of the Labour Law, an employer must not deduct more than 10% Wage of a worker for repayment of a loan. This provision is applicable to wages paid in advance as well.

- For loans granted for the building of accommodations, the deduction must not be more than 25% of the Wage.

- An employer shall be entitled to charge the worker the actual administrative fees and charges due for a loan.

The deduction from the wage during the month shall not exceed more than 25% of Wages, which may be increased to 50% for the payment of alimony.

Seamless Offboarding

Separation of an employment contract may occur due to several reasons:

- Completion of the fixed-term contract

- Employee resigning from the post

- Employer terminating with valid reason and proper notice

- Dismissal for serious misconduct

At the time of separation from the Company, one of the important payments to be made to employees in Bahrain is End of Service Gratuity (EOSG), except in some specific circumstances.

Therefore, it’s important to know the regulations around the same to be compliant as provided below:

a) Employees not covered under Social Insurance Law (both Bahraini and Non-Bahraini employees)

Article 116 of Labour Law, deals with the provision of End of service Gratuity (EOSG).

The basis of calculation was as follows:

- As per Article 47 of the Labour Law, EOSG is calculated based on the employee’s most recent basic wage plus any social allowance, if any (‘Wage’).

- For workers paid on a piece-rate, production basis, or with a fixed wage plus commission, the average wage over the last 3 months is used.

| Years of Service | Amount of EOSG |

| 0 to 3 years | Half of a month’s salary for each year |

| 3 years & more | 1 month’s salary for each year |

b) Employees covered under Social Insurance Law (both Bahraini and Non-Bahraini employees)

Entitled to EOSG as per the State’s pension and social security legislation.

Amendment introduced in 2024 for Non-Bahraini Employees

Effective 01st March 2024, a new regulation related to EOSG was introduced as per Decision No. (109) of 2023, applicable to non-Bahrainis working in the private sector. Under this scheme, the employers make monthly contribution to Social Insurance Organisation for EOSG. The contribution rate is defined based on the service period of an employee as provided below:

| Years of Service | Amount of EOSG |

| 0 to 3 years | 4.2% |

| More than 3 years | 8.4% |

This new scheme helps reduce the financial burden on employers by spreading the gratuity payments over time instead of a lump sum at the end of service. Furthermore, it has been clarified that such contributions are required to be made after the above regulation has been made effective.

Accordingly, in case of existing non-Bahraini employees, the calculation of payable EOSG will be a sum of the following:

- Gratuity by employer calculated from the start of service till February 2024, and

- Gratuity by SIO for the period starting from March 2024 till the end of service.

Note: As per Article 44 of the Labour Law, the amount of any debts or loans, due from the employees will be deducted from their entitlements.

1. Retirement

Employees can retire from the organisation upon reaching 60 years of age. However, an insured person can retire before the age of 60 if they have contributed to the insurance for at least 240 months. For an insured woman, retirement can occur before the age of 55 if she has contributed for at least 180 months.

Upon retirement, employees are eligible for the following End of Service Benefit (EOSB):

- Remuneration due

- Compensation for any unused holiday entitlement

- EOSG

2. Resignation

Employees may choose to resign, provided they adhere to the notice period. As per Article 40 of the Labour Law, upon resignation, employees must receive their wages and all the entitlements within 7 days from their last working day.

If an employment contract is ended without following the notice period, the party ending the contract must compensate the other party with the worker’s basic salary, fixed allowances, and other benefits for the entire notice period.

A worker can end the employment contract without notice or by giving notice in case of any kind of assault, breach of contract, or other reasons specified in Articles 105 and 106 of the Labour Law.

Upon resignation, employees are eligible for the following EOSB:

- Remuneration due

- Compensation for any unused holiday entitlement

- EOSG

3. Dismissal

According to Article 99 of the Labour Law, if an employer terminates a contract, the notice period can be extended beyond 30 days by mutual agreement.

If an employee is dismissed for reasons specified in Article 107 of the Labour Law, they are not entitled to termination benefits. Otherwise, they are entitled to the following EOSB:

- Compensation for any unused holiday entitlement

- EOSG

According to Article 111 of the Labour Law, if an employee is dismissed without cause or for unlawful reasons, they are entitled to the following compensations:

| Particulars | Compensation |

| Termination of indefinite employment contract within the first 3 months | Compensation equivalent to 1 month’s Wages. |

| Termination of indefinite employment contract after 3 months | Compensation within 2 days’ Wages for each month of service and at no less than 1 month’s Wage and not exceeding 12 months’ Wages. |

| Termination of definite or performance-based employment contract after 3 months | Compensation with Wages for the remaining period of the contract provided that the agreed compensation shall not be less than 3 months’ Wages or the remaining period of the contract, whichever is less. |

| Unfair dismissal | Additional compensation equivalent to one half of the compensation due unless the contract provides for a higher compensation. |

Note: ‘Wage’ here includes basic salary, fixed allowances and other benefits.

Conclusion

Bahrain, with its Vision 2030 project and progressive economic policies, is an attractive business hub in the Middle East. Even though several Government policies and schemes ease doing business in the country, managing payroll in Bahrain requires navigating local labour laws, social security contributions, and statutory reporting. Despite the absence of personal income tax, maintaining compliance with other mandatory contribution regulations might be challenging. Investing in advanced payroll systems for tailored solutions for Middle East will be an effective strategy to manage payroll accurately.