Introduction

Payroll management is an essential role for any organization, and it involves the timely and accurate processing of employee salaries, benefits, and deductions. The GCC region is a diverse and dynamic market with varying labour laws, making payroll management even more complex. Fortunately, numerous payroll software in the UAE are available on the market to help streamline the process and ensure compliance with regulations.

This blog discusses GCC payroll management’s various features and benefits, including automated payroll, customizable structure creation, and many more. We will also explore Akrivia HCM’s payroll management solution and the importance of GCC labour laws while managing payroll in the region.

Employee Benefits in GCC

Employee benefits are a crucial part of GCC payroll management. Various organizations provide these benefits to their employees in addition to their regular salaries as compensation for their work. The employee benefits include healthcare, payroll, End of Service Benefits (ESB) plans and paid time off.

In the GCC region, employee benefits offered by different organizations are regulated by local laws. For example, in the United Arab Emirates (UAE), the HR team must provide employees with basic medical care and emergency services.

Similarly, in Saudi Arabia, employers must contribute to their employees’ End of Service Benefits (ESB) plans with a minimum contribution of 18% of the employee’s salary.

The GCC health insurance market size reached US$ 15.3 Billion in 2021.

Looking forward, the research article from Research and Markets expects the market to reach US$ 23.6 Billion by 2027. According to a report by NBusiness in 2023, the average employer contribution to End of Service Benefit plans(ESB) plans in the GCC region is around 5.83% – 8.33% of the employee’s salary.

GCC Employee Management

Effective employee management in GCC is considered an essential success factor for any organization and a crucial aspect of payroll management. Employee management involves several processes, including employee onboarding, performance management, and employee development.

In the GCC region, organizations must comply with local labour laws while managing their employees. For instance, in Bahrain, employers must provide employees with a minimum of 30 days of annual leave in addition to public holidays. Similarly, in Oman, employers must provide employees with a minimum of 15 sick days per year.

Recruiting and retaining talented employees in the GCC region can be challenging due to the competitive job market and cultural differences. However, organizations can improve their recruitment and retention strategies by offering competitive compensation packages and employee perks and providing career growth and development opportunities.

GCC Labour Laws and Employer Understanding

The GCC region comprises six countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. While there are some differences in labour laws between the countries, they aim to protect workers’ rights and ensure fair workplace treatment.

Labour laws play a significant role in payroll management in GCC. These laws govern the relationship between employers and employees, and they are designed to ensure that employees are treated fairly and their rights are protected. In the GCC region, labour laws are established by individual countries, varying from one country to another.

Some of the common employee provisions in the GCC region include:

1. Employment Contract:

Employers must provide written employment contracts that include terms and conditions of employment, such as job duties, working hours, compensation, and benefits.

2. Working Hours:

The maximum working hours per week in the GCC region range from 48-56 hours, depending on different countries.

3. Wages:

Employers are required to pay workers at least the minimum wage provided by their respective governments. Overtime pay is mandatory, and for any work done beyond the maximum hours, employees have the right to ask for it.

4. Leave Entitlements:

In all the GCC countries, employees are eligible to annual leave, sick leave, maternity leave, paternity leave, and public holidays.

Employer understanding of GCC labour laws is essential for compliance and avoiding legal consequences. Studies have shown room for improvement in this area, with many employers needing a complete understanding of their respective countries’ labour laws and regulations.

Several studies have shown that understanding GCC labour laws is essential for avoiding illegal consequences. With many employers needing a full understanding of employment laws, payroll contributions, salary calculations, compliance, and employee leaves, HR is responsible for making employees understand this when they join the company.

A report by the International Monetary Fund, 2013 GulfTalent in 2020 found that GCC employers prioritized compliance with labour laws and regulations in their organizations.

Employee Payroll Terms in GCC Organizations

There are some of the most common GCC HR payroll terms that every company follows. These rules and regulations of each country are specific to laws, regulations, and company policies.

1. Basic Salary:

The basic salary is the fixed amount of money an employee receives after work every month, biweekly, or weekly. This salary can vary depending on the type of job, the qualifications, and the employee’s experience.

2. Housing Allowance:

A housing allowance is an additional money an employee receives for housing.

In the GCC countries, 20–40% of an employee’s basic salary is given for housing allowance.

3. Transportation Allowance:

The allowance can range from 5–10% of the employee’s basic salary.

This is an additional amount of money that an employee receives to cover the cost of transportation.

4. Bonus:

It is an additional amount of money that an employee receives as a reward for their performance or as a special payment.

5. Deductions:

A deduction is an amount of money that is subtracted from an employee’s salary for various reasons, such as taxes, social security, and health insurance.

6. Working Days:

Working days in the GCC depend on the number of days required to work per week or month.

In the GCC countries, working days vary from 5 to 6 days per week, depending on specific laws.

7. Overtime Pay:

An employee’s pay for working beyond their regular working hours is overtime pay.

In the GCC countries, overtime pay can range from 125% to 150% of the employee’s standard hourly rate.

8. Public Holiday Pay:

Public holiday pay is the amount of money an employee receives for working on a public holiday.

