Table of Contents

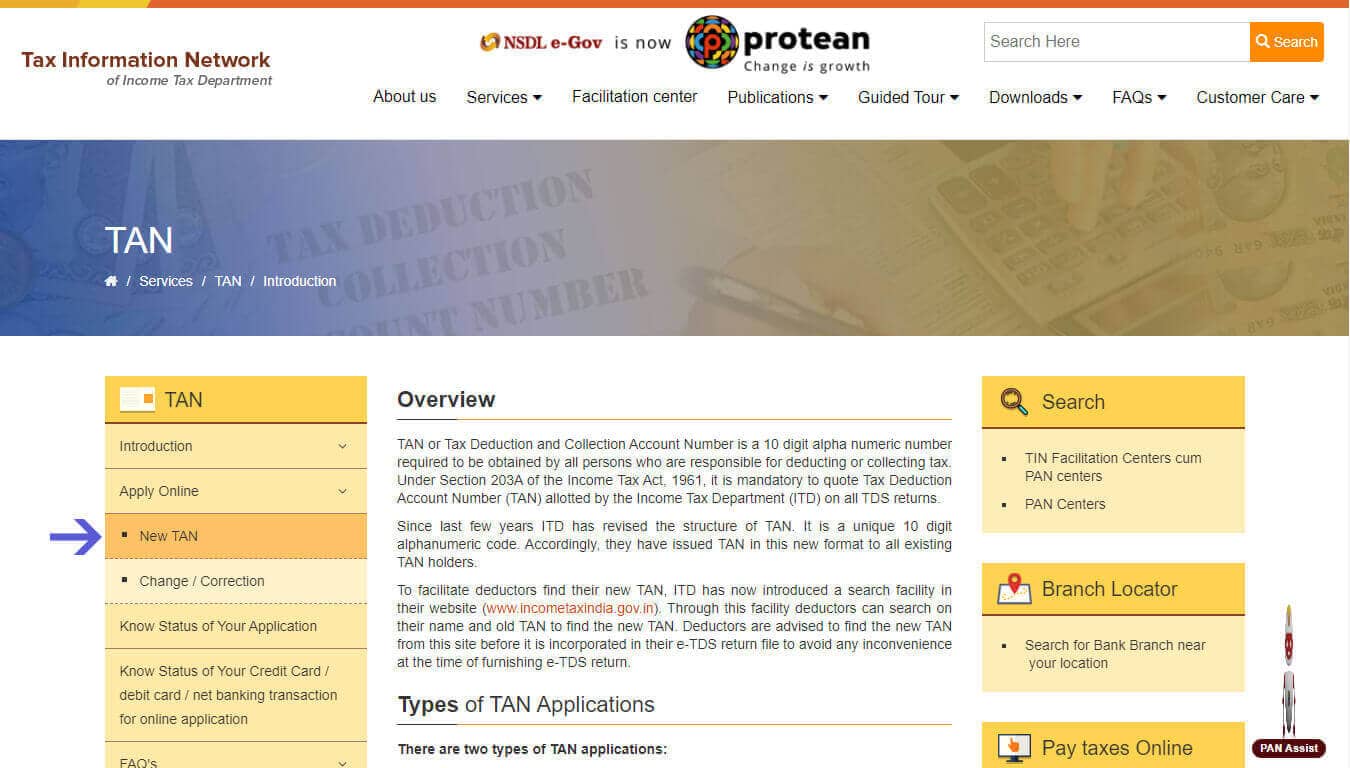

Form 49B is a document that serves as an application under Section 203A of the Indian Income Tax Act, 1961 for assigning a TAN number or TAN deduction and payment account number to beneficiaries who are eligible to take tax deductions on payments made by them. A 10-digit number, a Tax Deduction and Collection Account Number (TAN), is assigned to all individuals who receive payments subject to the Indian Income Tax Act, 1961. A form 49B is required when applying for a TAN, and taxpayers should be aware of this form.

