Country Overview

Vietnam, located in Southeast Asia, shares its borders with China, Laos, Cambodia, and the South China Sea. With a population of over 100 million people, Vietnam is renowned for its rich cultural heritage, historical significance, and dynamic workforce. The country operates as a one-party socialist republic under the leadership of the Communist Party of Vietnam (CPV). Hanoi serves as the capital city, while Ho Chi Minh City stands as the commercial hub of the nation.

Vietnam’s economy has transformed from a centrally planned economy to a market-oriented, becoming one of the fastest-growing economies in Asia. Following the GDP worth 429.72 billion US dollars in 2023, the nation has already reached 465.81 billion of U.S. dollars of GDP in 2024 till so far. Supported by its five-year socio-economic plan spanning from 2021 to 2025, the average growth rate of GDP in five years is expected to increase by 6.5% – 7%. Key sectors driving this growth include manufacturing, agriculture, services, and technology. Vietnam’s integration into the global economy has been significantly supported by various trade agreements, with key trade partners being the U.S., China, Japan, and the EU. Free Trade Agreements (FTAs) such as the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) boost Vietnam’s access to global markets and reduce tariffs for Vietnamese exports.

Its openness to foreign direct investment (FDI) has driven the growth of industries and improved infrastructure. According to the Ministry of Planning and Investment data, FDI into Vietnam has risen by 8% year-on-year to USD 14.15 billion in the first eight months of 2024. With its dedication to sustainable growth and forward-looking approach to business and economic development, the nation is proving itself to be one of the key players in the international arena.

Market Glimpse

Vietnam is emerging as a destination for outsourcing and technology due to its competitive labor costs and skilled workforce. Its location in ASEAN allows it to serve as a manufacturing and export hub. The nation is increasingly integrated into global supply chains, especially in electronics, textiles, and footwear manufacturing. Its welcoming stance towards FDI has significantly propelled industrial growth and enhanced infrastructure development.

Vietnam is proactively enhancing its business environment to attract foreign investors. The government has implemented several key reforms, including:

- Simplification of administrative procedures related to business registration, tax, customs, and labor.

- Improved transparency in legal frameworks and enhanced access to credit for enterprises.

- Investment in infrastructure, including highways, ports, and industrial zones, to facilitate trade and business operations.

- Emphasis on digital government services to streamline processes for businesses.

These measures collectively aim to create a more conducive and efficient environment for foreign investment. Moreover, the strategies to make business operations easy does not cease here. Vietnam offers several incentives to attract foreign businesses:

- Corporate Income Tax (CIT) incentives for businesses in high-tech industries, special economic zones, and economically underdeveloped regions.

- Import duty exemptions for goods used to set up fixed assets in specific sectors, including high technology and manufacturing.

- Favourable land rental rates and tax exemptions for investors in priority sectors.

- Government-backed loans or subsidies for sectors such as agriculture, renewable energy, and IT.

Another reason that makes Vietnam stands out as an attractive investment destination is its abundant and talented workforce. With a median age of around 32 years, the country boasts a young and dynamic population. Recent advancements in education, particularly in STEM fields, have further enhanced the skill set of the workforce. International companies have not failed to recognised Vietnam’s expanding pool of engineers, software developers, and skilled technicians, making it a compelling choice for investment.

Along with all the upsides, there are a few pointers that need to be taken care of before setting up a new business.

| Potential Problems | Measures to Protect Business |

| Complex bureaucracy | Understand local regulations, labor laws, and tax codes with the help of experts. |

| Threat of natural disasters | Develop a robust business continuity plan and invest in disaster-resistant infrastructure and insurance. |

| Abuse of intellectual property | Register intellectual property through an authorised agent at Vietnam’s National Office of Industrial Property (NoIP). Ensure the protection before establishing a presence in Vietnam. |

Transitioning from the wider economic context, we now turn our attention to the intricacies of payroll management, a critical component for any successful enterprise. This guide will explain the essential aspects of payroll, ensuring compliance and enhanced operational efficiency.

Payroll Compliance Essentials

To commence business operations in Vietnam, several registrations are required for a company. The initial step involves finalising the company name, followed by the mandatory submission of the application to the Department of Planning and Investment. This registration must adhere to the Enterprise Law 2020.

