Country Overview

Oman, a prime hub for trade and commerce in Middle East, shares a north-western border with the UAE and a western border with Saudi Arabia and Yemen. Like all other GCC countries, Oman is also diversifying their economy from the focus of oil and gas to make it and sustainable in the long run. For this purpose, the nation is currently following Vision 2040, a long-term government strategy for transforming Oman. The plan focuses on several key pillars, such as:

- Diversified and sustainable economy that is based on technology, knowledge, and innovation.

- Promoting a safe and well-preserved environment with balanced ecosystems and renewable resources.

- A cohesive society that is proud of its identity and culture and committed to its citizenship.

- Effective governance with comprehensive oversight and a swift justice system.

The dedicated framework of the transforming Vision project upholds Oman as a relevant location for business that is blooming with opportunities.

Market Glimpse

Oman is a prime location choice for business to tap is the regional as well as making an impact on the international market. According to World Bank, the annual GDP growth of Oman is 1.3% in 2023, and Oman News Agency mentions that as per preliminary data issued by National Centre for Statistics and Information (NCSI), it has reached to 1.7% in the 1st quarter of 2024, accumulating the total value of OMR 9,537.0 million. On the other hand, the revenue of non-oil activities has increased by 4.5% to OMR 6,803.3 million by the end of the 1st quarter of 2024, compared to RO 6,511.7 million at the end of the 1st quarter of 2023. The nation has also achieved growth in attracting Foreign Direct Investment (FDI). Statistics by NCSI indicated that the volume of FDI inflows recorded a growth of 57.5% until the end of the 4th quarter of 2023 to reach OMR 4.45 billion. The sectors that are on focus include food security, healthcare, aviation, tourism etc.

Along with all country’s focus on sustainable development through Vision 2040, the Government has streamlined business registration and licensing activities to make the whole process easier for the investors, to attract them further Oman also offers numerous incentives:

- 100% foreign ownership

- Low capital requirements

- Exemption from corporate income taxes up to 25 years

- Exemption from taxes on profits or dividends for 30 years

- Exemption from customs duties on imports and exports

While Oman presents numerous advantages, businesses should be mindful of potential challenges:

| Potential Problems | Measures to Protect Business |

| Bureaucratic regulations for visas and permits | Consult professionals who will guide throughout the visa and permit processes. |

| Mandate of Omanization quotas for sector-specific Omani employment | Aligning with Omanization goals and offer training programmes to the employees to support business needs. |

| Requirement of utilising local manufacturing and sourcing | Research and collaborate with local suppliers based on the need. |

The success of any company lies not only on the business strategies but also on how well they manage the payroll. Payroll management is a critical aspect that drives operational efficiency smoothly and guarantees compliance. In this guide, we will examine the key components of payroll, providing a thorough understanding of how to manage it effectively within your organisation.

Payroll Compliance Essentials

Starting a business in Oman can be done in a few easy steps. Once the structure and name of the business is fixed, one needs to go to Ministry of Commerce, Industry, and Investment Promotion (MOCIIP) to register the business. Additionally, one needs to apply for the necessary business licenses relevant to the business operations. This may involve approvals from different authorities. When all the permissions and registrations are on place, the company can start hiring employees.

In this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth. To start with, the links to relevant official sites are embedded below:

| Category | Regulation Number | Regulation Name |

| Social Security | Decree No. 52/2023 | Social Insurance Law |

| Labour Law | Decree No. 53/2023 | Labour Law |

Onboarding Simplified

In Oman, streamlining the onboarding process is essential for a smooth transition for both employers and employees. Discover below the best practices and legal requirements to make the onboarding experience compliant:

1. Employee Classification

In Oman, employees can be classified as following:

| Types of Employees | Definition |

| Full-time employees | Employees who are permanent without a specific end date. They work for standard hours and receive statutory benefits. |

| Part-time employees | Employees who work for fewer hours than full-time and have limited benefits. |

| Remote employees | Employees who work wholly or partially outside the workplace with virtual means. They can be either part-time or full-time workers. |

| Temporary employees | Workers hired for specific period or project, based on contract terms. |

| Incidental employees | Worker performing a work which does not fall within the activity practised by the employer. |

