Navigating taxes in India can be tricky for businesses and business owners, especially given the frequent changes and revisions that take place at the beginning of every financial year. In addition to the numerous compliances that come with running a business, employers also have to declare income tax on behalf of their employees. Known as ‘Tax Deducted at Source’ or TDS, this tax amount is a part of income tax that every salaried individual has to pay.

Besides this, companies also need to deposit the taxes timely to the government portal and issue Form 16 to employees so that they can file income tax returns on time.

As of AY 2023-24 nearly 8.18 crore ITRs were filed in India.

What is Section 192?

Section 192 of the Income Tax Act outlines that every employer who pays their employees under the category of ‘salaries,’ must deduct an estimated amount of income tax from the salary amounts.

Section 192 exhaustively lists details about TDS calculations and deductions. It specifies the tax rates under different slabs, exemptions, deductions, and the minimum taxable income. The provisions also address situations where an employee may have more than one employer or multiple sources of income.

Understanding Tax Regimes: The Old vs. New Regime

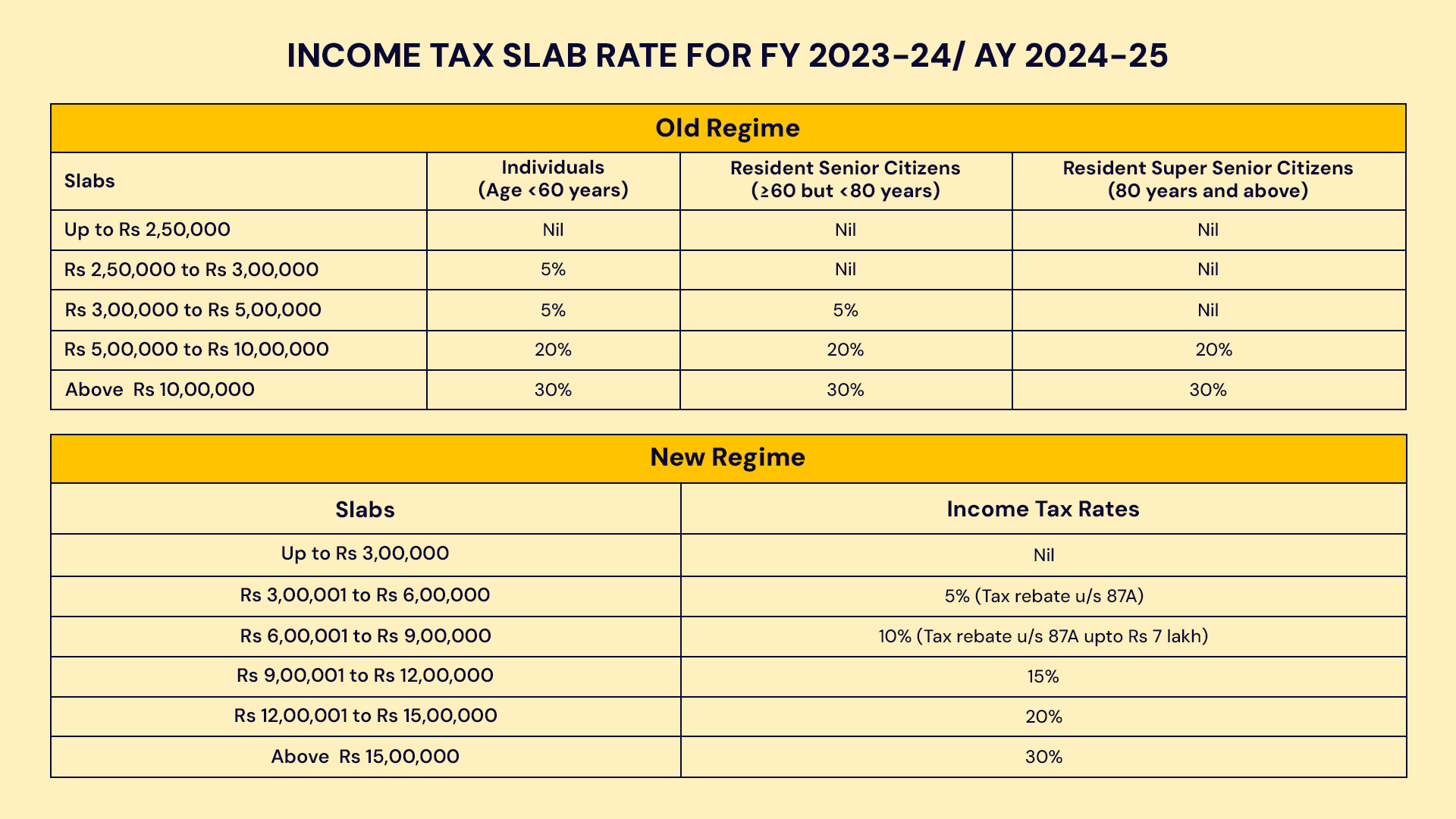

India follows a progressive tax system and presently has two frameworks. The New Tax Regime was introduced in 2020, after which the primary pre-exiting tax regime came to be known as the Old Tax Regime. While the New Tax Regime was made the default tax regime since FY 2023-24, taxpayers still have the choice to choose between either of the two for their tax calculations.

Understanding Exemptions and Deductions

Both regimes have their own set of parameters for exemptions and deductions. Under both regimes, there are several salary components that can help employees save on taxes. The Old Tax Regime has steeper tax slabs but with more exemptions and deductions based on different salary components like House Rent Allowance (HRA) and Leave Travel Allowance (LTA).