Upon completion of the paperwork, the company will be issued a Business Registration Certificate (BRC) and a tax identification number (TIN). Further, it must register with the relevant authorities for social insurance, health insurance, unemployment insurance and trade union.

In this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth. To start with, the links to relevant official sites are embedded below:

Onboarding Simplified

Setting up a smooth onboarding process in Vietnam involves adhering to several legal and procedural steps to ensure compliance and employee engagement. Ensuring a smooth onboarding process in this country involves careful attention to legal requirements, compliance with labor laws, and clear communication with employees about their rights and responsibilities. Adherence to these regulations helps companies avoid non-compliance and ensures a productive and compliant workforce from day one. Here’s a simplified guide to help streamline the onboarding process for new employees:

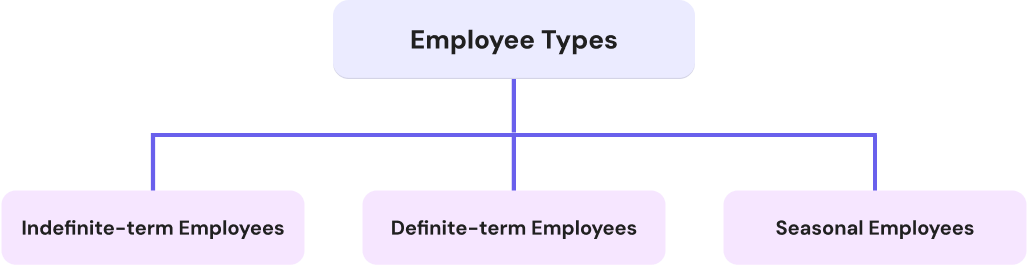

1. Employee Classification

In Vietnam, the employees can be classified as the following:

Based on the employment contract, the employee type is decided. The types of employment contracts have been discussed below.

2. Employment Contract

In Vietnam, the Labor Code (2019) outlines 3 types of employment contract:

It is mandatory to have a written employment contract before the employee starts to work. The contract must be provided in Vietnamese, and a foreign language version may accompany it for foreign employees. The contract should outline key details such as:

- Name of the employee & employer

- Title & job description of the employee

- Start date of employment

- Duration of employment (if employee is not on indefinite-term contract)

- Working hours and place and other obligations

- Salary details & other benefits

3. Minimum Wages

In Vietnam, labor laws define statutory pay applicable across Vietnam and minimum wages at regional level. These pay not only ensure minimum payment to employees but also impact salary based for Social Security contributions.

Article 3 of Decree 73/2024/ND-CP sets the statutory base salary for state employees, public officials, and those in the public sector. This base salary serves as the foundation for calculating various allowances, benefits, and other statutory payments. Statutory based effective from July 1, 2024, is VND 2,340,000 per month.

This base salary is used to determine payments for social insurance contributions, health insurance, and other statutory obligations.

Regional Minimum wages are set by Decree 74/2024/ND-CP across 4 regions defined in Vietnam and ensure compliance with statutory wages. All employees working under labor contracts are entitled to at least the regional minimum wage as provided below:

| Region | Daily Minimum Wage (in VND) |

| Region I | 4,980,000 |

| Region II | 4,430,000 |

| Region III | 3,930,000 |

| Region IV | 3,470,000 |

Any complaints by employees regarding non-compliance with minimum wage laws can be reported to the Department of Labor, Invalids, and Social Affairs (DoLISA).

Non-compliance with minimum wage laws can lead to fines ranging from VND 20 million to 75 million depending on the severity of the violation. It may also result in labor disputes, potential lawsuits, or penalties from labor authorities. Employers may be required to pay the difference between what the employee received and the applicable minimum wage.

4. Probation Period

The Labor Code (2019) outlines labor standards, rights as well as obligations and responsibilities of employees and employers. The Code also offers the legal framework for probation. The probationary period can be agreed upon for certain roles, but it should not exceed 60 days for positions that require a junior college degree or above, or 30 days for positions that require a secondary vocational certificate, professional secondary school; positions of or for technicians, and skilled employees and 06 working days for other jobs. Probation periods must be clearly defined in the employment contract. During the probationary period, employees are entitled to at least 85% of the agreed salary and to terminate their employment during the probationary period a minimum of 3 days’ notice is required.

Workplace Protocols

Vietnam’s labor regulations provide specific provisions to ensure fair treatment of employees and the maintenance of work-life balance. These provisions are outlined in the Labor Code, covering aspects such as working hours, overtime, breaks, leaves, and compensation.