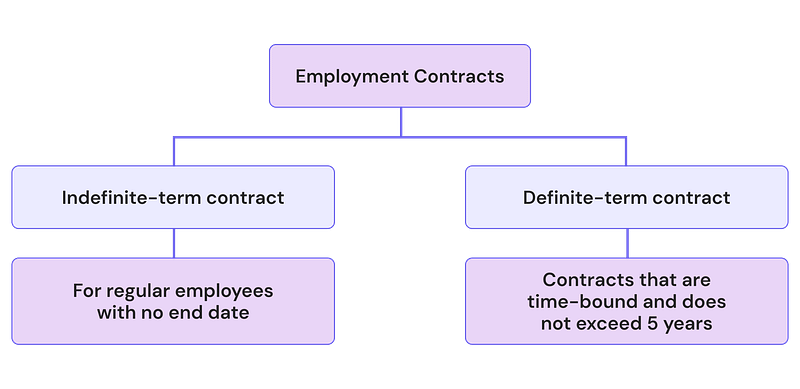

2. Employment Contract

- As per Article 7 of Labour Lawall employment contracts must be written in Arabic and subsequently translated into any foreign language as needed. In legal matters, only the Arabic version of the employment contract is considered valid in court.

- As per Article 33 of Labour Law, the employment contract must be in writing and made in the Arabic language in two copies, one for each party.

- The employment contract is considered of an indefinite period if the conditions as per Article 35 of Labour Law, is met.

As per Article 25 of Labour Law, the employer shall register employees within 30 days from date of employment with the below information:

- Date of commencement of work

- Wage specified for an employee

- Type of work

As per Article 36 of Labour Law, an employment contract must have the following information:

- The name of the employer and the establishment, and the address of the workplace.

- The name of the employee, his date of birth, qualification, occupation, place of residence, and nationality.

- The type of work, its conditions, and the contract period if it is for a definite period.

- The basic wage and any allowances, stipends, benefits, or gratuities to which the worker is entitled.

- Date of Payment

- Notice period

- Specifying laws, religious beliefs, customs and traditions

Employers are prohibited from recruiting non-Omani workers without obtaining authorisation from the Ministry. To secure this authorisation, employers must meet the conditions outlined in Article 27 of the Labour Law. Additionally, non-Omani workers are not permitted to commence employment without a valid work permit, with the conditions for granting such permits specified in Article 28 of the Labour Law.

3. Minimum Wages

As per Article 88 of Labour Law, the minimum wage is established through a decision issued by the Minister of Labour. This decision is made after consulting with the Committee for Joint Dialogue between Production Parties and receiving approval from the Council of Ministers.

As per Ministerial Resolution No. 222/2013, the minimum wage for Omanis shall be OMR 325 per month distributed as OMR 225 for basic salary and OMR 100 for allowances.

4. Probation Period

Article 37 of Labour Law specifies the following about probation period of an employee:

- The probation period for employees who receive a monthly wage is limited to a maximum of 3 months, while for other employees, it is capped at 2 months.

- An employee cannot be placed under probation more than once with the same employer.

- If the employee successfully completes the probation period, it is counted as part of their total period of service.

- Either party may terminate the contract during the probation period, provided that a minimum of 7 days’ notice is given to the other party.

Workplace Protocols

1. Working Hours

| Maximum Working Hours |

| 8 hours/day |

| 40 hours/week |

For Muslim employees the working hours reduces during the Ramzan:

| Maximum Working Hours |

| 6 hours/day |

| 30 hours/week |

2. Breaks

As per Article 76 of the Labour Law, the nursing female worker is granted 1 hour per day to care for her child starting after the end of maternity leave for a period of 1 year.

3. Rest day

As per the Article 77 of the Labour Law, employees must get at least 2 consecutive days of rest per week after working continuously for 5 days.

4. Overtime

- Employees may be required to work for more than the standard hours. However, the total working hours must not exceed 12 hours per day.

- The worker is entitled to an additional 25% of the hourly wage for each extra hour of work.

- If employees work on weekly rest days, they are entitled to 200% of the regular wage or an additional day of leave.

- The employer may ask the employees to work overtime without obtaining their consent for the activities mentioned in Article 72 of Labour Law.

5. Night Work Pay

Employees working overtime between 9:00 p.m. to 5:00 p.m. are entitled to an additional payment of 50% of the hourly wage for each hour of work.

6. Leaves Entitlement

As per Royal Decree No. 88/2022, following are the dates of official holidays:

| Public Holidays | Date | Number of Days |

| New Year’s Day | January 1 | 1 day |

| Isra and Mi’raj | 27 Rajab | 1 day |

| Eid al-Fitr | 29 Ramadan until 3 Shawwal | 5 days |

| Eid al-Adha | 9 Dhu Al-Hijja until 12 Dhu Al-Hijja. | 4 days |

| Hijri New Year | 1 Muharram | 1 day |

| The Prophet’s Birthday | 12 Rabi Al-Awwal | 1 day |

| National Day | 18 and 19 November | 2 days |

If one or both days of the weekend fall within the holidays, they are compensated by one day.

