Country Overview

With its stunning archipelago of over 7,000 islands, The Philippines is more than just a tropical paradise. The country boasts a dynamic economy, driven by a growing middle class, robust remittances, and a vibrant labor market. As one of the largest archipelagos in the world, the Philippines is located in Southeast Asia, sharing maritime borders with several countries such as China, Japan, Indonesia, Malaysia, Vietnam, Taiwan, and Palau. It ranks as the 14th most populous nation globally and has shown significant economic resilience. In 2023, the country’s GDP grew by 5.6% despite an elevated inflation rate and external challenges, and it further accelerated to 6.3% in the 2nd quarter of 2024. The government’s statistics agency’s report mentions that in 2023, the Philippines has decreased its poverty rate to 15.5%, down from 18.1% in 2021.

The country is also building up on the Philippine Development Plan (PDP) 2023-2028 as a part of the long-term vision of AmBisyon Natin 2040. This plan aims to pull down poverty to 9% by the end of his six-year term by 2028. It projects to uphold the Philippines as a prosperous country with an inclusive and resilient society.

The Philippine Government is also actively implementing its 8-point socioeconomic agenda:

- Protect purchasing power and reduce socioeconomic harm.

- Lower vulnerability and lessen the impact of the COVID-19 pandemic.

- Maintain strong economic stability.

- Generate more jobs.

- Generate quality jobs.

- Generate eco-friendly jobs.

- Maintain public safety and security.

- Ensure fair competition.

Looking ahead, the Philippines focuses on transitioning from a lower middle-income to an upper middle-income country while enhancing human capital and infrastructure. The private sector is preparing for a 6.2% median salary increase in 2024, up from 6% last year. This rise is driven by the need for skilled workers, competition for top talent, and ongoing inflation.

The Bureau of Internal Revenue (BIR) has introduced new measures under the Ease of Paying Taxes Act (‘the Act’), including the removal of the Annual Registration Fee (ARF) for business taxpayers. This change not only simplifies tax obligations for employers but also indirectly benefits employees by creating a more efficient and less burdensome tax environment. Some of the important measures under the Act are:

- Classification of taxpayers into micro, small, medium, and large categories and special concessions for micro and small taxpayers.

- Electronic or manual filing of returns and payment of taxes to BIR, or through any authorized agent bank or authorized tax software provider.

- Withholding of taxes to apply when income becomes payable.

As a result of these and various other provisions of the Act, businesses can focus more on growth and employee development, fostering a more productive and motivated workforce.

All these measures position the Philippines as a promising investment destination with a bright future on the global stage.

Market Glimpse

The Philippines has a mixed economy and is located as a key trade route connecting East Asia to the rest of the world. Key sectors such as business process outsourcing (BPO), manufacturing, electronics, and tourism play a crucial role in the economy. The country can be classified by steady GDP growth, stable inflation, and far-sighted fiscal policies. This stability is driven by strong domestic demand and a growing middle class with increasing purchasing power. Medium to large-sized businesses can benefit from this growing consumer base, expanding sales and market reach.

The Philippines offers a favorable business environment due to its high English proficiency and cultural affinity with Western countries, which facilitate smooth communication and effective negotiations. This cultural synergy fosters trust and long-term partnerships. Additionally, the country’s technological advancements, particularly in the BPO sector, provide businesses with access to a skilled IT workforce and innovative digital services. These factors, combined with a growing startup ecosystem, enhance operational efficiency and position businesses at the forefront of technological innovation, making the Philippines an attractive destination for international enterprises.

The advantages do not cease there. The Government’s commitment to fostering a business-friendly environment is evident through various support initiatives and incentives. The Fiscal Incentives Review Board (FIRB), an interagency government body, grants the following tax incentives to business enterprises who are registered with the investment promotion agencies (IPAs):

- Income tax holidays ranging from 4 to 7 years.

- 10 years of special corporate income tax rate for export enterprises.

- Exemption from customs duties on imported goods.

- VAT exemption on imports and zero-rated VAT on local purchases.

Along with all the upsides, there are a few pointers that need to be taken care of before setting up a new business.

| Potential Problems | Measures to Protect Business |

| Time-consuming bureaucratic processes | Hire legal experts to navigate through bureaucratic processes efficiently. |

| Inconsistency in enforcement of laws and complex tax systems | Proactively comply with regulations by engaging with industry associations and professional accountants to optimize tax planning, leverage available incentives and maintain overall compliance. |

| High cost of energy | Explore renewable energy sources and consider energy-efficient equipment. |

| Challenges of natural disasters | Develop a robust business continuity plan and invest in disaster-resistant infrastructure and insurance. |

Shifting from the broader economic landscape, let us delve into the intricacies of payroll management, a critical component for any thriving business. This guide provides the essential aspects of payroll, ensuring compliance and efficiency in business operations.

Payroll Compliance Essentials

Understanding the intricacies of payroll in the Philippines is crucial for businesses operating in this ethnically diverse Southeast Asian country. Any size of business, local enterprise, or multinational company can ensure compliance with local laws, effective workforce management, and overall employee satisfaction by navigating the Philippine framework of regulations. The registration process of a business is straightforward in the Philippines. One can register any type of business through the Philippine Business Hub (PBH), which is a one-stop destination for registering businesses.

Next, a certificate of registration is required. All businesses need to register with the Bureau of Internal Revenue (BIR) to obtain the status of a business. BIR is an affiliated agency of the Department of Finance and overseas collecting taxes in the country.

As the company begins its business operations and hires employees, it must register itself and its employees with the Department of Labor and Employment (DOLE), Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (HDMF/Pag-IBIG). Adhering to employment, social security, and withholding tax regulations will ensure statutory compliance and accurate payment of employee compensation. Additionally, all statutory deductions must be accurately withheld and remitted to the relevant authorities to avoid any non-compliance issues.

In the course of this guide, the statutory details right from onboarding to offboarding of an employee will be discussed in depth, and the links to relevant official regulation is embedded below:

| Category | Regulation No./Name |

| Income Tax Laws | Tax Code |

| Social Security Laws and Workers’ Investment and Savings Program (WISP) | Social Security Law |

| Pag-IBIG/ Home Development Mutual Fund (HDMF) | Home Development Mutual Fund law of 2009 |

| PhilHealth | Universal Health Care (UHC) Act |

| Employment Laws | Labor Code |

Onboarding Simplified

The employee onboarding process is governed by applicable labor code to ensure compliance with established standards. This process requires a well-defined employment contract that outlines all essential working conditions and payroll details, ensuring smooth payroll operations.