1. Working Hours

Article 105 of Labor Code (2019) outlines the standard working hours in Vietnam.

| Maximum Working Hours |

| 8 hours/day |

| 48 hours/week |

Employers and employees may agree on alternative working arrangements such as shifts, but the same should not exceed the above-mentioned maximum limits. In certain sectors, the government may allow fewer working hours, such as 6 hours per day for specific labor-intensive or hazardous jobs.

2. Breaks

In Vietnam, the laws regarding the breaks are outlined in the Article 109 of Labor Code (2019). According to this Article, employees working 8 consecutive hours per day, are entitled to a break of at least 30-minute during the workday. The employees working in night shift, are entitled to a 45-minute break.

3. Rest Day

Labor Code (2019) also defines that employees must have at least 1 full day (24 hours) of rest day, every week.

4. Overtime

Article 107 & 98 of Labor Code (2019), regularise the law related to overtime hours, pay and night shift allowance.

| Maximum Overtime Hours | |

| Monthly Overtime Limit | Yearly Overtime Limit |

| 40 hours | 200 hours |

Note: For some sectors, such as garment or electronics manufacturing, the limit may be extended to 300 hours per year.

For overtime work employees are entitled to extra pay.

| Overtime Wages | |

| Normal working days | 150% of the regular wage |

| Weekly rest days | 200% of the regular wage |

| Public holidays or paid leave days | 300% of the regular wage |

For any overtime work during the night shift, the rate is increased by an additional 20%, making the overtime pay during night shifts:

| Overtime in Night Shift (from 10PM to 6:00AM) | |

| Normal working days (night shift only) Normal working days (cross shift only from day to night) |

200% of the regular wage 210% of the regular wage |

| Weekly rest days | 270% of the regular wage |

| Public holidays or paid leave days | 390% of the regular wage |

5. Night Shift Pay

Employees working during night shifts (from 10:00 PM to 6:00 AM) are entitled to an additional allowance of 30% of their regular wage for night hours.

6. Leaves Entitlement

As per Article 112 of Labor Code (2019), the employees are entitled to paid public holidays on 6 occasions as mentioned below:

| List of Public Holidays | |

| Calendar new year holiday | January 01 |

| Lunar new year festival | 5 days decided by the Prime Minister |

| Victory Day | April 30 |

| International Labor Day | May 1 |

| National Day | September 2 and 1 preceding or following day |

| Hung Kings’ death anniversary | 10th of the third month of a lunar year |

Note: Foreign workers in Vietnam are entitled to 1 day-off on their traditional new-year holiday and 1 day-off on their national day.

Apart from above, as per the Articles 113-115 Labor Code (2019), employees of Vietnam are entitled to several other paid statutory leaves as provided below:

| Leave Type | Minimum Entitlement |

| Annual leave* | 12 days** |

| Sick leave | 30-60 days*** |

| Maternity leave**** | 180 days |

| Paternity leave | 5-14 days |

| Wedding of the worker | 3 days |

| Wedding of offspring or adopted child | 1 day |

| Death of a spouse, child, child-in-law, parent, parent-in-law or adoptive parent | 3 days |

* As per in Clause 1, Article 113 of Labor Code (2019), employees are granted an additional 1 day of leave for every 5 years of service with the same employer.

** For employees working in hazardous or physically demanding conditions, the entitlement increases to 14 days.

*** Depends on the employee’s years of service.

**** In case of twins or multiple births, the mother is entitled to an extra month for each additional child.

a. Holiday Pay

Employees working on a holiday are compensated according to standard overtime pay rates, without any additional holiday-specific payment. For details refer to the “Overtime” section.

7. Event-based Compensation

Employers are responsible for ensuring that the workplace complies with safety and health regulations. This includes providing the necessary protective gear and training for hazardous jobs. Safety training must be documented, and employees must acknowledge receipt.

Decree 45/2013/ND-CP governs workplace safety regulations, ensuring that employees are provided with safe working conditions and measures. If employees are injured or down with illness due to the work environment or suffering from work-related injuries or occupational diseases while performing work duties, or during company-sponsored activities, then they are entitled to compensation from the employer.