Apart from these statutory holidays, the employees of Bahrain are entitled to several other paid statutory leaves as provided below:

| Leave Type | Maximum Entitlement |

| Annual leave* (Article 78) | 30 days |

| Sick leave (Article 82) | 182 days** |

| Maternity leave (Article 84) | 98 days*** |

| Paternal leave (Article 84) | 7 days |

| Hajj leave**** | 15 days |

| Iddah leave (Article 84) | 130 days for Muslim female employees |

| 14 days for non-Muslim female employees | |

| Wedding leave (Article 84) | 3 days |

| Compassionate leaves (Article 84) | 10 days for demise of spouse & children |

| 3 days for demise of first-degree relative | |

| 2 days for demise of second-degree relative | |

| Examination leave (Article 84) | 15 days |

| Care Leave (Article 84) | 15 days |

* Applicable only after completing 6 months.

** The below table explains the sick leave compensation for an employee:

| Leave Days | Compensation Paid |

| First 21 days | Full wage |

| From 22 till 35 days | 75% of wage |

| From 36 till 70 days | 50% of wage |

| From 71 till 182 days | 35% of wage |

*** Another 14 days pre-natal period is allowed upon the recommendation from medical authority.

**** Applicable only after completing 1 years in the service, provided that the Hajj ritual has not been done previously.

Holiday Pay

If employees work on official holidays, they are entitled to 200% of the regular wage or an additional day of leave.

7. Event-based Compensation

- As per Article 103 of Labour Law, an occupational safety and health committee shall be established in the ministry, and its composition, determination of its competences, and work system shall be issued by a decision by the Minister of Labour.

- Occupational Hazards Contribution is a mandatory social security scheme that employers contribute for every month.

- The employer shall take all needful precautionary safety measures for securing the safety of the employees against the work hazards.

- Every employer must keep occupational safety records according to the forms, rules and regulations regarding of which a decision shall be issued by the Minister.

8. Other benefits

Although there are no other statutory benefits available, the employees may receive one-time or additional payment benefits, subject to their employment contract, such as:

- Bonuses

- Commissions and other supplemental wages

- Health insurance

- Accommodation and air tickets

Salary Essentials

Wages must be paid on a working day, adhering to the provisions mentioned in Article 90 of Labour Law:

- Monthly Wage Employees:Wages must be paid at least once a month.

- Part-Time Employment:For work exceeding two weeks, employees should receive weekly instalments based on completed work, with the remaining wage paid in full the following week after work completion.

- Other Employment Types:Wages should be paid weekly, unless agreed in writing to be paid bi-weekly or monthly. In all cases, wages must be paid within three days after the due period.

The employer’s liability is only discharged when the wages are transferred to the employees’ accounts in one of the approved local banks or financial institutions licensed by the Central Bank of Oman.

Wages must be paid through Wage Protection System (WPS). It is important to maintain the following information for processing via WPS:

- Employee ID

- Employee name

- Employee bank identification code

- Employee account number

- Salary frequency

- Number of working days

- Net salary

- Year and month of salary payment

1. Salary Components

| Salary Component | Definition |

| Basic salary | The basic pay or wages is the fundamental payment given to employees, determined by the nature or classification of their work as per their agreement before any additions or deductions. |

| Allowances | These are additional allowances offered by employers including:

These components may vary by industry and job position. |

| Others | The non-fixed portion of the salary, for instance:

|

| Social Security Contribution | Employer contribution to Social Protection Fund, Unemployment Insurance, Occupational Hazard and Insurance for Maternity leave are considered as part of gross pay. Employee contribution to Social Protection Fund, Unemployment Insurance, Occupational Hazard and Insurance for Maternity leave are not considered as part of gross pay. |

| End-of-Service Benefits | Gratuity, leave encashments and recoveries to be calculated after termination of an employee. |

2. Payslip Components

In Oman, employers are legally obliged to provide online payslips to their employees. While there are no legal stipulations regarding the format, these payslips typically include the following components:

- Basic salary

- Allowances

- Deductions

- Net salary

Decoding Deductions

1. Withholding Taxes

Oman does not have any income tax to be paid by employees. Therefore, the employers are not required to deduct any withholding tax.

2. Social Security

The social insurance system implements the Social Insurance Law and is administered by the Social Protection Fund.

Contributions are calculated during the year based on the insured’s contribution wage (Salary).

Salary is the gross salary or basic wage plus all allowances and stipends not exceeding the maximum limit.

Expats working in Oman are exempted from social insurance contributions. However, they must pay Job Security Fund contributions.