The New Regime on the other hand has more gradual increments in tax percentages but offers far fewer exemptions and deductions. Both regimes offer a standard deduction of INR 50,000 regardless of the salary amount.

Steps to Declare Income Tax on Behalf of Employees

It’s important for employers to educate themselves about tax-saving salary exemptions and deductions. It can help them create a salary breakup that helps employees minimize their tax liabilities.

Here’s how employers can declare income tax on behalf of their employees:

1. Collect Employee Information

At the beginning of the financial year, employers ask employees for their tax declarations. This contains information about their investments or any others tax-saving expenditure. Employees must also disclose of any other sources of income for proper calculation of taxes. This is also the point where the tax regime is selected by the employees.

2. Calculate Taxable Income

Once the employers receive the tax declaration and selected regime, they must calculate taxable income. Firstly, gross salary needs to be calculated based on salary components. Then standard deductions, allowances, and other applicable deductions like those under Section 80 (under the Old Regime) need to be factored in to arrive at taxable income.

3. Deducting TDS

After determining taxable income, employers need to calculate TDS based on the regime and the tax slab. Here’s how the TDS amount is determined:

4. Depositing TDS

Once the TDS amount has been calculated, employers need to deduct the monthly amount from an employee’s salary. This TDS amount then needs to be deposited every month within a specific date. For non-government deductors, TDS needs to be deposited by the 7th of next month, from April to February. For the month of March, the TDS has to be deposited by 30th April.

Depositing TDS Online

For depositing TDS online, employers need go to follow the following steps.

-

- Step 1: Visit the e-filing portal and click on e-Pay Tax under the Quick Links section.

- Step 2: Login with your TAN and assigned phone number through OTP verification.

- Step 3: Ensure your company name is correct and click ‘Continue’. This will take you to the e-Pay Tax page.

- Step 4: Select assessment year and click ‘Proceed.’ This will take you to the ‘New Payment’ tab.

- Step 5: Under this tab, select the nature of TDS being paid. You can select from the list of specified types mentioned under sections like 192, 193, 194 etc. Once done click ‘Continue.’

- Step 6: In the next page, select the relevant major head and enter the total amount of TDS deducted and other relevant tax break-up details. Then click on ‘Continue’.

- Step 7: You will be taken to the page where you can select your preferred payment method from net banking, debit card, NEFT, etc and click on ‘Continue.’

- Step 8: The next page contains all the information you entered for review, and you can click on ‘Pay now’ after ensuring all the details are accurate.

- Step 9: A dialog box with ‘Terms and Conditions’ will appear. Check ‘I agree’ and click on ‘Submit to Bank’.

- Step 10: You will be taken to your selected payment gateway. Enter the relevant payment mode details. For net banking, you’ll have to log in to your account for accessing the payment option. Once you’ve entered all the details and click ‘Confirm’ the payment will be verified and completed through an OTP. After entering the OTP, click on ‘Submit’.

After this, you’ll be redirected to the income tax portal where you can find your challan details.

Depositing TDS Offline

For depositing TDS offline, you need to follow the previous steps up to step 6. After that, the steps are as follows:

- Step 1: From the payment method selection page, select ‘Pay at bank counter’ from the payment options. Then you need to select your payment mode and authorised bank from the list. It is not necessary to have an account in the bank you select. Click ‘Continue.’

- Step 2: You will be taken to your challan preview. After verifying all the details, click ‘Continue’.

- Step 3: You will receive the ‘Download’ option for the challan, which you can print out and visit a branch of your selected authorised bank to complete the rest of the process.

5. Filing Quarterly TDS Returns

In addition to depositing TDS, employers also need to file quarterly TDS returns on behalf of their employees. Not filing quarterly returns within the due date can result in hefty fines, varying from INR 10,000 to 1,00,000. The quarterly return filing dates are as follows:

For TDS deduction payments made under ‘salary’ employers must fill Form 24Q for quarterly returns. For payments other than salary, returns must be filed under form 26Q.

To file quarterly TDS returns, employers must download the latest version of the TDS Return Preparation Utility java file from Protean and fill in the relevant details into the application accordingly. The website also includes a tutorial on how to fill out and submit details accurately.

6. Issuing Form 16

Employers are also required to issue form 16 to their employees for every financial year. It is generally issued before June 15th at the end of the financial year.

Form 16 hast two components, Part A and its annexture, Part B. Part A contains the TAN and PAN details of the relevant parties and the details of TDS deductions and quarterly returns. Part B on the other hand contains the detailed salary breakup, other allowances, and deductions. Employees cannot download form 16 directly but they can ask for a copy from their employer who can generate and download it directly from TRACES.

Declare Income Tax Easily with Payroll Management Software

Considering all the steps involved to declare income tax for every individual employee, it is easy to get overwhelmed with all these exhausting tasks. What’s more they need to be done monthly, quarterly and annually. A comprehensive payroll management software, like Akrivia HCM’s payroll product, can help you track these payments effortlessly. From ensuring tax compliance to issuing form 16, implementing this payroll management solution can greatly simplify your payroll process.

To know more about what Akrivia HCM can do for you, get a demo today!

What additional tips do you have to ensure timely and accurate TDS declarations? Let us know in the comments.

2 comments

This actually answered my problem, thank you!

Hi my friend! I want to say that this article is amazing, nice written and include almost all important infos. I would like to see more posts like this.