Compensation and benefits for work-related accidents are regulated under Article 145 of the Labor Code (2019) and specific provisions in the Law on Social Insurance (2014). Articles under this Law cover benefits from the social insurance fund, including medical and rehabilitation costs, allowances, and lump-sum payments for work-related accidents.

| Seriousness of the injuries | Compensation |

| Reduces the employee’s working capacity by 5% to 10% | Minimum 1.5 months’ salary |

| Reduces the working capacity by 11% or more | Compensation increases proportionally |

| 100% disability | Up to 30 months’ salary |

| Death or serious accidents | Compensation equivalent to 30 months’ salary |

Note: Social insurance will cover additional payments for medical care and rehabilitation related to the work injury or occupational disease, including ongoing benefits for long-term disabilities

8. Other Benefits

Workers in Vietnam also receive the 13th month salary bonus, also known as the Tet bonus, is an additional month’s salary traditionally paid in January or February, just prior to the Lunar New Year. Although not legally mandated, this practice is deeply rooted in Vietnamese culture and is widely regarded as a standard practice. The bonus is often depending upon the employee’s performance and the company’s annual business outcomes. By integrating the 13th month salary bonus into the overall compensation framework, companies in Vietnam can offer competitive remuneration packages that meet employee expectations, especially during the significant Tet holiday period.

Eligibility for the 13th month salary bonus generally extends to most full-time employees. Some organisations may adjust the bonus proportionally for those who have not completed a full year of service or may offer additional performance-based bonuses. Typically, this bonus is equivalent to 1 month’s basic salary, though the exact amount can vary based on company policy and the employee’s performance throughout the year.

Some employers offer extra benefits such as health insurance, team building, year-end party, travel allowances, and education subsidies, but these are often non-taxable and may not be included in the gross salary.

Salary Essentials

Salary payments, deductions, and variable wages in Vietnam are primarily covered by the Labor Code 45/2019/QH14 and associated regulations. Article 94 of this Code covers the obligations of employers regarding salary payments, specifying that salaries must be paid in full and on time. While Article 95 of the Labor Code defines payroll periods and methods, emphasising that salary payments must be made at least once a month and stipulating the form of payment which can be in cash or through bank transfer.

1. Salary Components

The table below provides an overview of the various salary components that constitute the gross salary:

| Salary Component | Definition |

| Basic salary | This is the core salary, which must not be lower than the minimum wage set by the government for each region. Refer to the “Minimum Wages” section to know the ranges. |

| Allowances | Additional allowances often form part of the gross salary and may vary by employer or job function. Common allowances include:

|

| Bonuses |

|

| Overtime Pay | If an employee has done overtime work, then they are entitled to this pay. It is calculated based on the employee’s basic salary. To know the rates, refer to “Overtime” section. |

| Night Shift Allowance | Employees working during night shifts are entitled to an additional allowance. To know the rates, refer to “Night Shift” section. |

| Social Security & Insurance Contributions | Employer’s statutory contribution to the social security and insurance is considered as part of gross pay in Vietnam. More details in the “Social Security” section. |

| Trade Union Contribution | Employers are required to contribute to the trade union fund, which supports employee welfare and labor rights protection. It is considered as part of gross pay in Vietnam. |

2. Payslip Components

A payslip in Vietnam should clearly show how an employee’s salary is calculated, including gross salary components, deductions, and the net salary. The mandatory components to be shown in the payslip are as follows:

- Gross Salary: This is the total salary before deductions, and it includes basic salary, allowances. Other variable components include overtime and nightshift allowance pay and 13th salary bonus

- Deductions: These are statutory deductions that reduce the gross salary to the net (take-home) salary. The deduction components include Personal Income Tax (PIT) and contributions of social insurance, health insurance and unemployment insurance.

- Net Salary: The final salary amount credited to the employee’s bank account after all deductions have been made.

- Total working days

- Overtime hours

Decoding Deductions

In Vietnam, employers are required to comply with various regulations related to withholding taxes, social security, and ensuring the employees are getting the accurate minimum wage to avoid any non-compliance. Below is an overview of the key regulations, their applicability, reporting requirements, and the impact of non-compliance.

1. Withholding Taxes

Personal Income Tax (PIT) is applicable to both Vietnamese and foreign employees who earn income in Vietnam. In Vietnam, the General Department of Taxation (GDT) under the Ministry of Finance is responsible for receiving and processing PIT reports.

