Table of Contents

Form 16 is provided by the employer to the employee; it contains the details of the amount of tax deducted at source (TDS) from an employee’s salary.Employees usually need it when depositing their ITRs with the IT department Under Section 203 of the IT Act, employers must provide this information to taxpayers’ employees at the end of every financial year.

The document gives all the details of the basic pay, tax deducted, and the submission date to the IT department. You should know that if you switch jobs and tax has been deducted at all the places, you should get a different Form for each of them.

Various elements that you will find in Form 16 are:

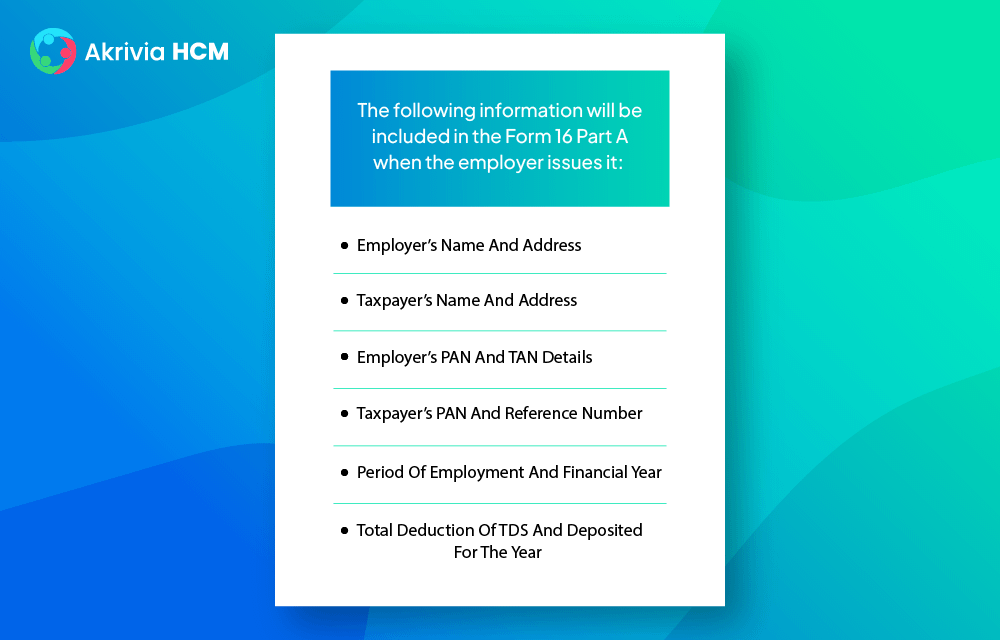

The employer will include the following information in the Part A

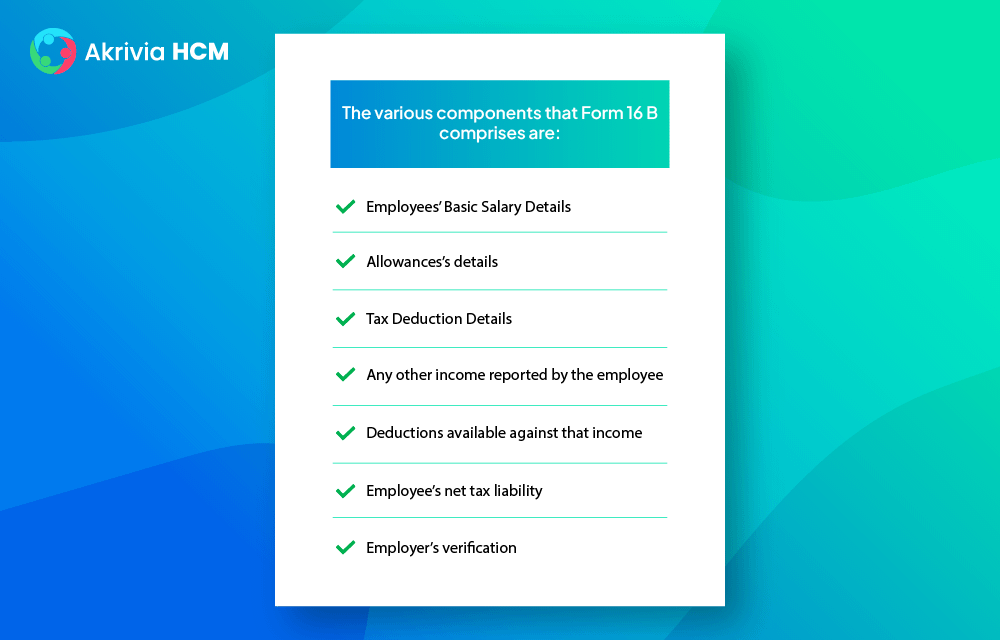

This form consists of the detailed bifurcation of the tax amount as per the investment declarations made by you at the start of the financial year and the proof of the documents submitted while filing the ITR. The various components that part B comprises are:

Form 16A is the TDS certificate issued in place of income other than salary, constituting accruals from returns against fixed deposit investment, mutual funds, gold bonds, and other forms of capital gain. Form 16B, on the other hand, certifies tax that has been deducted from income accruing from the sale of immovable property (building or a part of it and land).

The Ministry of Finance’s guidelines stipulates that any salaried individual whose tax is deducted by the employer is eligible to get it. Issuing it is not mandatory for a company if an employee does not fall in the taxable category. But, various companies issue the form even to employees who don’t fall into the taxable bracket as it is a convenient way of providing consolidated information concerning employees’ total earnings.

The whole business of managing the HR function is quite complex for both employers and employees alike. There are so many details to take care of, especially taxation, that it becomes critical to take care of these things with extreme meticulousness. That is where Akrivia HCM steps in by making the entire employee service experience concerning payroll management flawless.

The digital revolution has changed every sector worldwide, which is equally valid for the HR function as well. This becomes even more important in today’s time when remote and hybrid working are on the buzz. Akrivia HCM offers the best payroll software in India that helps empower and enable one’s workforce in the best possible manner.

Let’s Recruit, Reward, and Retain

Your Workforce Together!