In a competitive economy where talented individuals have ample opportunities and attrition of employees is widespread, employers must find ways to retain their quality talents. One such way is by offering loyal employees rewards for their service in it.

Gratuity covered under the Payment of Gratuity Act, 1972 is a monetary benefit or surplus amount of money from an employer to certain employees upon completion of a period of service. But, unlike a loyalty bonus, a gratuity amount is usually paid out when an employee’s service tenure is over under specific circumstances. All registered organizations must pay the same part of employee compensation.

According to the Payment of Gratuity Act 1972, public and private sector companies with more than ten employees are eligible for gratuity payout.

To receive it, an employee should be:

Employees who have not completed five years of service but had a disability due to an accident or illness are also eligible for gratuity payment. The amount is payable to their nominee if an employee dies during service.

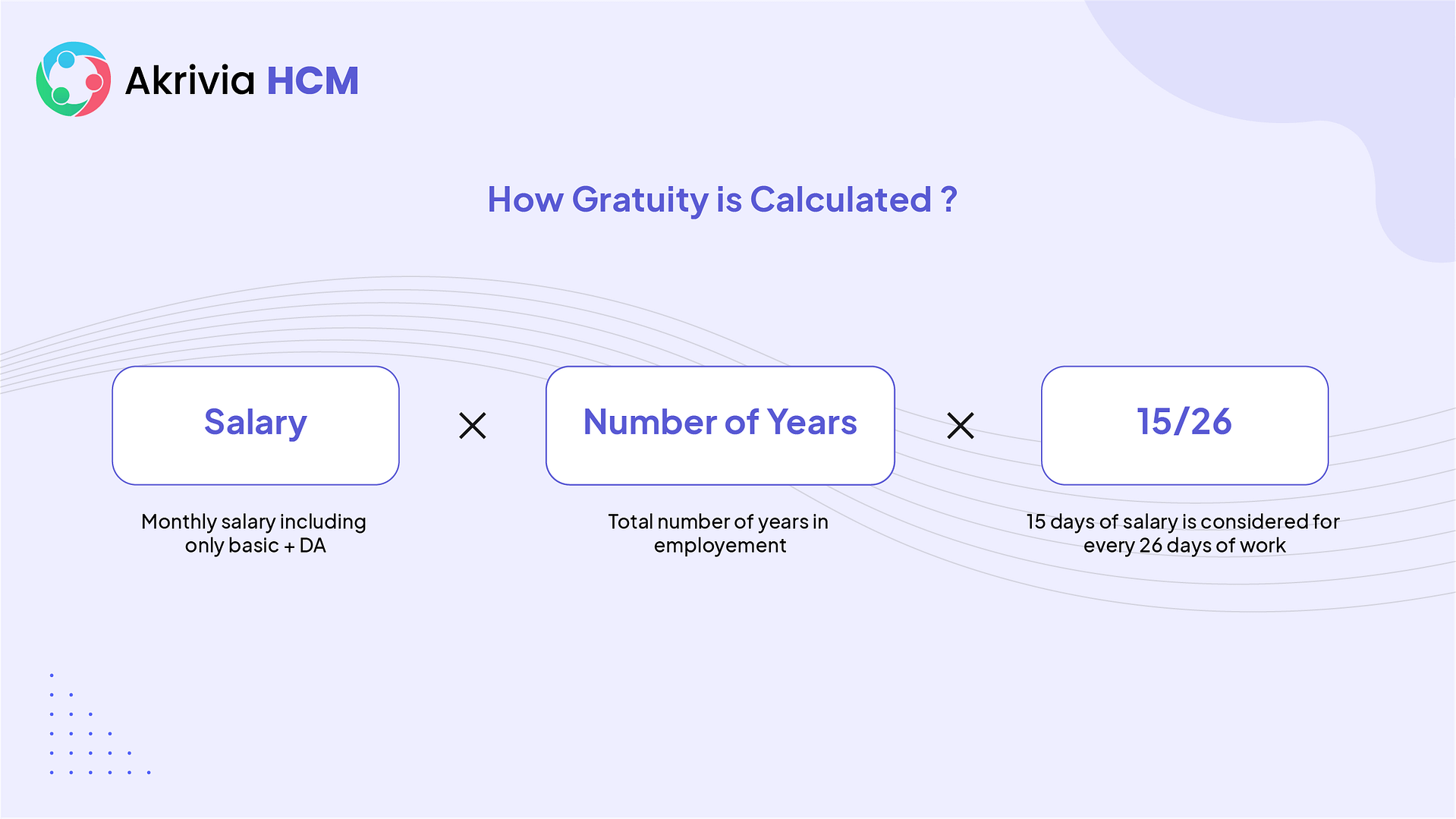

The gratuity amount payable depends on an employee’s last gross salary and the years of service completed. At the time of payout, an eligible employee can receive the monetary benefit equivalent to 15 days’ salary for every year of service completed.

Gratuity Formula:

This Gratuity formula varies slightly for employees working in organizations with less than ten employees that do not come under the Act. The new 30 working days will replace the old standard of 26 working days, and the formula becomes

Let’s assume an example to understand how it is calculated. Assume the last drawn gross salary of Rs. 1,00,000 (basic + dearness allowance) for an employee leaving the current organization before retirement. The employee has completed a continued service tenure of 12 years and is eligible for it.

Any company covered under the Act can calculate its amount for the employee as:

Gratuity amount = (15 x 100000 x 12)/ 26 = Rs. 6,92,307

The calculation and value will change if the organization is not covered under the Act.

New gratuity amount = (15 x 100000 x 12)/ 30 = Rs. 6,00,000

Over the years, as an employee’s salary undergoes appreciation and the last drawn salary amount increases, the amount also naturally increases.

Some employers can also pay out an additional monetary benefit with the eligible gratuity amount as an incentive for good performers. But such practice is not mandated by the law and can be up to the employer’s discretion.

It is paid to any government employee is free from taxes under the Payment of Gratuity Act, 1972. For private-sector employees, however, the tax-exempt amount can be the lower of the following three:

The difference amount will be taxable if the actual gratuity received is higher than the amount eligible.

By law, it paid by a company to an individual employee can’t exceed Rs. 20 lakhs. Any amount over Rs. 20 lacks is considered ex gratia and is not tax-exempt.

Note – Employees must apply for their gratuity payment when leaving the organization, which the employer should process within 30 days. If there is any delay on the employer’s part, simple interest is also payable for the delay duration and the amount.

It is nearly impossible for organizations with an employee base running up in thousands and several of them staying with the organization for more than five years to keep track of every individual’s gratuity. Fortunately, several payroll software in India can be used to maintain updated records for all employees.

Employee salary details, tenure, and any incentive to be included with the gratuity can be maintained in a centralized database. Organizations can accurately calculate its value during employee exit and full-and-final settlement. Using cloud-based payroll software automatically shares the application form with the employee, making the entire process seamless.

Besides, HR can use a gratuity calculator to easily calculate the amount paid out at retirement or completion of service. In a gratuity calculator, the HR team only needs to enter details about the last drawn salary and tenure of service to derive the actual amount.

With the help of such automated tools, the payout can be simplified and naturally integrated into employee compensation as well as enhance the accuracy of the payroll calculations.

Let’s Recruit, Reward, and Retain

your workforce together!