Employees will receive compensation in Vietnamese Dong (VND), if their salary and other benefits are based in another currency, it must be converted into VND based on the foreign exchange rate, as specified.

The employer is responsible for withholding taxes (PIT) from employees’ gross salary and remitting them to the tax authority.

The employee’s taxable income includes salaries, allowances, benefits, and bonuses in any form except for non-taxable income prescribed by the Law on Personal Income Tax (PIT), Law No. 07/2007/QH12 and its amendments, including Law No. 71/2014/QH13. These laws outline which types of income are subject to tax and specify certain exemptions, such as allowances for meals, uniforms, and travel under certain conditions.

PIT in Vietnam is progressive, and the rate depends on the employee’s monthly assessable income. Tax rates are applied, as per the table provided below, after deducting certain exemptions, such as:

- Personal relief of 11,000,000 VND per month

- Dependent Relief of an additional 4,400,000 VND per month for each registered dependent.

| Compensation Range | Prescribed Withholding Tax |

| Up to VND 5 million | 5% |

| VND 5 to 10 million | 10% |

| VND 10 to 18 million | 15% |

| VND 18 to 32 million | 20% |

| VND 32 to 52 million | 25% |

| VND 52 to 80 million | 30% |

| Above VND 80 million | 35% |

The PIT on probation period will be based on total monthly income. The rate will be as the following:

| Residential Status | PIT Rate |

| Resident | 10% |

| Non-resident | 20% |

For Non-resident employees, withholding PIT will be 20% in both probation & labor contract.

Reporting

Reports and filings related to PIT are submitted to local tax departments under the GDT based on the location of the company or the employee’s residence. Employers are required to report monthly or quarterly PIT deductions from employee salaries, and at the end of March of the following year, an annual PIT finalisation report must be submitted.

| Submission of Monthly Tax | Filing of annual PIT report |

| 20th of the following month | 31st of March of the following year |

Non-Compliance

| Type of Non-compliance | Implications |

| Late payment / Under-reporting | Penalties of 0.03% per day on the unpaid tax amount. |

| Significant under-reporting | Additional fines of up to 20% of the underreported amount. |

2. Social Security

Law on Social Insurance (2014) addresses mandatory contributions to social insurance, health insurance, and unemployment insurance, which are required to be deducted from gross salary.

Social security contributions must be made by both employers and employees, covering social insurance, health insurance, and unemployment insurance. Social insurance is compulsory for both Vietnamese and foreign employees who have signed labor contracts of at least 1 month.

To know the rate of the contribution, refer to the following table:

| Type of Fund | Purpose | Employee’s contribution | Employer’s contribution | Total Contribution |

| Social Insurance | Covers retirement, sickness, maternity, work injury, and occupational disease benefits. | 8% | 17.5% | 25.5% |

| Health Insurance | Provides coverage for healthcare services. | 1.5% | 3% | 4.5% |

| Unemployment Insurance* | Helps employees during periods of unemployment. | 1% | 1% | 2% |

*For unemployment insurance, foreign employees are not entitled because this is a special policy for Vietnamese employees.

Reporting

Employers must register and submit contributions monthly to the local Social Security office. The contributions must be paid by the 30th of each month.

Non-Compliance

| Type of Non-compliance | Implications |

| Late payment | Penalty of 0.03% per day of the outstanding contribution. |

| Not participating in compulsory social insurance | Fines ranging from VND 12 million to 15 million. |

| Prolonged failure in compliance | Severe legal consequences, including criminal liability for individuals involved. |

3. Trade Union Contribution

All employers are required to contribute to the trade union fund, which supports employee welfare and labor rights protection. The contribution rate is 2% of the monthly salary level used as a basis for social insurance contribution.

4. Minimum Take Home Pay

The Labor Code of Vietnam does not legally mandate minimum take-home pay requirement for employees. However, employers must ensure that after statutory deductions, the employee’s take-home pay does not fall below the minimum wage. The minimum take-home pay must be calculated based on the applicable regional wage, adjusted by statutory deductions such as taxes and social insurance. For further information refer to the “Minimum Wages” section.

Seamless Offboarding

Ensuring compliance during the offboarding process is crucial and should not be overlooked. Offboarding employees in Vietnam involves adherence to specific regulations, depending on whether the employee is retiring, resigning, or being dismissed. The Labor Code (2019) governs all offboarding processes, including the necessary notice periods, termination payments, and timelines. Below is a guide on how to manage the offboarding process for retirement, resignation, and dismissal.