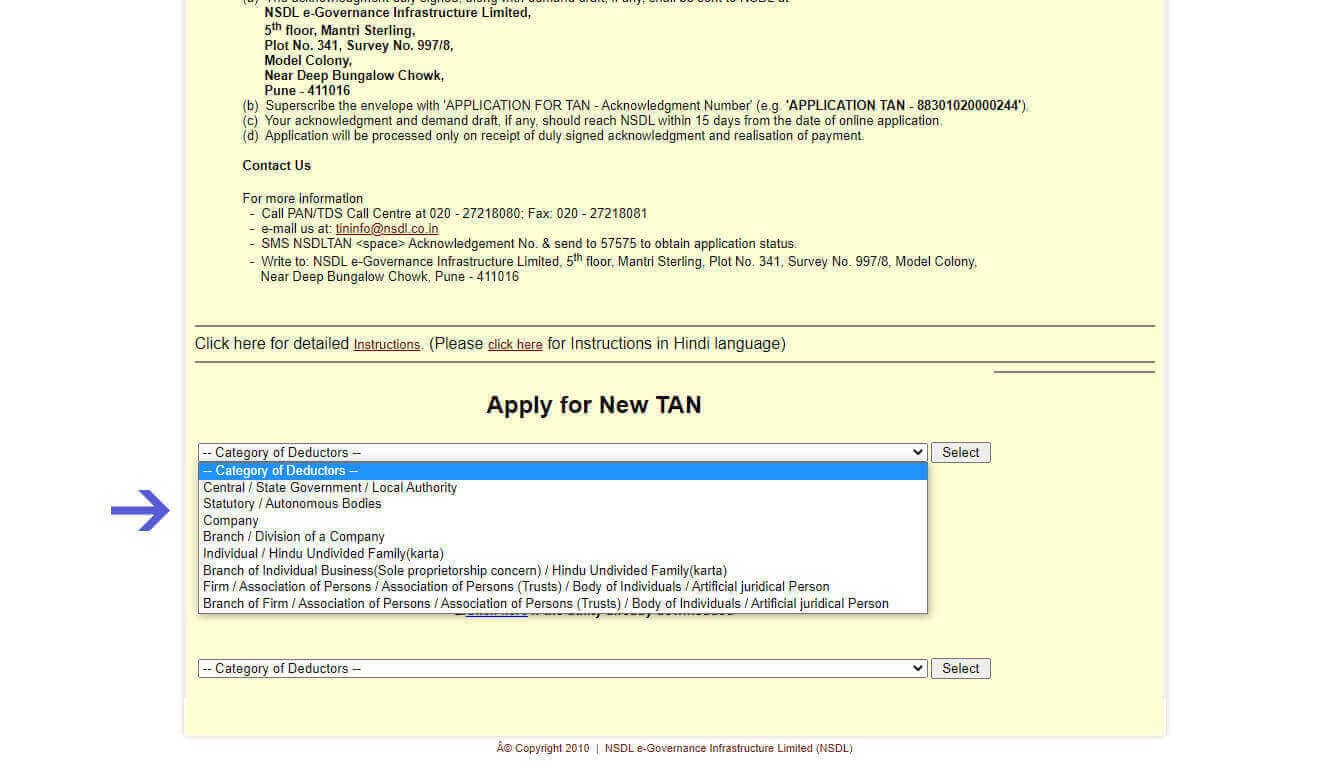

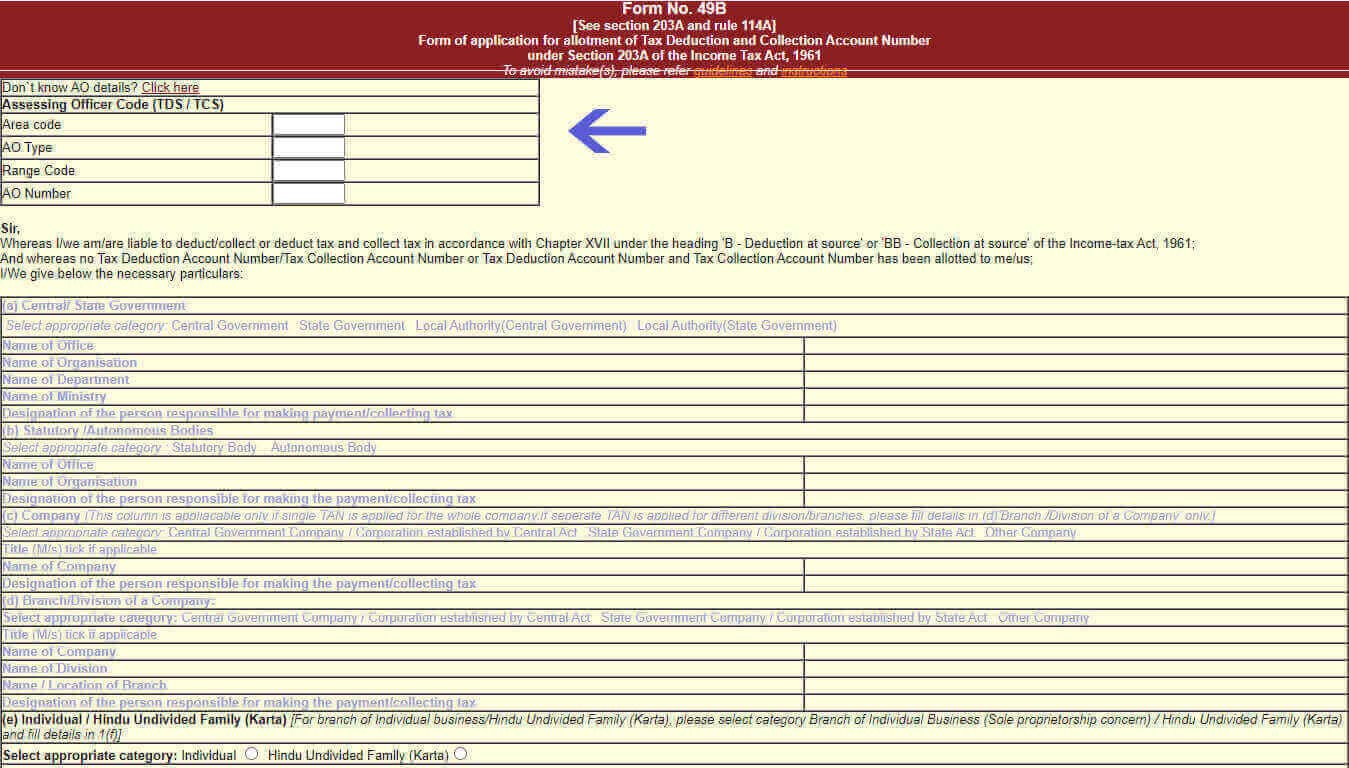

As per Section 203A of the Income Tax Act of 1961, Form 49B is a tax-related document that must be submitted if a person is to receive a TAN. Therefore, applicants must learn how to fill Form 49B correctly without any errors. Because it is so crucial for payees who do not have a TAN, banks have the legal right to refuse payment fulfillment. Non-TAN applicants who deduct taxes may be charged Rs 10,000. No additional documents are required while applying for Form 49B. You must file a TAN when filing either the TDS(Tax deducted at source) or TCS return by online and offline. Applicants must apply through the official National Securities Depository Limited or UTI Infrastructure Technology and Services Limited portal; the form is in PDF format. The applicant has to submit their mandatory details and complete the Form 49B process. In case of online submission, the applicant must send proof of identity and residency via mail to NSDL TAN Registration Division.

In the case of an online application, the applicant must print out a copy of the acknowledgment and send it to the Income Tax Department. No documents are required for an offline application.

The fee to apply for Form 49B is Rs 65+GST. This fee can be paid through numerous payment gateways such as demand draft, cheque, net banking, debit card, or credit card. If a cheque is used for payment, it must be made out in favor of NSDL-TIN, and if a demand draft is used, it must be drawn in favor of NSDL-TIN.

To apply for a Tax Account Number, applicants must mail their completed form in an envelope containing the words APPLICATION FOR TAX ACCOUNT NUMBER (Your Tax Account Number) written on the outside of the envelope. Applicants must also send a Demand Draft or cheque to the National Securities Depository Limited along with their application. The acknowledgment form and proof of payment must be mailed within fifteen days of submitting your application. Until this information is received, your application cannot be processed.

An individual who is required to pay taxes in India should apply for a TAN in order to get all the details regarding income tax returns. Individuals sometimes get confused about various steps involved in getting a TAN. Still, for simplification, I have listed all the necessary measures so that you can apply for it without facing any challenges.

Let’s Recruit, Reward, and Retain

your workforce together!