In the GCC countries, public holiday pay can range from 150% to 200% of the employee’s regular hourly rate.

How Does Akrivia Hcm Help With Payroll Management in GCC?

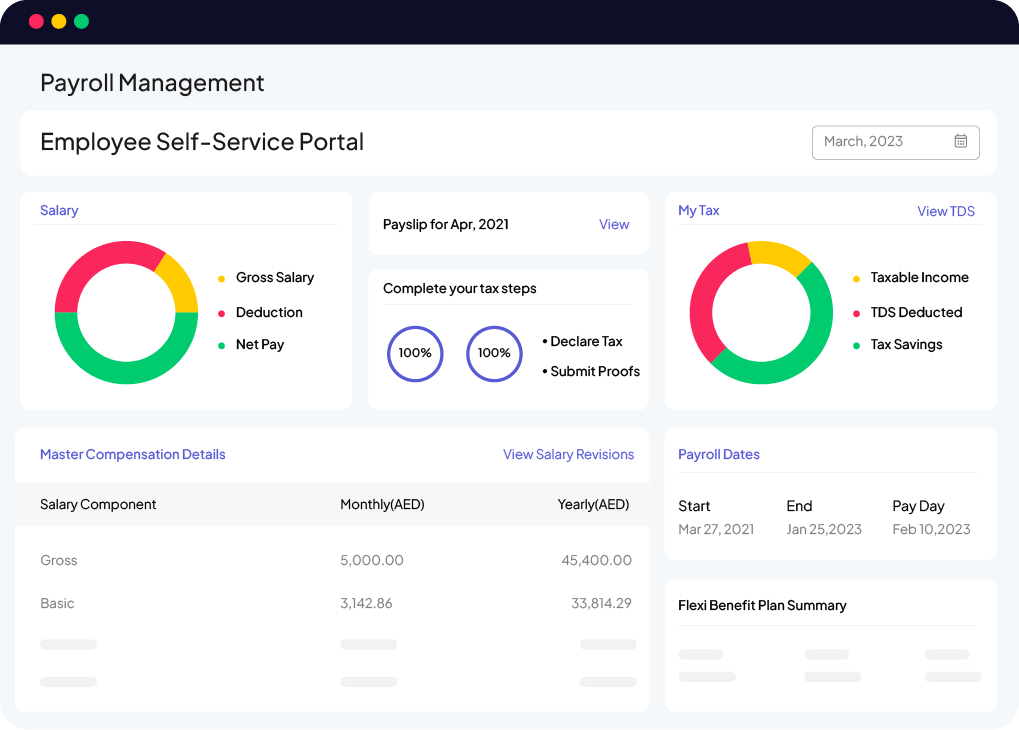

Akrivia HCM is a cloud-based HCM software in UAE that offers payroll management solutions for enterprises in the GCC region. Designed to comply with the HR regulations of the GCC region related to employee benefits, the hire-to-retire suite provides a wide range of features, including payroll processing, tax management, compliance reporting, and many more. The configurable structure creation and retrospective salary revision enhance the proper understanding of salary structure and its application in real-time scenarios. Akrivia HCM allows GCC organizations to manage their employee benefits, including insurance, ESB, annual leave, sick leave, etc., all in one place.

Are you tired of manual payroll management, cumbersome calculations, and repetitive tasks? It’s time to automate your payroll process with the Akrivia HCM payroll management suite. The automated arrear calculation enables the organization to reduce errors and offer accuracy with payroll management. With its advanced features and customizable structure creation, Akrivia HCM makes your payroll process efficient, accurate, and hassle-free.

Additionally, Akrivia HCM seamlessly integrates with other HR modules like Time and Attendance, Leave Management, Recruitment, Expense Management, and Off-boarding, ensuring a seamless HR experience. The suite also enables the automation of leave salary advances and provides a WPS report, SIF file generation, variance report, and accrual report for gratuities and leave.

Tax computation, expenses, and claims management are also essential features of the Akrivia HCM payroll management suite. With the rule-based restriction on claims, you can ensure that employee claims are verified and processed correctly.

Conclusion:

To maintain compliance and avert legal repercussions, firms must comprehend the labour laws and regulations in the GCC region. Organizations may automate compliance reporting and make sure they follow labour laws and regulations by using payroll management software like Akrivia HCM. Organizations can stay informed about the most recent changes to GCC labour laws and employer understanding through research articles and real-time data to ensure efficient and compliant processes. An all-inclusive solution that streamlines and automates payroll processes is the Akrivia HCM payroll management suite. Akrivia HCM guarantees that your payroll process is quick, accurate, and hassle-free because of its cutting-edge features, customized structure development, and easy connection with other HR modules.

So why wait? Switch to Akrivia HCM today and streamline your payroll process today!

2 comments

Thank you for this comprehensive guide on redefining payroll in the GCC region! Your insights on employee benefits and management are incredibly valuable for businesses navigating the complex landscape of human capital management. Keep up the excellent work!

Fantastic guide on redefining payroll in the GCC! Your detailed insights into employee benefits and management are incredibly valuable for businesses in the region.