As per the Labor Code, the requirements for onboarding an employee are defined below:

1. Employee Classification

Philippine laws and jurisprudence specifically recognize the following types of employees:

| Types of Employees | Definition |

| Permanent/ Regular employees | Traditional full-time position where employee is a consistent part of labor force with a regular work schedule and benefits. |

| Casual or temporary employees | Workers hired for a limited duration or on a non-regular basis, either to address short-term staffing needs or to fill in for absent permanent employees. |

| Probationary employees | New hires undergoing a probationary period, where the employer assesses their performance before offering permanent employment status. |

| Part-time employees | Have fewer and more flexible working hours compared to permanent employees. May or may not receive the same benefits as full-time workers. |

| Commission-based employees | Employers who receive compensation primarily based on their performance or when they help in sales or revenue generation. |

| Contractual employees | Worker hired for a specific duration or project to work within an employment contract. |

| Apprentices/ Student Trainees/ Interns/ OJT | Students or recent graduates who join the workforce for practical training or hands-on experience for a limited duration, as part of an academic requirement or skill development program. |

| Consultant | Experts and professionals with specialized skills working in companies on a contractual basis. |

It is crucial to classify employees based on the nature of their work. The company must specify the employee type in the offer letter and ensure compliance with the applicable regulations.

Further, in employment contract the Job level of employee is also defined which indicates the hierarchy of position of employee within an organization, define roles and responsibilities, and reporting structures.

Here is a simplified breakdown of common job levels in the Philippines:

| Job levels | Definition | Characteristics | Examples |

| Rank and File | Employees handling day-to-day operations. | 1) No supervisory or managerial duties. 2) Crucial for business functions. |

Clerks, technicians, sales staff, service personnel. |

| Supervisory | Supervisors managing rank-and-file employees. | 1) Guide and ensure tasks are completed efficiently. 2) Handle performance evaluations, training, and conflict resolution. |

Team leaders, shift supervisors, department heads. |

| Managerial | Managers planning and coordinating department activities. | 1) Oversee supervisors and rank-and-file employees. 2) Set goals and strategies for their departments. |

Operations managers, human resources managers, marketing managers. |

| Executive | Top-level leaders making strategic decisions for the company. | 1) Set policies and direction for the organization. 2) Involved in high-level planning and represent the company externally. |

EO, COO, CFO, and other C-suite positions. |

2. Employment Contract

An offer letter is a legal agreement between a new hire and their employer. It must include the correct information to comply with Philippine DOLE laws.

The following mandatory information should be included in a valid employment contract or offer letter to ensure compliance with the country’s labor regulations:

- Job title and responsibilities.

- Salary amount, payment frequency, and any allowances or benefits.

- Work hours, days, and shift details.

- Proposed start date.

- Employment type (regular, contractual, or temporary)

- Length and terms of probationary period, if applicable.

- Benefits such as health insurance, 13th-month pay, leave entitlements etc.

- Work location.

- To whom will the employee report?

- Any special employment conditions, like non-compete clauses.

- Statutory deductions information on SSS, PhilHealth, and Pag-IBIG contributions.

- Terms for resignation or termination.

- A space for the employee to sign and accept the offer.

3. Minimum Wages

Employers must ensure that wages in employment contracts meet or exceed the minimum wage set by regional regulations. In Philippines, minimum wage rates vary by region, reflecting local economic conditions, living costs, and poverty levels. Unlike many other countries, the Philippines does not have a national minimum wage. Instead, the Regional Tripartite Wages and Productivity Boards (RTWPBs) review and adjust wages based on factors such as inflation and the cost of living, making changes as needed rather than on a fixed schedule.

Please refer to the table below for the minimum wages in key regions:

| Region | Region Name | Daily Minimum Wage (in PHP) | Effective from When |

| National Capital Region | Metro Manila | 645 | 17-Jul-24 |

| REGION III | Central Luzon | 500 | 16-Oct-23 |

| REGION IV-A | Calabarzon | 560 | 30-Sep-24 |

| Component Cities | 520 | 30-Sep-24 | |

| 540 | 1-Apr-25 | ||

| 1st Class Municipalities | 520 | 30-Sep-24 | |

| 2nd and 3rd Class Municipalities (Previously Emerging Growth Area) | 450 | 30-Sep-24 | |

| 4th, 5th, and 6th Class Municipalities (Previously Resource-Based Area) | 420 | 30-Sep-24 | |

| 450 | 1-Apr-25 | ||

| REGION VII | Central Visayas-CLASS A (cities of Carcar, Cebu, Danao, Lapulapu, Mandaue, Naga, Talisay & Municipalities of Compostela, Consolacion, Cordova, Liloan, Minglanilla, San Fernando or Expanded Metro Cebu) |

501 | 2-Oct-24 |

| Central Visayas-CLASS B (cities that are not covered Under Class A – Bais, Bayawan, Bogo, Canlaon, Dumaguete, Guihulngan, Tagbilaran, Tanjay, Toledo) | 463 | 2-Oct-24 | |

| Central Visayas-CLASS C (other municipalities not covered under Class A and Class B) | 453 | 2-Oct-24 | |

| REGION XI | Davao Region | 645 | 1-Sep-24 |

For more information on the minimum wages for other regions, please refer to this link.

4. Probation Period

The probationary period helps evaluate an employee’s performance and skills. According to Article 281 of the Labor Code, it cannot exceed 6 months unless extended by a formal apprenticeship agreement. After completing the probationary period, the employee automatically becomes a regular staff member, gaining benefits and job security.

Workplace Protocol

After hiring an employee, it is crucial to comply with legal working conditions. Employment law defines working hours, break times, rest day, overtime pay, and other legal eligibilities for the benefit and support of employees.

1. Working Hours

- In the Philippines, working hours and shifts are also regulated by the provisions of the Labor Code.

- The normal working hours for an employee should not exceed 8 hours per day and 48 hours a week.