1. Retirement

The retirement age in Vietnam is gradually increasing as part of reforms. Starting from 2021, the retirement age is 60 years and 3 months for men and 55 years and 4 months for women, with gradual increases until it reaches 62 years for men in 2028 and 60 years for women in 2035.

Employers are responsible for processing any remaining salary, unused leave payments, and completing social insurance contributions by the last working day of the retiring employee, just as in the case of resignation or termination of contract. However, all retirement benefits, including pensions or lump-sum social insurance payments, will be managed and disbursed by the Social Insurance Department.

The retiring employee is eligible for the following benefits:

- Pension – Employees who have made social insurance contributions for at least 20 years are entitled to a monthly pension. The pension amount is based on the employee’s average salary during their working years.

- Social Insurance Lump Sum – Employees who do not qualify for a pension may receive a lump-sum social insurance payment based on their contribution period.

These benefits are handled entirely by the Social Insurance Department, with the employer ensuring that social insurance contributions and necessary paperwork are finalized before the employee’s retirement.

2. Resignation

Employees have the right to resign by providing a notice period to the employer. The notice period depends on the type of labor contract and the reason for resignation.

| Type of Contract | Duration of Notice period (in Days) |

| Indefinite-term Contract | 45 |

| Fixed-term Contract | 30 |

| Seasonal Contract | 3 |

Note: For certain reasons such as unsafe working conditions, harassment etc. the employee can resign without notice.

The resigning employee is eligible for the following benefits:

- Final Salary – Payment for any work completed up to the resignation date.

- Unused Leave Compensation – Employees are entitled to payment for any unused annual leave days at the time of resignation.

- Severance Pay – If an employee has worked for the company for more than 12 months, they are entitled to severance pay, calculated as half a month’s salary for each year of service. However, severance is not applicable if the employee resigns without proper notice or voluntarily without a legitimate reason.

All outstanding salary, leave compensation, and severance pay must be settled by employers within 7 working days following the employee’s final working day. In exceptional circumstances, this period may extend up to 30 days.

3. Dismissal

Dismissal in Vietnam must follow specific legal grounds and procedures. Employers need to ensure compliance with the Labor Code to avoid disputes or penalties. Dismissal can occur if an employee violates company regulations, commits misconduct, or fails to meet performance standards after due warning.

No prior notice is required if the dismissal is a result of grave misconducts such as theft, dishonesty or violence. For dismissals due to economic reasons or restructuring, the employer must give the same notice period as for resignations:

| Type of Contract | Duration of Notice period (in Days) |

| Indefinite-term Contract | 45 |

| Fixed-term Contract | 30 |

| Seasonal Contract | 3 |

The following benefits will be applicable to the employee in case of termination resulting from different scenarios:

- Severance Pay – Employees dismissed for economic reasons or downsizing are entitled to severance pay if they have worked for more than 12 months. This pay is calculated at half a month’s salary per year of service.

- Job Loss Allowance – For dismissals due to company restructuring, economic difficulties, or technological changes, employees may receive a job loss allowance of 1 month’s salary for every year of employment, provided they have contributed to unemployment insurance for more than 12 months.

- Lump-sum Social Insurance Payout – Employees who have contributed to social insurance but are not eligible for monthly pension may apply for a lump-sum social insurance payout, equivalent to 1.5 months’ salary for each year of contribution before 2014, and 2-months’ salary for each year of contribution after 2014.

Conclusion

With projections suggesting continuous economic development in the years ahead, Vietnam’s potential for growth is significant. To benefit from this potential, it is crucial to have in-depth understanding of Vietnam’s labor laws, tax regulations, and social security requirements. Additionally, staying informed about any regulatory changes is essential, as the legal landscape is evolving in the nation to simplify the bureaucracy matters. Subscribing to updates from relevant government bodies or consulting with legal experts will always help.

Moreover, to make the payroll complexities a less troublesome, companies may invest in reliable payroll software to automate calculations for taxes, contributions, and other deductions. To prevent compliance risks, and manage the payroll with ease, hire payroll professionals and train HR staff to keep them informed about regulations and best practices. Maintain a robust payroll system will not only minimise the risks of non-compliance, but also ensuring overall satisfaction of the workforce, leading to more productive management of the company.