As per Social Insurance Law, employers and employees must contribute towards the following insurances:

| Insurance Type | Salary Range (in OMR) | Employer Contribution | Employee Contribution |

| Elderly, disability and death | 325-3,000 | 11% | 7.5% |

| Work Injuries and Occupational Diseases | 325-3,000 | 1% | – |

| Job Security Fund | – | 0.5% | 0.5% |

| Insurance for Maternity Leave | – | 1% | – |

| Insurance for Sick and Other Leaves | – | 1% | – |

GCC Insurance Protection Extension Program

Under the GCC Insurance Protection Extension Program, the Oman employers employing workers from other GCC countries, are required to register such employees in the pension or retirement insurance system of their home country. The other GCC countries are Bahrain, Kuwait, UAE, Qatar, and Saudi Arabia.

Registration of an employee from another GCC country who is working in the Oman in the pension or retirement insurance system of their home country involves coordination with the social protection fund, which functions as a liaison to the social insurance agencies of other GCC countries.

Employers in the Oman are required, for each of their employees working in the Oman whose home country is another GCC country, to deduct any applicable contributions from the employee’s wages and make any applicable employer-provided contributions based on requirements of the pension or retirement insurance program of the employee’s home country.

The employee and employer shall bear their share of the contributions in accordance with the rates applicable under the law of the employee’s home state, provided that the share of the employer does not exceed the percentage in force in the state of employment. If the actual employer’s share exceeds the percentage in force in the state of employment, then the difference in rates to be deducted from employee’s wage.

Reporting

Employers are required to pay monthly social insurance contributions within 15th of the following month.

Non-compliance

| Type of Non-compliance | Implications |

| Late payment | 5.5% annually of the amounts due |

| Violating the law | Not exceeding 3,000 Omani Riyal. |

3. Minimum Take Home Pay

- Employers are prohibited from deducting more from a worker’s wage than what was mutually agreed upon for any loans provided during the contract period. Additionally, they cannot charge interest on the loans.

- This rule also applies to any wages paid in advance.

- According to Article 65 of the Labour Law, an employer cannot impose a fine on an employee for each violation that exceeds 5 days’ wages in 1 month.

- As per Article 68 of the Labour Law, in cases of loss, damage, or destruction of tools, machinery, or products, the employer is not permitted to deduct more than 25% of the worker’s monthly gross wage.

- Employers are allowed to withhold or reduce a worker’s wages by up to one-fourth for specific debts, such as legal maintenance debts or amounts owed to the Government or the employer. In cases of multiple debts, legal maintenance debts take priority.

Seamless Offboarding

Ensuring compliance during the offboarding process is crucial and should not be overlooked. Separating employees involves adherence to specific regulations, depending on whether the employee is retiring, resigning, or being dismissed.

Notice Period

The notice period must be 30 days for the monthly salary employee and 15 days for others. If the contract is terminated without observing the notice period, the party terminating the contract shall pay the other party compensation equal to the notice period or the remaining part of it calculated based on the final gross wage the worker was receiving

End of Service Gratuity

The employer shall pay the worker a gratuity for the period of his service, not less than the basic wage for each year of his service.

The worker is entitled to the gratuity for the fractions of the year proportional to the period he spends in service

Note: Irrespective of the type of separation, for any debts or loans, due from the employees will be deducted from their entitlements.

1. Retirement

Employees can retire from the organisation upon reaching 60 years of age. However, there’s a gradual increase in this age by one year every seven years, eventually reaching 65. Upon retirement, employees are eligible for the following End of Service Benefit (EOSB), payable on the date of termination:

- Remuneration due

- Compensation for any unused holiday entitlement

- End of Service Gratuity (EOSG)

2. Resignation

As per Article 41 of Labour Law, the employees may resign without adhering to the notice period or before the expiry of the contract period if it is for a definite period while retaining all their rights, including the end-of-service gratuity and right to compensation.

As per Article 91 of the Labour Law, upon resignation, employee must receive their wages and all the entitlements within 7 days from their last working day.

Upon resignation, employees are eligible for the following End of Service Benefit (EOSB):

- Remuneration due

- Compensation for any unused holiday entitlement

- EOSG

3. Dismissal

The employer may dismiss a worker without prior notice and without an end-of-service gratuity if they meet any of the conditions specified in Article 40 of Labour Law else, they are eligible for the following End of Service Benefits (EOSB), payable on the date of termination:

- Remuneration due

- Compensation for any unused holiday entitlement

- EOSG

Conclusion

Oman, with its Vision 2040 initiative and strategic economic reforms, is emerging as a key business destination in the Middle East beyond oil and gas sector. Despite no personal income tax, compliance with other mandatory contributions is essential. While the Government has taken many steps to ease business operations, navigating local labour laws and other regulatory requirements may get challenging. Investing in advanced payroll systems tailored for the Middle East can help businesses manage payroll efficiently and stay compliant.