- As part of working hours, there are three common shift schedules in the Philippines, referring to work arrangements where employees rotate through different time slots, such as day, evening, or night shifts.

| Types of Shift Schedules | Definition | Example |

| Normal Working Schedule | 6 working days schedule with one rest day | Monday to Saturday 8:00 AM – 5:00 PM (1-hour lunch break) |

| Compressed Work Week | 5 or less working day schedule, without exceeding 12 hours a day and 48 hours per week. | Working 10 hours a day for 4 days a week. |

| Shifting Schedule | Dayshift: Work from 8:00 AM to 5:00 PM with a 1-hour unpaid meal break. Nightshift: Work between 10:00 PM and 6:00 AM, with a meal break. Midshift: Work starting in the afternoon and ending late in the evening, typically 8 hours long |

8:00 AM – 5:00 PM (with 1 hour break) 10:00 PM – 6:00 AM (with 1 hour break) 2:00 PM – 10:00 PM (with 1 hour break) |

Please refer to the table below for information on the types of shift schedules in the Philippines:

Note: Shift schedules may be arranged based on the employer’s needs and operational requirements

2. Breaks

- Under Article 85 of the Labor Code, employers are obligated to provide employees with a minimum of 60 minutes off for their regular meals.

- In addition to these meal periods, rest periods or coffee breaks running from five to twenty minutes shall be considered as compensable working time.

3. Rest Day

- Employers are required to provide employees with a rest day of not less than 24 consecutive hours after every six consecutive normal workdays.

- If an employee is required or permitted to work on a rest day, they shall receive additional compensation of 30% of their regular wages as a premium pay. The calculation for same is as follows:

| Rest Day Premium pay | Rates |

| Work performed on Rest Day | Hourly Rate * 130% * No. of hours worked |

4. Overtime

According to Article 87 of the Labor Code, overtime pay refers to the additional compensation for work performed beyond eight (8) hours a day.

Overtime pay for different working and non-working days is as follows:

| Overtime pay | Rates |

| Working more than 8 hours on Ordinary Working Days | Hourly rate * 125% (overtime rate) * OT hours |

| Working more than 8 hours on Rest Days or Special non-working day | Hourly rate * 130% (special holiday / rest day premium rate) * 130% (Overtime rate) * OT hours |

| Working more than 8 hours when special holiday falls on the scheduled rest day | Hourly rate * 150% special holiday on rest day premium rate) * 130% (Overtime rate) * OT hours |

| Working in Excess of Eight (8) Hours on regular holiday | Hourly rate * 200% (Holiday Pay) * 130% (Overtime rate) * OT hours |

| Working in Excess of Eight (8) Hours when regular holiday falling on the scheduled rest day | Hourly rate * 260% (Holiday pay on rest day) * 130% (Overtime rate) * OT hours |

5. Night Shift Differential (NSD)

- This is an additional pay of 10% of an employee’s regular wage for each hour worked between 10 PM and 6 AM

For example, if an employee’s basic hourly wage is ₱100, they will receive an additional 10%, bringing the total to ₱110 for an hour. - Night shift differential pay can be adjusted or modified in favour of employees through the following means:

- Employment contracts.

- Company policies.

- Collective bargaining agreements (CBAs).

- Other employment agreements.

The night shift differential pay (NSD) for different working and non-working days is as follows:

Night Shift Differential pay Rates Ordinary Working Days Hourly rate × 110% (NSD premium rate) * No. of hours worked Working on Rest Day Night Shift and Special Holiday Night Shift Hourly rate × 130% × 110% (NSD premium rate) × No. of hours worked Working on Special Holiday and at the same time Rest Day Night Shift Hourly rate × 150% (Holiday pay premium rate) × 110% (NSD premium rate) × No. of hours worked Working on Regular Holiday Night Shift Hourly rate × 200% (Holiday pay premium rate) × 110% (NSD premium rate) × No. of hours worked Working on Regular Holiday and at the same time Rest Day Night Shift Hourly rate × 260% (Holiday pay premium rate) × 110% (NSD premium rate) × No. of hours worked Working on Double Holiday Night Shift Hourly rate × 330% (Holiday pay premium rate) × 110% (NSD premium rate) × No. of hours worked Working on Double Holiday and at the same time Rest Day Night Shift Hourly rate × 390% (Holiday pay premium rate) × 110% (NSD premium rate) × No. of hours worked

6. Leaves Entitlements

In Philippines, holiday entitlements are governed by the Labor Code. There are two main types of holidays in the Philippines. The details on which are as follows:

a. Legal / Regular Holidays

| Regular Holidays | |

| New Year’s Day | January 1 |

| Maundy Thursday | The date will be notified separately |

| Good Friday | The date will be notified separately |

| Araw ng Kitingan | April 9 |

| Eid’s Fitr (End of Ramadhan) | The date will be notified separately |

| Labor Day | May 1 |

| Independence Day | June 12 |

| Eid’s Adha (Feast of Sacrifice) | The date will be notified separately |

| National Heroes Day | Last Sunday of August |

| Bonifacio Day | November 30 |

| Christmas Day | December 25 |

| Rizal Day | December 30 |

Legal or Regular holidays are days that are typically celebrated nationwide. Listed below are the regular holidays that are mandatory for all employers to observe:

b. Special Non-Working Days / Special Holidays

This holiday often commemorates special events and local celebrations. As per the recent proclamation, listed below are the special non-working holidays:

| Special Non-Working Holidays | |

| Chinese New Year | Date is separately notified |

| Black Saturday | Date is separately notified |

| Ninoy Aquino Day | August 21 |

| All Saint’s Day | November 1 |

| Feast of the Immaculate Conception of Mary | December 8 |

| The day before Christmas | December 24 |

| The day after Christmas | December 26 |

| Last day of the year | December 31 |

Apart from these holidays, the employees are also entitled to several other paid statutory leaves as provided below:

| Leave Type | Minimum Entitlement |

| Service Incentive Leave (SIL)* | 5 days |

| Maternity Leave** | 105 days |

| Paternity Leave | 7 days |

| Parental Leave (Solo Parents) | 7 days |

| Special Leave (for Women) *** | 2 months |

| Bereavement Leave | 3-5 days (No legal minimum is mentioned) |

* Service Incentive Leave (SIL) is provided under Article 95 of the Labor Code, employees who have worked for at least one year in a company are entitled to this benefit. Many companies provide service incentive leave in the form of sick leave, vacation leave, or a combination of both.

