Table of Contents

The Employee Provident Fund (EPF) is a retirement plan that is subsidized by the Government of India and managed by the Employees Provident Fund Organization (EPFO).Upon retirement, the employee receives the entire contribution with interest. The interest rate is fixed by the Employee Provident Fund Organization every year.

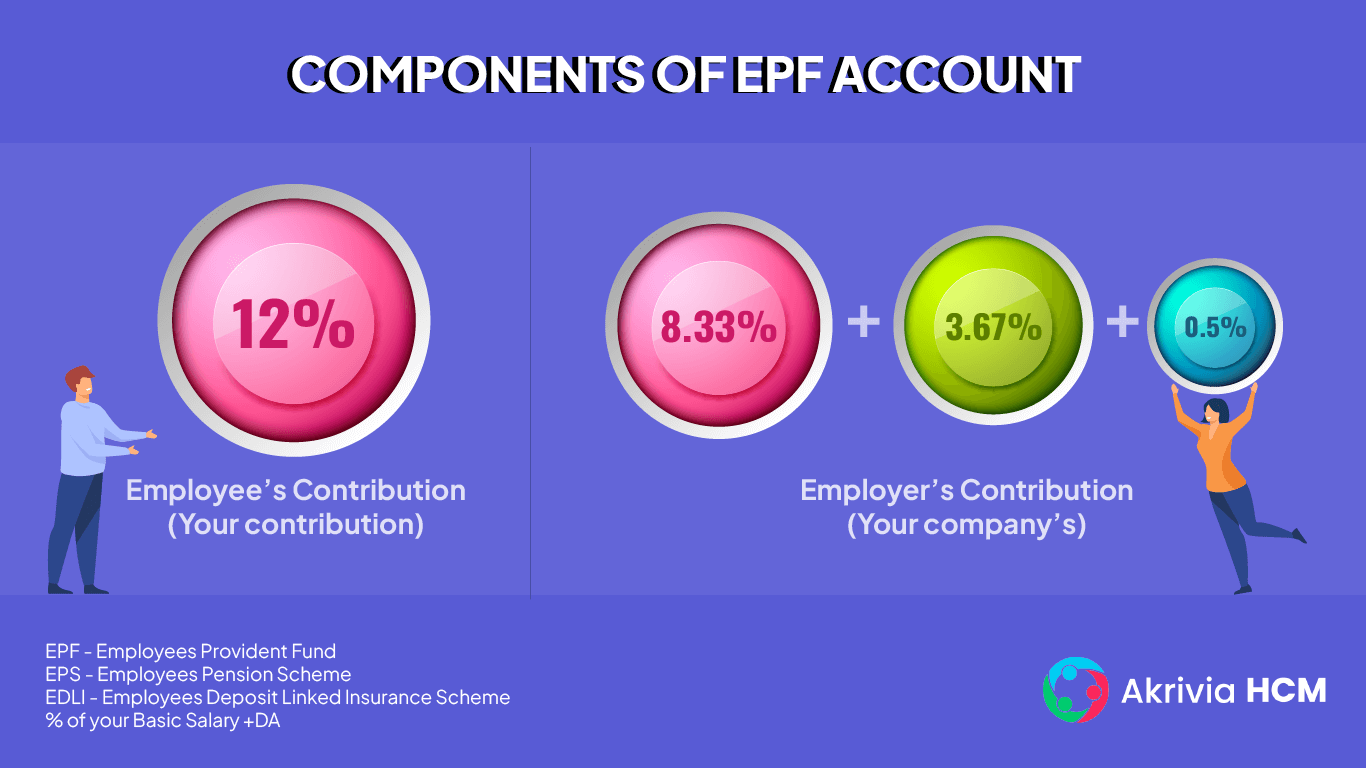

Both employee and employer contribute about 12% of the salary every month in equal proportions. 12% is calculated on a sum of Basic Salary and Dearness Allowance. Two numbers are allotted to employees for the Employee Provident Fund scheme, a Provident Fund Account Number and a Universal account number. The PF number identifies the employee particulars and the company details and scheme particulars. The Universal Account Number stays the same throughout an individual’s employment history, even if they change jobs. A 12-digit numberis given to the members of the EPFO through which the employee can manage their account is known as a Universal Account Number (UAN).

The employer’s contribution of 12% for FY 22 is distributed as follows:-

| Employers Contribution to | % Distributed |

| Employee’s Provident Fund | 3.67% |

| Employee Pension Scheme | 8.33% |

| Employees’ Deposit Linked Insurance Scheme | 0.5% |

| EPF Admin charges | 1.1% |

| EDLIS Admin Charges | 0.01% |

Employer’s contribution is reduced to 10% for establishments where there are less than 20 employees or if losses exceed the net worth of the company.

The EPF interest rate for the year 2022-23 is 8.1%, as fixed by the EPFO. The EPFO reviews and sets interest rates annually. The balance in the account is determined by adding together the employer’s and employee’s contributions at the end of the year.