** An additional 15 days of unpaid leave may be granted.

*** This applies to women undergoing surgery related to gynaecological disorders.

c. Holiday Payout

Understanding holiday pay is essential for both employers and employees, particularly for part-time and weekend workers.

The legal framework for holiday pay is outlined in Articles 94 to 96 of the Labor Code, which detail the entitlements for employees working on holidays.

For regular holidays, the employee is entitled to 100% of their wage rate, provided they need to be present or are on paid leave for the working day immediately preceding the holiday. However, if the employee is required to work on such holiday, then they are entitled to minimum 200% of their daily wages.

If there are two consecutive regular holidays, like Maundy Thursday and Good Friday, an employee may not be paid for both holidays if they are absent from work the day before the first holiday. However, if they work on the first holiday, they are entitled to holiday pay for the second holiday.

For special non-working days, the employee is entitled to 100% of their wage rate. However, if the employee works, then they are entitled to an additional 30% of their daily wage for the first eight hours.

To summarise the above payouts and other scenarios where the payout may differ during the holiday is summarized below:

| Holiday pay | Rates |

| Working on Special Holiday | Hourly rate × 130% × No. of hours worked |

| Working on Special Holiday which is also a Rest Day | Hourly rate × 150% × No. of hours worked |

| Working on Legal/Regular Holiday | Hourly rate × 200% × No. of hours worked |

| Working on Legal/Regular Holiday which is also a Rest Day | Hourly rate × 200% × 130% × No. of hours worked |

| Working on a Double Holiday | Hourly rate × 300% × No. of hours worked |

7. Event-based Compensation

The employer is obligated to offer a range of benefits and compensation to ensure the security of employees while they are at work. In the Philippines, the Employees’ Compensation Commission (ECC) under the Department of Labor and Employment (DOLE) manages the Employee Compensation Program (ECP), ensuring proper implementation and distribution of benefits. If employees are injured or become ill due to the work environment, they can receive the following benefits under this compensation program.

| Compensation for Accident | Compensation for Death |

| Sickness/disability benefits | Death compensation |

| Medical benefits | Funeral expenses |

| Carers’ allowance | |

| Rehabilitation services |

For details on the benefits to be paid out in the scenarios mentioned above, please refer to the regulation EMPLOYEES’ COMPENSATION PROGRAM (ECP).

8. Other Benefits

All employers are required to pay their rank-and-file employees a 13th month pay, equivalent to one-twelfth of their total basic salary earned within the year. This amount must be paid by December 24 of the tax year, and it is exempt from tax up to ₱90,000 per annum.

Salary Essentials

1. Salary components:

In the Philippines, the Department of Labor and Employment (DOLE) outlines the mandatory salary components.

Refer to the table below to understand the various salary components that make up the gross salary in Philippine payroll.

| Salary Component | Definition |

| Basic Pay | It is the standard pay an employee receives, determined by the nature or classification of their work according to their agreement, before any additional compensation or deductions. |

| 13th Month Pay | Refer to Other Benefits section above to know more. |

| Unused Leave Encashment. | Unused leave encashment occurs when employees receive payment for unused leave credits, typically upon resignation, retirement, or according to employer policy (e.g., Service Incentive Leave, Vacation Leave, etc.). |

| Holiday Pay | Additional compensation is provided for employees who work on regular holidays or special non-working days. |

| Fringe Benefits | Fringe benefits are goods, services, or other advantages provided or granted in cash or in kind by the employer. Examples of these benefits include:

These benefits are subject to fringe benefits tax (FBT). |

| De-minimis Components | De-minimis benefits are small perks or allowances given by employers to boost employee morale and productivity. These benefits are either not taxed or only partially taxed. Below are the components of de minimis benefits:

These amounts are exempt from taxation. However, any payment exceeding the specified limit will be subject to tax. |

2. Payslip components

Employment Law specifies the mandatory components of a payslip. The following components must be included in the payslip:

- Basic gross pay for the payroll period.

- Overtime.

- Vacation and sick leave encashment.

- 13th months’ pay (if included in that month)

- Bonuses, if any.

- Deductions.

Decoding Deductions

In the Philippines, employers are required to make several mandatory deductions in the following forms:

1. Withholding Taxes

The Philippines follows January to December as their tax year and requires employers to withhold income tax from employee salaries in accordance with BIR guidelines. The original guidelines for withholding taxes were outlined in National Internal Revenue Code of 1997 also known as Tax Code, which is amended by TRAIN ACT, that now govern the Income Taxes.

Please refer to the section below for information about the annual tax rates:

| Compensation Range (in PHP) | Prescribed Withholding Tax Rates |

| Up to 250,000 | 0% |

| Over 250,000 – up to 400,000 | 15% of the excess over ₱250,000 |

| Over 400,000 – up to 800,00 | ₱22,500+ 20% of the excess over ₱400,000 |

| Over 800,00 – up to 2,000,000 | ₱102,500 + 25% of the excess over ₱800,000 |

| Over 2,000,000 – up to 8,000,00 | ₱402,500 + 30% of the excess over ₱2,000,000 |

| Over 8,000,000 | ₱2,202,500 + 35% of the excess over ₱8,000,000 |

The tax withholding rates are determined based on the frequency of salary payments. For instance, if wages are paid daily, the corresponding daily withholding tax table should be applied. Similarly, the appropriate tax slabs must be followed for weekly, monthly, fortnightly, and semi-monthly payouts.