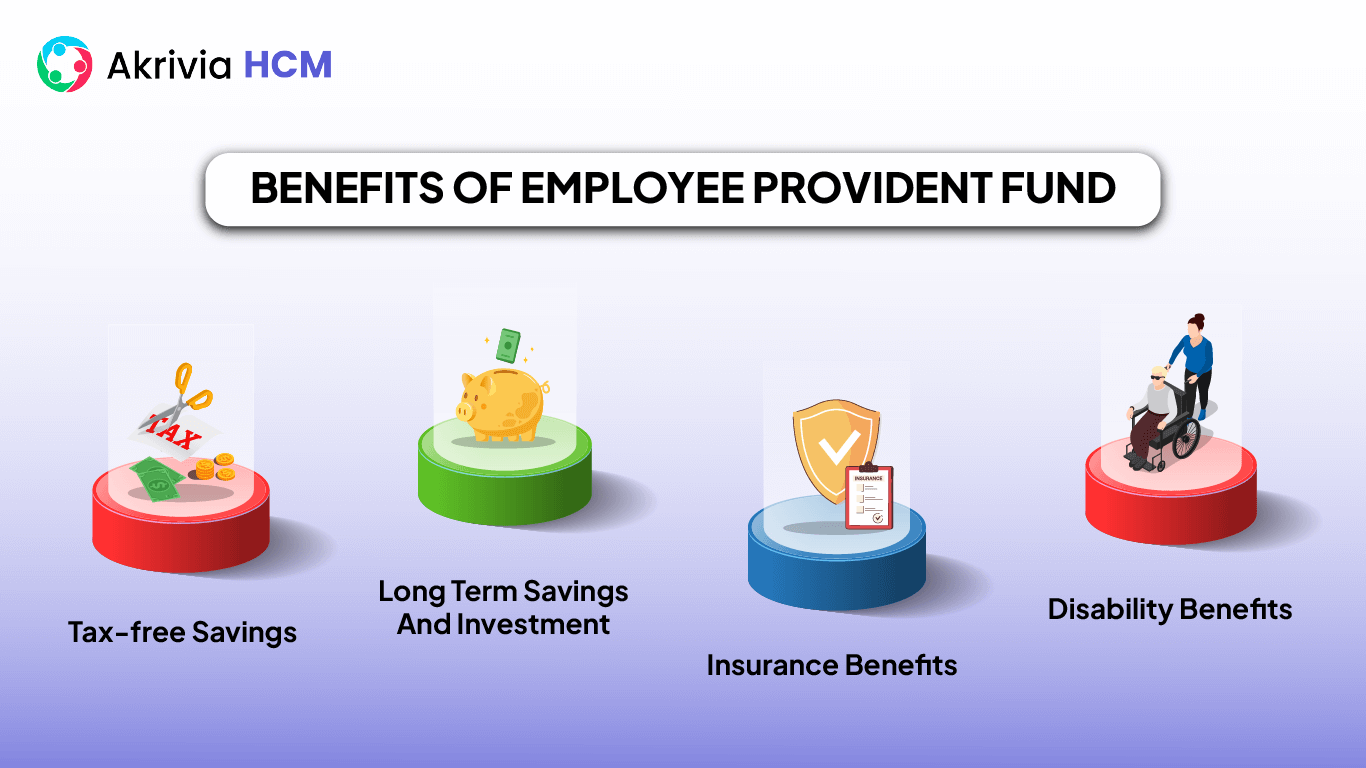

Special benefits

The Different forms used in EPF to communicate with the EPFO include the following:-

| EPF Form | Use of the EPF Form |

| Form 31 | EPF Withdrawal |

| Form 14 | Buying LIC Policy |

| Form 10D | For claiming a monthly pension |

| Form 10C | For claiming withdrawal benefits/scheme certificate of EPS |

| Form 11 | EPF Account Transfer |

| Form 19 | Final Employees’ Provident Fund Settlement |

| Form 20 | EPF Final settlement in case of death of the employee |

| Form 2 | Declaration and nomination form for EPF & EPS |

| Form 5 IF | Claim as per EDLI scheme |

| Form 15G | To save TDS on the interest income on EPF |

| Form 5 | New employees registering for EPF and EPS |

| Form 11 | Auto transfer of EPF |

The important forms are Form 31 for EPF withdrawal, Form 10 D for claiming a monthly pension, and Form 10C, which is used to claim withdrawal benefits and access scheme certificates of the Employee Pension Scheme. Form 19 is for getting the final Employees Fund settlement after retirement.

The three types of schemes under EPFO include:

The employers’ contribution is routed to all these three schemes.

If we assume employees’ salary (Basic salary + dearness allowance) is Rs 20,000.

Employees contribution is 12% = 12% X Rs 20,000 = Rs 2,400

Employer’s contribution to EPF is 3.67% = Rs 20,000X 3.67%= Rs 734

Employer’s contribution to EPS is 8.33% = Rs 1666

Total employer’s contribution is Rs 2,400

The interest rate for FY 2022-23 = 8.1%

Monthly interest for FY 2022-23 = 8.1%/12= 0.675%

The total EPF contribution of employer and employee is Rs 3134

Interest calculated on a monthly basis would be Rs 3134* 8.1% /12 = Rs 21.15

The EPF scheme offers employees the opportunity to save money, but it can be a complicated and time-consuming task for employers to calculate and track each employee’s PF contributions. If you are tired of calculating and tracking your employees’ retirement funds manually, Akrivia HCM Payroll Software can be your helping hand. It automates monthly PF calculation in just one click with an easy-to-use interface, time-saving automation, real-time reporting, and innumerable features.

Let’s Recruit, Reward, and Retain

Your Workforce Together!