Below are the different types of payroll frequencies and their corresponding withholding tax tables:

Daily withholding tax table

| Compensation Range (in PHP) | Prescribed Withholding Tax Rates |

| ₱685 and below | 0 |

| ₱685 -₱1,095 | 0.00 +15% over ₱685 |

| ₱1,096 – ₱2,191 | ₱61.65 +20% over ₱1,096 |

| ₱2,192 – ₱5,478 | ₱280.85 +25% over ₱2,192 |

| ₱5,479 – ₱21,917 | ₱1,102.60 +30% over ₱5,479 |

| ₱21,918 and above | ₱6,034.30 +35% over ₱21,918 |

Weekly withholding tax table:

| Compensation Range (in PHP) | Prescribed Withholding Tax Rates |

| ₱4,808 and below | 0 |

| ₱4,808 – ₱7,691 | 0.00 +15% over ₱4,808 |

| ₱7,692 – ₱15,384 | ₱432.60 +20% over ₱7,692 |

| ₱15,385 – ₱38,461 | ₱1,971.20 +25% over ₱15,385 |

| ₱38,462 – ₱153,845 | ₱7,740.45 +30% over ₱38,462 |

| ₱153,846 and above | ₱42,355.65 +35% over ₱153,846 |

Fortnightly withholding tax table:

| Compensation Range (in PHP) | Prescribed Withholding Tax Rates |

| ₱9616 and below | 0 |

| ₱9,616 – ₱15,383.99 | 0.00 +15% over ₱9616 |

| ₱15,384 – ₱30,769 | ₱865.2 +20% over ₱33,333 |

| ₱30,770 – ₱76,923 | ₱3,942.4 +25% over ₱30,770 |

| ₱76,924 – ₱307,691 | 15,480.9 +30% over ₱76,924 |

| ₱307,692 and above | ₱84711.3+35% over 307,692 |

Semi-monthly withholding tax table:

| Compensation Range (in PHP) | Prescribed Withholding Tax Rate |

| ₱10,417 and below | 0 |

| ₱10,417 – ₱16,666 | 0.00 +15% over ₱10,417 |

| ₱16,667 – ₱33,332 | ₱937.50 +20% over ₱16,667 |

| ₱33,333 – ₱83,332 | ₱4,270.70 +25% over ₱33,333 |

| ₱83,333 – ₱333,332 | ₱16,770.70 +30% over ₱83,333 |

| ₱333,333 and above | ₱91,770.70 +35% over ₱333,333 |

Monthly withholding tax table:

| Compensation Range (in PHP) | Prescribed Withholding Tax Rate |

| ₱20,833 and below | 0 |

| ₱20,833 – ₱33,332 | 0.00 +15% over ₱20,833 |

| ₱33,333 – ₱66,666 | ₱1,875.00 +20% over ₱33,333 |

| ₱66,667 – ₱166,666 | ₱8,541.80 +25% over ₱66,667 |

| ₱166,667 – ₱666,666 | ₱33,541.80 +30% over ₱166,667 |

| ₱666,667 and above | ₱33,541.80 +30% over ₱166,667 |

For withholding tax calculation, the following steps need to be followed based on different payroll frequency:

- Calculate Gross Income: Sum all taxable regular and supplementary compensation (e.g., Basic Salary, Overtime, and taxable 13th Month Pay).

- Calculate Statutory Contributions: Sum all deductions (e.g., PhilHealth, SSS, HDMF, and WISP).

- Determine Net Taxable Income: Subtract statutory contributions from gross income.

- Apply Tax Rates: Use the appropriate tax table based on payroll frequency to determine the withholding tax.

These 4 steps are involved in the tax calculation where there is no annualization.

Tax Annualization:

Tax annualization is the process of determining the total tax owed by employees for the period from January to December. This process is also called as Year-end adjustment. According to regulations, annualization, or year-end adjustment, is performed in December of the calendar year.

Steps for Tax Annualization as per Statutory:

To perform the annualization calculation at the end of the year, please follow these steps:

- Determine the total taxable regular and supplementary compensation paid to the employee for the entire calendar year.

- If the employee had previous employment during the year, add the taxable regular and supplementary compensation paid by the current employer to the taxable compensation income received from previous employers for that calendar year.

- If the employer-employee relationship is terminated before December, the taxable compensation will be the amount paid from the beginning of the current calendar year up to the termination of employment.

- For year-end adjustments, the taxable compensation income will be the amount paid during the current tax year.

- Calculate the total tax due based on the total taxable compensation for the tax year. Adjust PERA tax credit if employee have invested under Personal Equity and Retirement Account (PERA)*.

- Ensure that the tax due matches the tax withheld from January to November. Withhold any difference from the employee’s salary in December or refund it by January 25 of the following year.

For reference purposes, BIR Income Tax Calculator can be used to determine the accurate withholding tax amounts for salaries, services, and other types of income.

* The Personal Equity and Retirement Account (PERA):

The PERA Act aims at encouraging individuals to save for retirement by offering tax incentives. Any Filipino aged 18 and older with a Tax Identification Number (TIN) can open a PERA account and contribute up to PHP 200,000 per year, or PHP 400,000 in case of Overseas Filipino Workers (OFWs).

As per Revenue Regulation number 07-2023 released by BIR, contributors can avail a 5% tax credit of the contributions made to PERA account to reduce their income tax liability.

After making contributions, employees shall request the PERA authorities to issue a Tax Credit Certificate (TCC) to claim the tax credit through their employer. The PERA tax credit is applied by the employer only at the end of the year by submitting the PERA Tax Credit Certificate (TCC) to the employer and applying for the credit based on the TCC amount.

Notes:

- If the tax owed is less than the PERA credit, the unused credit can be carried forward. This carry-forward is unlimited and is based on the Tax Credit Certificate (TCC).

- For mid-year new hires, the current employer applies the PERA credit at the year-end only.

- No PERA credit is granted during employee separation.

In addition to withholding tax, employers shall remit the fringe benefit tax to BIR if any fringe benefits are paid to the employees like Housing, Foreign travel will attract fringe benefits tax and not the withholding tax. The fringe benefit tax rates are as mentioned below:

| Category | Fringe Benefit Tax Rate |

| Filipinos, resident aliens, and non-resident aliens working in the Philippines | 35% |

| Non-resident aliens not engaged in trade/business | 25% |

| Aliens and Filipinos in executive/technical roles for foreign companies | 15% |

Reporting

| Tax Withholding Form No/Name | Purpose | Due Date for Submission | Frequency |

| BIR 1601 C | Monthly remittance returns of income taxes withheld on compensation | By 10th day (if offline) and by 15th day (if online) of the following month. | Monthly |

| BIR 2316 | Employee’s compensation and taxes withheld during the tax year | Issued to employees – By January 31 of the following year or at the time of termination. Submitted to BIR – By January 31of the following year. |

Annual |

| Annex F | Certification of the list of employees qualified for substituted filing of their income tax return | Submitted along with the BIR Form 2316 on or before January 31 of the following year. | Annual |

| BIR 1604 C | Return of annual income taxes withheld on compensation. | On or before January 31 of the following year. | Annual |

| Alpha list schedule 1 | Employee’s compensation income and tax withheld within a calendar year for non-minimum wage earners. | On or before January 31 of the following year as an attachment to BIR Form 1604C. | Annual |

| Alpha list schedule 2 | Employee’s compensation income and tax withheld within a calendar year for minimum wage earners. | On or before January 31 of the following year as an attachment to BIR Form 1604C. | Annual |

| BIR 1604 F | Annual information return of income payments subjected to final withholding taxes | On or before January 31 of the following year. | Annual |

Below are the details of different forms for employer tax withholding, including their purpose, submission dates, and frequency:

Non-Compliance

An employer’s obligation for payroll will be fulfilled only if the withholding tax deductions made are remitted and reported on time without any delay to BIR.

Failure to do so may result in penalties from the BIR. A surcharge of 25% to 50% of the tax or deficiency may be imposed for any wilful neglect to file the return within the period prescribed by the BIR or for failure to pay the full or part of the tax owed.

2. Social Security

Employers with at least one employee are required to contribute from the start of their operations and to deduct the employee’s share every month from their employment income. Employee’s membership becomes active on their first day of work.

According to the Social Security Law, the formula for calculating the SSS contribution is as follows:

To derive the Monthly Salary Credit, first we need to calculate the compensation base, i.e., actual remuneration paid for employment during the month including the mandated cost-of-living allowance, and the cash value of any other remuneration paid in non-cash forms.

Once the compensation based is determined, the same needs to be located in the Social Security table to determine the MSC. As per the said table, the minimum and maximum monthly salary credit limits are PHP 4,000 and PHP 20,000, respectively.

The contribution rates for employees and employers are as follows:

| Salary Range | Employer’s Contribution | Employee’s Contribution |

Total Contribution |

| ₱4000 to ₱20,000 | 9.5% | 4.5% | 14% |

Note:

As per the social security law, the term “monthly” refers to the period from the end of the last payroll period of the preceding month to the end of the last payroll period of the current month if compensation is calculated on an hourly, daily, or weekly basis. For other compensation bases, “monthly” shall mean a period of one (1) month

Reporting

Below are the details of the different forms that must be submitted to the SSS authorities:

| Social Security Form No/Name | Purpose | Due Date for Submission | Frequency |

| SSS-R3 | Remittance of employees’ monthly contributions. | Last day of the following month | Monthly* |

| SSS-R1 A | Update new hires and terminated employees’ details, or changes in employee status. | Within 30 days from actual employment date. | Onetime |

| SSS certificate | View the SSS contribution made by employee since the date of joining of employee. | Upon the employee request. | Annual |

*Quarterly for new employer till the registration process is completed.

3. WISP (Workers’ Investment and Savings Program)

- The Workers’ Investment and Savings Program (WISP) is a voluntary savings and investment initiative in the Philippines designed to help employees build their savings and invest for their future.

- It is a provident fund program under the SSS.

- The WISP contribution is calculated based on the Monthly Salary Credit, which is computed in the same manner as SSS contributions.

WISP has two types of contributions:

- Mandatory WISP: For SSS members whose monthly salary credit for SSS contributions exceeds ₱20,000.

- Voluntary WISP Plus: Available to all SSS members, either can be contributed as a percentage of their salary or a fixed amount every month.

The contributions for this scheme are outlined as follows:

| Contribution Category | Employee contributions | Employer contributions | Minimum MSC (in PHP) |

Maximum MSC (in PHP) |

| Mandatory WISP | 4.5% | 9.5% | 20,500 | 30,000 |

Reporting

Since this is a scheme for SSS members or employees, the contributions are reflected in the SSS-R3 form as mentioned in the reporting section of social security contributions, which is submitted monthly by the employer.

Non-Compliance

For any overdue payments in social security contributions, the following penalties will be imposed:

| Category | Interest | Penalties |

| Social Security System and WISP contribution | 1% per month until paid | 2% per month from the date the contribution falls due until paid. |

4. Pag-IBIG

- Pag-IBIG, or the Home Development Mutual Fund (HDMF), is a government-run savings program in the Philippines that provides essential savings and housing benefits to Filipino workers.

- The Pag-IBIG contribution is calculated based on the monthly compensation, which includes the basic salary and other allowances payable by an employer to an employee for work performed or to be performed, or for services rendered or to be rendered.

- The benefits of the HDMF include earning dividends on savings, access to housing loans for purchasing, building, or renovating homes, and short-term loans for emergency needs and other purposes.

The contribution rates for employees and employers are as follows:

| Salary Range | Employee contributions | Employer contributions | Employee Maximum contribution (in PHP) | Employer Maximum contribution (in PHP) |

| 1,500 and below | 1% | 2% | 15 | 30 |

| over 1,500 | 2% | 2% | 200* | 200* |

*Maximum monthly compensation to be used for contribution calculation is 10,000 PHP. Hence the maximum monthly contribution is 200 PHP.

Apart from the above mandatory contribution, the member employee can also make voluntary contribution without any limit, however the employer is only required to contribute only the mandatory contribution, unless they agree to match the employee’s higher contribution.

Reporting:

Below are the details of the different forms to be submitted to Pag-IBIG:

| Pag-IBIG Form No/Name | Purpose | Due Date for Submission | Frequency |

| Membership Remittance Form | To remit monthly contribution, salary loan and housing loan | End of each calendar month. | Monthly |

| Pag-IBIG download | Report and remit Pag-IBIG Fund employee contributions | Last day of the following month. | Monthly |

| HDMF certificate | To employees for showing HDMF contribution made since the date of joining | Upon the employee request. | Annual |

Non-Compliance

For any overdue payment of the Pag-IBIG contribution, the following penalties will be imposed:

| Category | Penalties |

| Pag-IBIG | Any portion of the amount due that remains unpaid after the due date shall be charged with a penalty of 1/20 of 1% for every day of delay. |

5. PhilHealth

- PhilHealth, a government-based health insurance program in the Philippines, provides essential financial support for medical expenses such as hospital stays, surgeries, and doctor visits.

- Contributions to this healthcare coverage are made by both employees and employers and are calculated based on the employee’s monthly basic salary (MBS).

- The MBS is the fixed basic rate of an employee and does not include sales commissions, overtime pay, allowances, 13th-month pay, bonuses, or other gratuities. It also excludes any deductions from the employee’s pay due to undertime, tardiness, leaves without pay, absences, or similar circumstances.

Notes:

PhilHealth contributions are typically made monthly; however, for other payroll frequencies, contributions shall be calculated for each pay period or any specified period within the month. The monthly contribution to PhilHealth is computed based on the employee’s basic pay.

The contribution rates for employees and employers are as follows:

| Salary Range | Employee contributions | Employer contributions | Monthly Contribution (in PHP) |

| ₱10,000.00 and below | 2.5% | 2.5% | ₱500.00* |

| ₱10,000.01 to ₱99,999.99 | 2.5% | 2.5% | ₱500.00 to ₱5,000.00 |

| ₱100,000.00 and above | 2.5% | 2.5% | ₱5,000.00** |

*Minimum monthly basic salary limit to be used for contribution calculation is 10,000 PHP.

** Maximum monthly basic salary limit to be used for contribution calculation is 100,000 PHP.

Reporting:

Below are the details of the different forms to be submitted to PhilHealth:

| PhilHealth Form No/Name | Purpose | Due Date for Submission | Frequency |

| ER 2 | PhilHealth report of the employee-members who have newly joined | Within 30 calendar days from the date of employee hiring | Monthly |

| EPRS or bank file | To remit the PhilHealth contribution made by employee since the date of joining of employee | 15th day of the following month. | Monthly |

| PhilHealth Certificate | To employees for showing PhilHealth contribution made since the date of joining. | On employee requests. | Annual |

Non-Compliance

For any overdue payment in the PhilHealth contribution the following penalties will be applied:

| Category | Interest | Penalties |

| PhilHealth | Principal amount x 2% or PHP200, whichever is higher, compounded monthly based on the number of months delayed | Not less than PHP 5,000 but not more than PHP 10,000 multiplied by the total number of employees of the firm |

6. Statutory Loans

In the Philippines, statutory loans play a crucial role in providing financial assistance to employees. Employers are responsible for ensuring accurate deductions of the due amount, including any interest or penalty for late remittance from the employee’s salary and remittance to the SSS and Pagi Big, if requested by the employees and the respective authorities.

| Type of Loan | Definition | |

| Statutory Loan Pag-IBig | HDMF Calamity Loan | Provides immediate financial aid to affected Pag-IBIG Fund members in calamity-stricken areas, as declared by the Office of the President or the Sangguniang Bayan. |

| Multi-Purpose Loan | Designed to help qualified Pag-IBIG Fund members with any immediate financial need. | |

| HDMF Short-Term Loan | Designed to help members with any immediate financial need. | |

| Statutory Loan SSS | SSS Salary Loan | Granted to an employed member or a currently paying self-employed or voluntary member to help them meet their short-term financial needs. |

| Calamity Loan | Offered to SSS members living in disaster-stricken areas. | |

| Housing Loan | Offers a direct housing loan facility for overseas Filipino workers for house repairs, improvements, or mortgages. | |

| Educational Loan | Aims to support SSS members beneficiaries in their educational costs. | |

Reporting:

Below are the details of the different forms to be submitted to Pag-IBIG and SSS loans:

| Loan Remittance Form No/Name | Purpose | Due Date for Submission | Frequency |

| Short-term loan remittance form | To remit Pag-IBIG loans | End of each calendar month | Monthly |

| Collection List | To remit SSS loans | End of each calendar month | Monthly |

7. Minimum Take Home Pay

The Labor Code does not specify about the minimum take-home pay amount; however, companies can establish their own policies regarding this matter for the benefit of their employees.

According to Labor Code, the following wage deductions are permitted under specific situation as mentioned below:

- Statutory Deductions- This includes withholding tax, contributions to the Social Security System, Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-IBIG Fund)

- Other deduction like insurance and union dues, statutory loan deductions etc. can only be done, if authorized by the written agreement between the employer and the employee. This agreement must be voluntary and should not compromise the employee’s right to receive their full wage.

- Employer shall not ask employees to make any deposits from which deductions related to damages caused by negligence or fault of the employee is made except where and as specified.

Seamless Offboarding

Maintaining compliance during the offboarding process is equally important, and employers should not overlook this aspect of employment. Typically, the termination of employment occurs when an employee retires, resigns, or is dismissed for serious reasons. Depending on the reason for termination, the employee will receive certain termination payouts, as outlined below:

1. Retirement

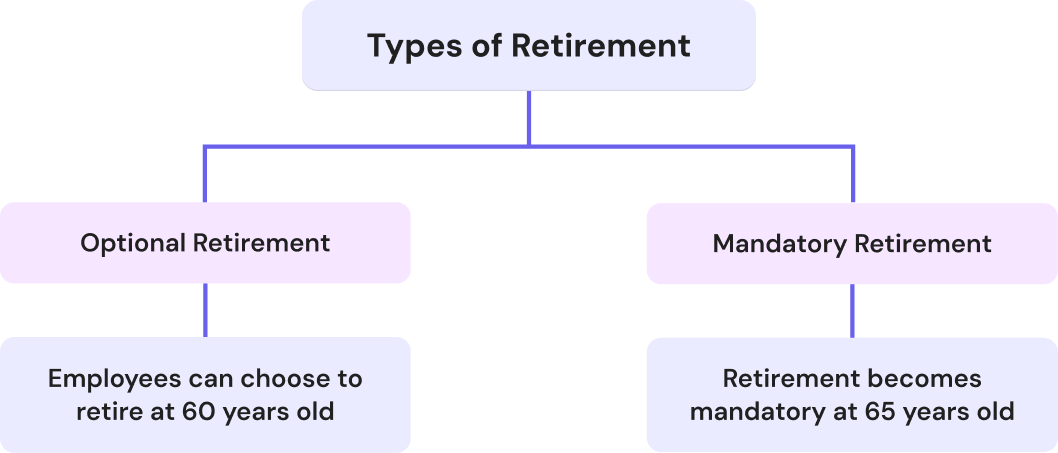

Philippines have 2 types of retirement:

According to the provisions of Labor Code, any employee may be retired upon reaching the retirement age established in the collective bargaining agreement or other applicable employment contract.

On retirement, the employee shall be entitled to receive such retirement benefits as per Labor code or collective bargaining agreement or other agreements. Provided that an employee’s retirement benefits under any collective bargaining and other agreements shall not be less than those provided in the Labor code.

To be eligible for retirement pay as per Labor code, an employee must has reached 60 years but not beyond 65 years and have served at least 5 years in the same establishment.

The minimum retirement pay shall be equivalent to one-half month salary for every year of service wherein any fraction of at least six months shall be considered as one whole year.

For computing retirement pay, “one-half month salary” shall include the following:

- 15 days’ salary based on the latest salary.

- Cash equivalent of not more than 5 days of service incentive leave.

- One-twelfth or 2.5 days of the 13th-month pay

Accordingly, one-half month salary shall be used as equal to 22.5 days salary, as per above inclusions. Hence, the formula for calculating the retirement pay is as follows:

In additional to above the employee is also entitled to the proportionate thirteenth-month pay for the calendar year and to the unused leave encashment.

Note:

Retirement pay is exempt from tax if the employee has served the same employer for at least 10 years and is at least 50 years old. Otherwise, it is taxable and included in gross income. Additionally, no deductions for SSS, HDMF, or PhilHealth are applied to retirement pay.

2. Resignation & Dismissal

In the Philippines, termination of employment can be initiated by employer or employee and must be based on valid and just causes as defined by the Labor Code of the Philippines. In addition to the below benefits certification of employment should be issued to employee by employer.

| Offboarding reason | Termination reason | Applicable benefits |

| Termination -By Employer due to just cause |

|

Only Final pay* |

| Termination (Dismissal)-By Employer due to authorized cause |

|

Final Pay* Separation Pay** |

| Resignation- Employee serving 30 days’ notice period |

|

Final Pay* |

| Resignation- Employee not serving 30 days’ notice period |

|

Final Pay* (Refer note below) |

Note: The employer cannot withhold an employee’s final pay just for not giving the 30-day notice. However, they can deduct any financial losses caused by the employee’s failure to provide notice from final pay.

* Final Pay means unpaid salary, unused leave encashment (if applicable), pro-rated 13th-month pay, and any bonuses or other benefits as per company policy.

** Separation Pay means employee’s ½ month latest monthly salary per year of service, where monthly salary includes basic salary and regular allowances.

Conclusion

The Philippines offers a favorable business environment, and government bodies actively promote foreign investment through fiscal incentives. However, managing payroll in the Philippines involves navigating several complexities. Employers must handle different pay periods, varying social security obligations, and loan repayments, all while ensuring compliance with statutory reporting requirements. These challenges necessitate a robust payroll system to maintain accuracy and efficiency.

Investing in advanced payroll systems and staying updated on regulatory changes are crucial for effective payroll management. Additionally, the country’s technological advancements and skilled, English-speaking IT workforce enhance operational efficiency and innovation, while the growing middle class expands consumer demand. These factors position the Philippines as a prime location for international businesses, promoting expansion and progress in a growing market.

FAQs

No, the minimum wage covers only the basic pay of an employee. Allowances and benefits are not considered while calculating minimum wages.

If a 20-minute paid meal break is provided, the 1-hour rest is not required for:

- Non-manual work

- Companies operating at least 16 hours daily

- Emergency cases (e.g., equipment repairs, perishable goods).

Yes, probationary employees are also entitled to 13th month pay.

Yes, employees who resign before the 13th month pay is released are eligible for a pro-rated 13th month pay. This amount is calculated based on the salary they earned during their period of employment within the calendar year.

No, SIL is not available for contractual employees.

The employer should apply double legal holiday rates, as this provides greater benefits to employees. This ensures fair compensation in accordance with labour laws.

A mother can transfer up to 7 days of her 105-day maternity leave to the child's father, extending the paternity leave to a total of 14 days under the Expanded Maternity Leave Law.

Holiday pay for piece-rate employees must be at least the average daily earnings from the last seven actual workdays before the holiday. However, it cannot be lower than the statutory minimum wage.

There are two methods of tax calculation applicable i.e., General Method and Cumulative method. Annualisation at year end is a mandatory process irrespective of the method used by employer during the tax yar.

The overpayment of income tax due to excess withholding tax, the employer will process the refund and include it in the employee’s final payroll for the year.

No, de-minimis benefits paid exceeding the exempt limit are taxed separately as Fringe benefits. Tax on such benefits is calculated based on separate tax rates provided.

No, the limits are not pro-rated and are applied as such employee has been paid the de-minimis for complete month.

The bonus will be taxed in the current year, the year it was received, even if it covers prior work.

No, any amount received by the employee or their heirs in such cases is exempt from taxation and not included in gross income.

No. As per the current regulation of Tax Code there are no tax exemptions based on dependent declarations.

Yes, if their income is sourced from the Philippines then it is subjected to local income tax. Tax treaties may apply to avoid double taxation.

No, employment income earned by PWDs are taxable as regular employees.

No, only Philippines nationals are eligible for Pag-IBIG contributions.

Employees with multiple employers must contribute separately through each employer, ensuring the total SSS contributions do not exceed the maximum monthly salary credit (MSC). Employers must remit their share accordingly, and employees should inform them to ensure proper computation.

Employers are required by law to deduct SSS loan payments from employees' salaries and remit them to SSS. They must also ensure that all payments are up to date before an employee resigns.

Yes, the current employer is required to consider the total income of the employee for the year, including income from the previous employer(s), This will include the tax exemptions already been claimed for 13th month pay and social contributions.

Yes, the PhilHealth contribution is still due even if there is no salary payable for the month due to loss of pay. The contribution will be calculated in the standard salary fixed for the month.

Yes, MWEs are exempt from income tax on their minimum wage, holiday pay, overtime pay, night shift differential, and hazard pay. Pay elements paid in addition to aforementioned components are taxable. Accordingly, 13th month pay paid to MWE will be taxable in their hands.

No, the employer cannot withhold final pay that includes unpaid salary, unused leave encashment, pro-rated 13th month pay, and any bonuses or other benefits.

Yes, as per Article 113 of the Labour Code, deductions for unreturned property can only be made with the employee’s written consent. This means the final pay, including pro-rated 13th-month pay, unused leaves, etc., must be released within 30 days of separation unless the employee has agreed to any deductions.